Ask the Experts: ERCOT and NYISO Energy Prices, Hydrogen in Japan

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy purchasing decisions.

Most recently, customers requested information on expectations on Texas weather this summer, the reason for rising energy prices in New York, and how Japan is one country that is spearheading the hydrogen movement.

Constellation’s team of market experts addresses them here:

What are Texas summer expectations?

The three biggest expected drivers this summer (and most summers going forward) that can combine to stress ERCOT reserves include:

- Heat. When it’s ~100 F or higher in Houston and +102 F in Dallas, it is generally hot enough to put ERCOT load at ~69 GW or more.

- Low wind conditions tighten reserves. When wind is below ~3 GW by hour ending 15 (3 p.m. CST), it reduces available reserves later in the day (hour ending 18) as solar is starting to come off.

- Thermal outages. There were ~9 GW of thermal units in outage last Monday, June 14th, and that reduced 30-minute reserves to below 3 GW, which pushed the price to $2,000/MWh. Normal outages in a summer have averaged 3.5 GW per ERCOT for 2018-2020.

Average NYISO power prices across major hubs increased by 50% year-over-year in May, and natural gas prices increased 75% year-over-year. What’s the reason?

In looking at NYISO forward pricing:

- Economic rebound in activity in NYSIO year-over-year for May as COVID restrictions have been lifted.

- There are higher gas prices year-over-year as NYMEX is up over $3/MMBtu.

- Retirement of Indian Point #3, which was 10% of (Zone J) NYC’s baseload power supply.

- New York’s plan to introduce a carbon tax starting in 2024 is lifting forwards for that year and beyond (already been a factor for over a year).

- Additionally, specific zones are experiencing more congestion than usual due to planned outages related to transmission projects and upgrades.

For more information on NYISO market conditions, review the recording of a NYISO webinar from June 9th.

How can you advise Texas commercial customers to curtail their load to avoid blackouts if all the power they use is critical for the business to function (i.e., nursing homes and hospitals)?

If a customer is on a fixed price product or an percentage index product and close to 100% of the load is fixed, there is protection from index electricity pricing volatility. For customers that are on index but deemed critical infrastructure (e.g., hospitals and nursing homes), they may be required to have back-up generation which could be utilized at times (there are limitations on the number of hours per year they can run). Based on summer volatility in ERCOT in 2019 and this past February, it is prudent for customers to have a percentage of load fixed/locked for summer (e.g. June-September) and winter (e.g. January-February).

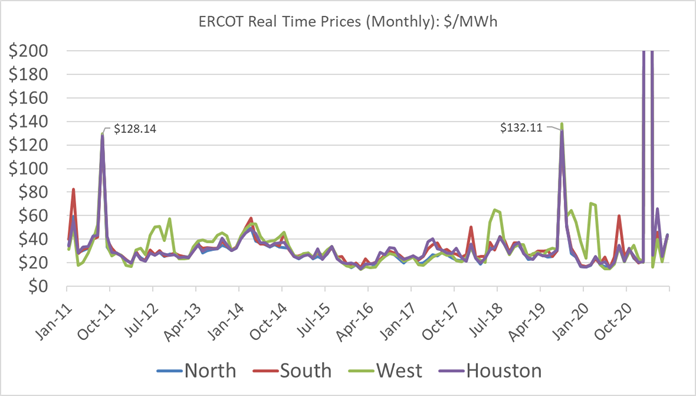

Looking at real-time prices since 2011, it is summer and winter months where the volatility has historically appeared, compared to most “shoulder” months, which have been in the $20-$30 range. Note: there are exceptions with West and South zone congestion. The current expectations are that growth in solar and wind resources will continue, and there will be very few new thermal builds, so until batteries get much larger and provable (winter months), ERCOT could likely face summer and winter volatility.

Japan is investing in hydrogen as an energy source. Any thoughts on this direction?

Japan is making big investments in hydrogen; they currently are subsidizing the largest number of hydrogen-fueling stations in the world right now meant for hydrogen cars that will compete with electric vehicles.1 Additionally, the Japanese are also getting ready for the maiden voyage of a hydrogen-fueled vessel that will travel from Kobe, Japan to Australia and back.

Japan realizes China has a majority share of the global battery market, so this is seen as an attempt to compete with China. Furthermore, “Japan has very few other options to reduce its non-power carbon emissions,” according to a report on EnergyGlobal.com.

Japan has to import most of its energy, including hydrogen, especially after the nuclear accident at Fukushima in 2011.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.

Source