Ask the Experts Part I: Insights on Texas Forward Pricing, The Impact of Motor Oil Production on Natural Gas Market

3 min readIn our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions, such as weather, gas storage and production, and domestic and global economic conditions. Most recently, customers requested further information on events that could impact their businesses in certain regions of the country during our September webinar.

Constellation’s team of market analysts and meteorologists addresses them here:

Do you see the Texas forward on peak pricing settling back down over the next few months or so, or is it here to stay?

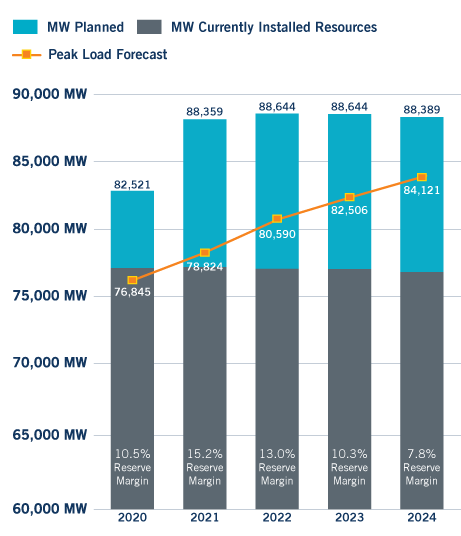

The move to higher ERCOT forward prices is overall here to stay because of two primary reasons. First, generation reserve margins remain tight and below the North American Electricity Reliability (NERC) target reserve margin of 13.75%. Second, load continues to grow 1.5% on average on a year-over-year basis in ERCOT as the Texas economy continues to expand.

Wind generation played a key role in this summer’s volatility as output was very varied day to day. Under peak load conditions when load was in excess of 70 gigawatts (GW), this tightened the ERCOT reserve margin significantly enough to reduce available reserves to below 3,000 megawatts (MW) and eventually 2,000 MW, triggering the price cap of $9,000.

The reserve margin will increase in 2020 and 2021, but the majority of the new builds will be wind and solar which are renewables and intermittent in nature requiring gas-fired generation to make up its shortfall.

Source: ERCOT

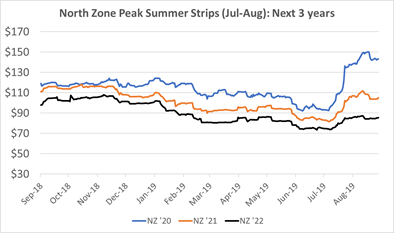

The most sensitive market prices to reflect ERCOT’s tight generation reserve margin is the Summer On-Peak (5×16) strips for July/August. For July/August 2020, they were trading in the low $90/MWh at the end of July but moved up to near $150 by the end of August as we saw ERCOT real-time prices reach $9,000/MWh in the third week of August.

Source: Constellation

Can you speak more about the changes to Ohio’s Renewable Portfolio Standards (RPS)?

Ohio Governor Mike DeWine has signed into law House Bill 6, which is scheduled to go into effect by October 22, 2019. The bill, in essence, reduces overall renewable portfolio standards (RPS) requirements in the state of Ohio through 2026 and eliminates it completely by 2027, while at the same time eliminating the solar carve-out portion by 2020.

Please note that House Bill 6, however, is being challenged by Ohioans Against Corporate Bailouts (OACB). The group will then have until October 21, 2019 to submit nearly 266,000 valid signatures in order to put the question on the 2020 General Election ballot. if the petition is found to be valid by the Secretary of State, the legislation will not go into effect until it has been approved by the voters in the 2020 General Election.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.