Ask the Experts: Natural Gas Prices and Storage, COVID-19 Economic Recovery, Wildfire Smoke

In our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions, such as weather, gas storage and production, and domestic and global economic conditions. Most recently, customers requested further information on the factors driving current gas prices and storage inventories, the U.S. economic recovery and debt level, and the potential temperature impact of smoke from the ongoing wildfires.

Constellation’s team of market experts addresses them here:

“What was the reason for today’s (9/23) run-up on natural gas prices? What will gas storage look like going into the withdrawal season, and what storage is anticipated at the end of the season?”

Several key drivers are influencing natural gas prices as we enter October:

- Gas production has been range-bound recently at ~85-87 Bcf/d with current indications from third-party sources that it’s closer to 85 Bcf/d. We are seeing possible declines in Pennsylvania production, linked to dry gas (northeast part of state) and natural gas liquids (southwest part of state).

- LNG Feedstock deliveries are back to 6 Bcf/d after Tropical Storm Beta moved out of the Gulf region, and Cameron LNG is likely to return in October, which could lift LNG exports to 8 Bcf/d.

- Exports to Mexico are currently 5.7 Bcf/d (+0.5 Bcf/d) as a new pipeline system to receive U.S. gas comes online and older oil units are replaced by newer gas units.

- Weather in early October will be warm out West (lingering cooling degree days) and cooler than normal in the East (initial heating degree days).

- Current storage is 3.76 Tcf after last week’s 76 Bcf injection. The storage surplus is +14% over year-ago levels and +12% above the five-year average. How much the surplus narrows over the coming weeks will likely have an impact on winter pricing.

The U.S. Energy Information Administration (EIA) predicted winter storage to reach ~3.97 Tcf by October 31st and land around 1.59 Tcf by March 31st, per its Short-Term Energy Outlook (STEO) on September 9th. Weather remains a key driver of demand this winter, and gas production and LNG export (8-10 Bcf/d) levels will factor into end-of-season storage numbers.

“What are your thoughts on the market impact if a COVID-19 vaccine fails to develop?”

It was the COVID-19 public health crisis that induced a recession, so full economic recovery likely requires a vaccine. As the charts below illustrate, both consumer spending and declines in unemployment have been assisted by Federal Stimulus spending. A vaccine is especially important for the recovery of airline, recreation and service sectors, which remain under various restrictions and are impacted by people’s reluctance to travel long distances.

Source: TracktheRecovery.org

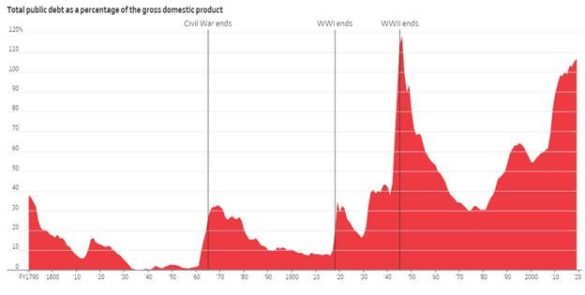

“How concerning is the increasing U.S. debt level?”

U.S. debt levels have reached $27 trillion, the highest in the world. However, the U.S. economy is also the world’s largest. For comparison, the U.S. debt-to-GDP ratio is 104%, while Japan has a 236% debt-to-GDP ratio, most of any country. A chart of U.S. debt-to-GDP over time is included below.

Inflation has remained below the Federal Reserve’s +2% annual target for the past several years, and the Fed announced in September that it will manage inflation to a range. Interest rates remains low under current Fed policy, which is allowing the Federal government to borrow and finance the U.S. debt.

Source: Wall Street Journal

“Will smoke in California and moving across the country from wildfires have a cooling impact on temperatures?”

Depending upon the thickness of the smoke, smoke generally has a cooling impact on daytime high temperatures and a warming impact on overnight lows.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar on October 21st, 2020, by visiting www.constellation.com/marketintelwebinar.