Ask the Experts Part I: Drivers of Forward Power Prices and State Renewable Energy Goals

3 min readIn our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions. Most recently, customers requested further information on forward power prices and statewide renewable energy goals during our November webinar.

Constellation’s Commodities Management Group addresses them here:

Does the U.S. have enough installed or planned renewable assets/capacity to fulfill the promises made by government on all levels, as it relates to the timing of their promises (e.g., MD’s goal of 50% by 2030)?

In 2018, the installed wind and solar capacity in the United States was currently only 8% or 337 Billion kWh out of 4,171 Billion kWh generated. Renewables continue to grow, but due in part to their intermittent nature, require backup from resources including conventional hydropower, thermal and nuclear power to keep consistent energy flowing to the grid at 59 hertz. Currently, battery storage can meet short-term needs (i.e., several hours) but not adequately over several days. Gas, coal and nuclear are expected to remain the backbone to the grid until there is a breakthrough in battery or other technology.

It was reported a week ago that ERCOT expects sufficient generation for winter and spring. What’s Constellation’s take on this announcement?

For winter months, ERCOT reported in its Seasonal Assessment of Resource Adequacy (SARA) report on November 7th that it had adequate reserves for this coming winter. ERCOT has 82.4 GW of total resource capacity available for this coming winter and a peak demand of 62.3 GW forecasted, or approximately 20 GW of available reserves. The all-time winter record load was 65.9 GW set back on January 17, 2018, so it would be possible to exceed that in a cold enough weather pattern. But remember that ERCOT is primarily a summer-peaking market (i.e., new all-time record loads are set in summer months of July and August when air conditioning load drives overall demand to its highest levels). Reserves appear adequate for this coming Spring 2020 as well, and load is not expected to surpass winter levels.

Source: http://www.ercot.com/news/releases/show/194081

Source: ERCOT

What are some drivers of RTC forward power prices?

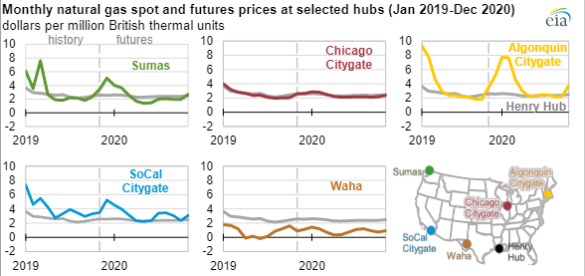

The drivers of round-the-clock (RTC) forward power prices are fuel input costs including those encompassing nuclear, coal, oil and natural gas. Natural gas is primarily the key fuel that sets the locational marginal pricing (LMP) in Day-Ahead and Real-Time Markets. Therefore, forward gas prices for regional markets are the driving factor in the price of power.

As the chart below illustrates, the NYMEX at Henry Hub in Louisiana is a benchmark for gas prices nationally, but it is regional delivery points that will reflect the cost that generators will have to pay over the course of a year for gas-fired generation.

Source: EIA

Other costs may include non-energy components, such as capacity, transmission and renewable portfolio standards (RPS), etc. These type of costs have been rising over the past several years as older coal plants retire, and newer renewable capacity must be integrated into the grid.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.