2012 Update on Gross Receipt Taxes Passed Through To Businesses in Pennsylvania

2 min readTypically, taxes that are collected on your electric bill are kept separate and apart from the revenue on which those taxes are applied. However, in Pennsylvania, the Gross Receipts Tax (GRT) is passed through to the consumer and considered to be part of the revenue base against which the GRT is calculated.

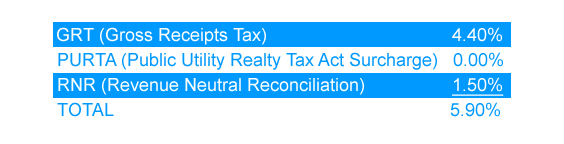

We posted about this last year, but a few changes have been made to this year’s calculation that went into effect January 2012. The new total GRT calculation is broken down as follows:

It is common practice in Pennsylvania for electricity suppliers to use an adjusted rate to ensure they are billing the appropriate revenue to cover business costs. This practice is called “grossing up.”

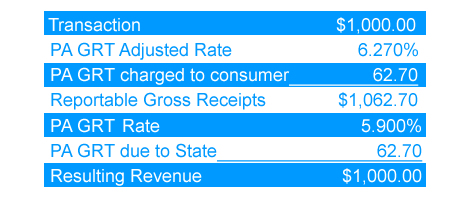

The 2012 calculation formula is:

Cost = (Taxable Amount)/(1 – GRT)

Or

1/(1-0.059) = 1/0.941 = 1.0627

Below is an example to demonstrate how the adjusted rate works.

Utilities and electricity generation suppliers use varying methods to invoice the Pennsylvania GRT.

Constellation Energy presents the GRT as a separate line item, which allows our customers to identify its exact amount. See a sample bill here. Other suppliers may embed the tax in their price, making it more difficult to confirm their calculation method (i.e. whether or not they are ‘grossing up’).

Please leave me a comment below if you have any questions!