Gas Prices at Historic Lows But for How Long?

3 min readDuring the February 2020 Energy Market Intel Webinar, Constellation’s team of market analysts known as the Commodities Management Group (CMG) and internal team of meteorologists presented on winter weather, natural gas storage and production, the coronavirus’ impact on energy, as well as pricing trends.

Our internal meteorologist, Dave Ryan, opened the webinar with a look at winter weather and how winter 2019/2020 is slated to be the top five warmest winter since 1950, and what is expected as winter winds down and spring emerges.

Weather Update

In our January webinar, we suggested that we were on target for a top 3 warmest winter, however the slight change to cooler temperatures at the end of the winter season was enough to push the winter to the top 5, so currently we are forecasting this winter to be in top 5 warmest winters.

After a cool start to March, a warmer-than-normal pattern nationally could resume later in the month and persist into spring.

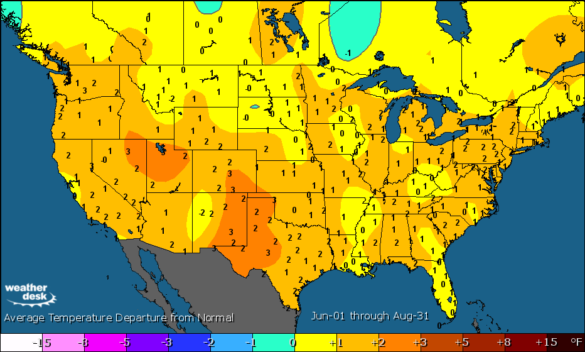

Because the average of the last 10 summers is so warm and well-above the standard 30-year normal, the summer forecast is more likely to come in cooler than warmer vs. the 10-year normal. That being said, there has been a trend for hot summers this past decade. El Niño Southern Oscillation (ENSO) may play a role; if oceanic water temperature patterns trend more toward La Niña, it would offer a hotter risk. We do not see much drought across the nation currently. Spring rains will be important for the development of the summer ridge. Right now, the soil moisture patterns are more conducive for western heat and east cooling for the start of summer.

Source: MAXAR Technologies

Coronavirus and its Impact on Energy

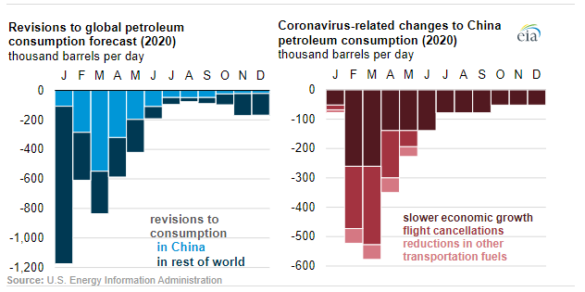

The team took a brief look at the potential impacts of coronavirus on energy markets in the near term. The International Energy Agency has recently issued an updated crude oil demand forecast calling for a decline of 435,000 bbls per day on an annualized basis, the first such year-over-year decline in ten years. The Energy Information Administration appears to be edging its 2020 crude oil demand forecast downward in response to coronavirus, trimming 378,000 barrels per day of demand from the previous forecast. The Japan/Korea Marker, the benchmark for Asian liquefied natural gas (LNG) prices, fell below $3.00 per MMbtu for April delivery, a near all-time low, reflecting low demand driven in part by the coronavirus. Falling Asian demand for crude and lower crude oil pricing that could result would be supportive of U.S. natural gas pricing.

Source: EIA

Storage and Production Update

The team also looked at the end-of-winter storage forecasts where inventories of natural gas are expected to be ample and that would begin the traditional injection season that begins April 1st. Natural gas production appears to be flattening with the near-term peak in production having occurred in late November of 2019. The team discussed the falling rig count and the potential for gas production to fall year-over-year in response to low commodity prices. Lastly, historic pricing averages and analytics were reviewed over the past 20 years, and the team noted that prompt-month natural gas prices have been below $2 per MMbtu about 1.4% of the time in the 21st century. Additionally, the deferred NYMEX natural gas futures strip prices have never been lower.

To stay updated on these topics and more, join us in March for our next Energy Market Intel Webinar on March 18, 2020 at 2:00 p.m. ET. In next month’s webinar, we will review gas and power fundamentals in light of Q1 or Q2 price lows via the year-over-year storage surplus.