Zeroing in on Controllable Factors of Energy Price: What You Can Start Doing Today

3 min readWhat is the best way to buy energy that capitalizes on managing both price and risk? There are several considerations that play into an energy-purchasing decision, including appetite for risk and the amount of time to allocate to the buying process.

Energy users within competitive retail markets should take advantage of the benefits available to them, including choosing their energy supplier, such as Constellation, and the ability to structure their electricity procurement strategies in a way that can capitalize on both price and risk.

Uncontrollable vs. Controllable Factors

Many different factors can affect the price of energy, including uncontrollable factors and controllable factors. Uncontrollable factors include weather, the economy and other difficult-to-predict market factors like the shale revolution, which has increased gas production, surpassing demand and lowering energy prices across the board.

However, an important controllable factor that customers should consider is the structure of their power supply contract.

Consumers in competitive markets can select power contracts that range from monthly to annual to multiyear agreements and choose from a range of buying structures. These include “Fixed Price,” “Index” and “Blended” options.

These options have given customers unprecedented flexibility to align their energy cost strategy with corporate goals, budgets, risk tolerance and fiscal calendars.

Source: Constellation White Paper

What is the Best Buying Structure?

While not all energy purchasing needs are created equal, neither are all power purchasing strategies. Research from Constellation found that certain strategies perform better compared to others, but only in specific market conditions, such as a recession and polar vortex.

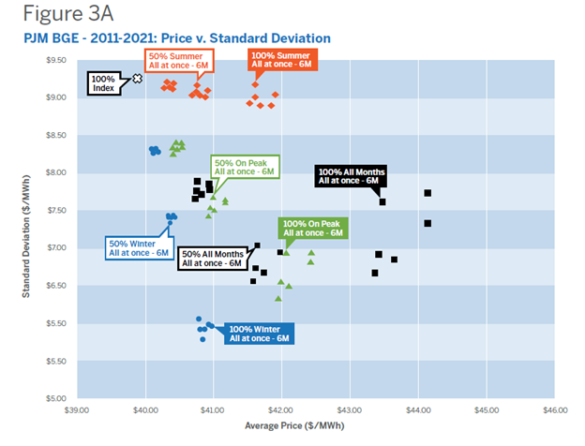

The research showed that despite distinctly different market conditions, one truth remains constant: A “blended” strategy is generally the best way to purchase power for most businesses with respect to balancing both price and risk. See results in the graphic below, where the y-axis represents risk and x-axis represent price. However, there are market-related events that may impact the trajectory of these figures, including anomalous weather events, such as what was seen in February 2021 with Winter Storm Uri, when prices skyrocketed in Texas and had rippling impacts beyond.

How to Approach Blended Energy Strategies

Each business is unique, and while basing the approach on business needs and goals can be very beneficial, it’s also important to consider risk tolerance, usage patterns and even incorporation of automation.

1. Risk Tolerance

For more accurate budgeting and planning, businesses often prefer to minimize risk. However, there are ways to take advantage of market variations while reducing risk. For example, purchasing a percentage of load at regular intervals over time – known as layering – rather than all at once, provides not only budget predictability but also allows the option of taking advantage of market opportunities.

2. Usage Patterns

When and how a company uses energy is important. Does your business use more energy in the summer or the winter? Is your business a 24/7 operation that uses the same amount of power throughout the day, or is 75 percent of power used during the day?

Answers to these questions help identify ways to take on risk and provide budget certainty in the purchasing approach. Constellation’s Energy Manager application can help you monitor and find patterns in your energy usage, and is available at no charge to customers.

3. Automation

Rather than worrying about whether the right purchasing decision is being made at the right time, some or all of an organization’s power purchasing can be automated. An automated, algorithmic approach can help achieve a more consistent procurement process over time and take the guesswork out of the decision. Constellation’s Minimize Volatile Pricing allows customers to diversify and automate their energy purchasing over time.

Whether or not an automated or manual method is utilized, our analysis demonstrated that it is most beneficial to have at least some portion of load incorporating an index price (i.e., customers would pay a variable index rate like the Day-ahead or Real-time index for their electricity) to ensure the “blended” strategy ultimately pays off both price- and risk-wise.

It is worth considering whether your business’ existing energy purchasing strategy is helping your organization achieve business goals, manage risk and achieve budget certainty. To learn more about our electricity solutions, visit www.constellation.com/power.