Ask the Experts Part II: Your Regional Power and Gas Questions Answered

3 min readIn our monthly webinar series, the Energy Market Intel Webinar, we offer our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy purchasing decisions.

Most recently, customers requested information on regional and national factors, such as a decline in natural gas production, impacting their energy prices.

Constellation’s team of market experts addresses them here:

In MISO and PJM, what’s the reasoning behind 2023 being lower than 2022?

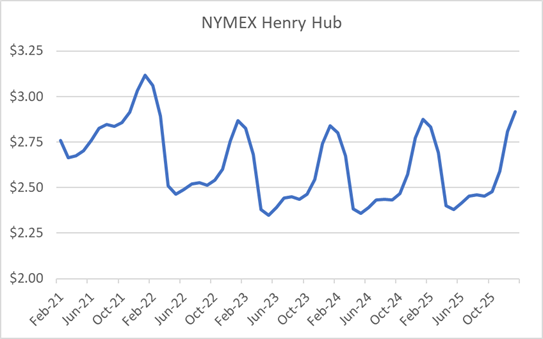

The biggest driver of 2022 being at a premium to 2023 in PJM and MISO is that the NYMEX natural gas forward curve is at a premium for 2022 over 2023. That is driven by the expected decline in production for 2021, which could extend into first part of 2022. As a result, the gas market is “backwardated” with near-term months trading at a premium to outer years. This fuel cost input is reflected in the forward power prices in MISO and PJM. It is expected that production will recover by 2023 if not likely sooner. As we progress through 2021 and if production were to remain flat at 90 Bcf/day, then that could change the shape 2021 and 2022 pricing.

Source: NYMEX

What is your forecast for ISO-NE, NYISO and PJM capacity markets, and how they might impact demand side management (DSM) and distributed energy generation (DEG)?

Demand-side management (DSM) and demand response (DR)resources continue to put downward pressure on capacity prices due to its cheaper costs than traditional resources. There may come a point where there is saturation or just a pivot to renewables, and not as much new DR enters the market. The auction results over the next few years could reveal any trends.

As for DEG, impacts to capacity could include decreased capacity requirements as DEG will likely decrease end-user demand off the grid (as more users will partially offset their usage from their DEG), although that will likely be offset by more electrification and potentially lower imports as we have seen an increase in capacity requirements in the Feb. 8 ISO-NE auction. For more on ISO-NE demand forecasts, visit their website.

How will the increase in electric vehicles moving forward affect the generation needed to keep them running?

Right now, electric vehicles (EVs) are a small share of overall national power demand. A move to greater EV use, say by 2035, could move more charging demand to overnight and off-peak hours. How people plan to work and commute to work will have a big impact on driving and EV charging demand.

What are the drivers of the back-to-back gas production declines? Driller credit crunch? Depressed commodity market prices?

The reason production fell in 2020 vs. 2019 has to do with the collapse in the price of oil in the second quarter that drove oil production down from 13 million bbls/day to 10 million bbls/day, causing a decline in “associated natural gas production,” that is, gas that is associated with crude oil production. Additionally, there was a collapse in natural gas liquids (e.g., propane, ethane, butane) prices, and of course, natural gas hit a multi-year low as well. The pricing collapse precipitated a 75% decrease in oil and gas drilling thereafter.

The steep decline in oil and gas drilling, coupled with relatively low prices (producers are not swimming in cash at this point and absorbed enormous financial damage in 2020) are the primary features carrying over into the Energy Information Administration’s (EIA) forecast for lower production in 2021 vs. 2020 and 2019.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.