Ask the Experts Part II: The Factors that Impact the Trajectory of Rising Prices

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy purchasing decisions.

Most recently, customers requested information on liquefied natural gas exports and their impact on domestic supply, the status of coal in a world that is focused on decarbonization, as well as concerns on near-term energy pricing.

Constellation’s team of market experts addresses them here:

What impact will the new Russian pipeline have on LNG exports?

In the near term, the rest of this year, the impact is limited as the deliveries are just ramping up and the E.U. is in a very short storage condition. In the longer term, there may be an impact where U.S. deliveries are reduced, all other things being equal.

Wind output in the U.K. has been low in September due to low wind conditions in the North Sea with U.K. power prices clearing 10 times higher than a year ago. U.S. LNG will likely continue to go to Europe in the short term as their storage is below the five-year average (2014-2020).

Russia is currently seeking to have NordStream 2 pipeline in operation by this winter and while construction is completed, it need needs some European regulatory approvals and so has been sending less gas through Ukraine (which collects a transit fee). Russia is seeking to displace the supply to Europe via Ukraine via NordStream 2 and so regulatory approval is of timely importance. The European Commission could take another 2-4 months to grant final approvals, but Europe is facing some tight gas storage levels approaching winter if they remain on the current pace.

Source: SP Global

What about coal?

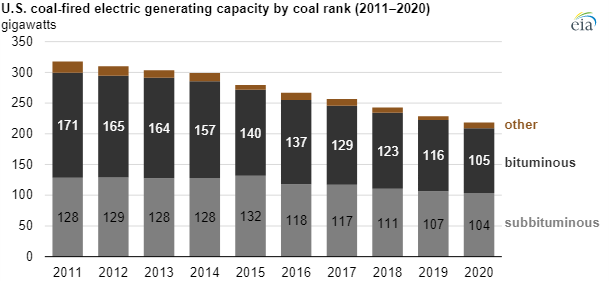

Coal is still a big part of the U.S. energy picture at least as far as electric power generation is concerned. Coal is going to represent 25% of total U.S. electric generation in 2021, up from about 20% last year. As gas prices rise, coal can capture additional market share of the power generation market in the two- or three-year time frame – this noted, the U.S. has retired nearly 50% of its coal-fired power generating capacity over the past 13 years, and as such, coal’s ability to capture its historic market share of generation has its limits. Additionally, coal will continue to face major head winds over emissions issues.

A lot of the coal generation that has retired over the past few years has been bituminous-sourced (Appalachia) while coal from Wyoming is more subbituminous in nature.

Source: EIA

Are producers really seeing significantly higher cashflows given that many hedged before prices started running up?

As the Antero Resources presentation from early September (Sept. 8th) illustrates, different producers have varying hedge levels. Some like CNX and EQT have a greater share of production hedged while Antero and Range Resources had scaled back their hedging over the past 12-18 months and have more risk of a price correction but more upside gain from the recent market run up to $5/MMBtu.

Source: Antero Resources

There is a what I call a “pricing wave” moving relentlessly forward… raising 222 > 223 > 224 > 225 > 226. Is there any reason to believe this trend is going to either continue, slow down or stop?

It could be all of the above. The case for continuing the trend looks like: production continues to disappoint, a very cold winter, a very hot summer, exports remain at very high levels, crude oil trends down in price closer to $50/bbl.

The case for slowing down looks like: production improves materially in response to price, consumers conserve as they see higher prices, and moderate winter and summer temperatures and crude stays at or above $70/bbl).

The case for a stop and reverse situation looks like: producers respond robustly to higher prices, winter warm, summer cool.

The natural gas supply and demand balance hinges on various factors that change, not least of which is the weather, which can have a very large impact on the market. Throw in global pandemics and financial crises and inflation in for good measure.

How much of these multiple concerns are already priced into the futures today?

The question of “how much of the information available in the market is baked into the price of a security or commodity” is a common one – the answer is, we don’t really know; if everything about the price of an item is known and “baked in”, the price would not change. Prices do change because despite the large amounts of information available; there are things that are unknown in real-time and certainly unknown in the future.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.