Auction Shows Mixed Results for Electricity Capacity Costs in 2017

4 min readResults from the recent Midcontinent Independent System Operator (MISO) annual capacity auction show there are ample resources available to meet expected demand during the coming year. The regional transmission organization ensures power is delivered to all or parts of 15 states. But like many other markets in the United States, MISO’s generation mix is facing significant change as a result of regulatory and market forces. As a result, customers in some areas will pay higher capacity costs in the coming year while others will pay lower costs.

The auction aims to ensure there is sufficient generation capacity available to meet peak electricity demand across the MISO footprint for the upcoming planning year, which runs from June 1, 2016 through May 31, 2017.

The voluntary annual auction for load servers is a key component of MISO’s resource adequacy process, which also allows participants to self-supply capacity in order to meet their requirement. The auction sets the price paid to power plant owners that agree to make their generators available when called upon at times of peak demand, and also determines how much load is required to pay for the reliability provided by capacity resources.

The auction procured 122,379 MW of traditional generation resources, 3,462 MW of behind-the-meter generation, 5,819 MW of demand response resources, and 3,823 MW of imported generation resources. However, as noted in MISO’s press release announcing the results, the generation mix in MISO is rapidly evolving. According to Richard Doying, MISO’s Executive Vice President of Operations and Corporate Services, “More generation is retiring, resulting in a tighter supply across the MISO region.”

As a result of a number of generation retirements and exports in MISO this year, the capacity auction results once again surprised many market participants, with a mixed impact depending on location. Here’s a look at the results and the impact on each region.

Examining the Results

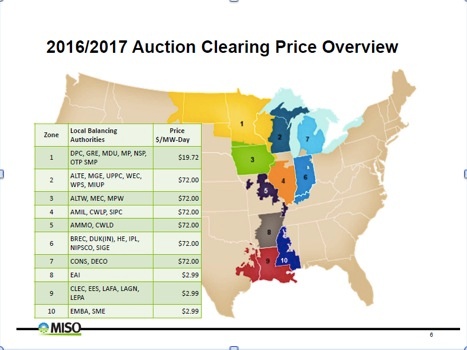

For the purposes of ensuring resource adequacy, MISO’s footprint is split into 10 Local Resource Zones. In MISO’s Midwest region (Zones 2-7), the capacity auction cleared at a uniform rate of $72 per MW-day. For customers taking competitive retail supply, this region covers both the Ameren zone in Illinois, as well as Consumers and DTE in Michigan. All load in MISO pays the auction clearing capacity rate for the zone in which it is located.

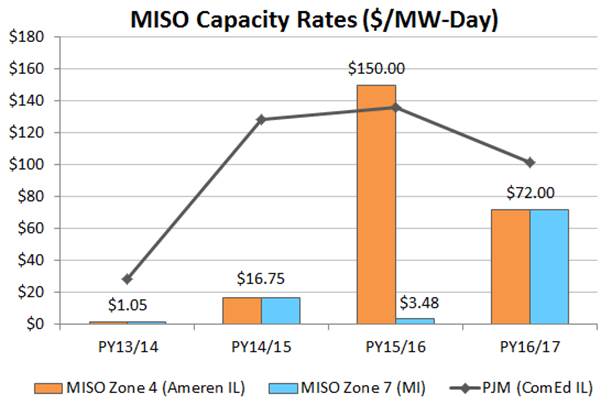

Compared with the auction results for planning year 2015/16, capacity rates decreased by 52 percent in Ameren IL (Zone 4), while rates jumped by nearly 2,000 percent in Michigan (Zone 7). A year ago, in MISO’s Zone 4, capacity cleared at $150 per MW-day, nearly in line with rates in PJM’s ComEd zone in northern Illinois, which has historically had much higher capacity rates than the MISO market (as a basis for comparison, capacity rates for PY15/16 and PY16/17 in PJM’s ComEd zone cleared at $136 per MW-day and $102 per MW-day, respectively). Meanwhile, customers in Michigan will be paying $72 per MW-day in the coming planning year, compared to $3.48 per MW-day resulting from the previous auction. For a customer with a 60 percent load factor, this auction will result in approximately a $5.42 per MWh decrease in capacity costs in Ameren IL, while the same load in Michigan will pay $4.76 per MWh more for capacity on a year-over-year basis.

What Factors Impacted this Year’s Outcome?

The Midcontinent region has seen a number of coal unit retirements over the past several years. Due to these retirements, including seven coal units that retired in Michigan during April 2015, much of MISO North cleared at a higher price. Due to sufficient import and export capability in Zones 2-7, these zones cleared as a single, unconstrained zone at a uniform capacity price.

Future Electricity Reliability

As noted above, market forces, such as falling natural gas prices, and environmental regulations are driving significant changes to the generating fleet in MISO that may affect future reliability. Due to a changing generation fleet that will rely more on natural gas resources and possible generation shortages as early as 2020, MISO is working to address seasonal and locational reliability issues while also ensuring that market capacity prices, in restructured states like Illinois and Michigan, provide incentives for investment in order to sustain existing needed resources and attract new resources where and when needed.

MISO is expected to file proposals at FERC in July to make these changes.

Why Capacity Costs Matter to Electric Customers

In MISO, where capacity costs have historically represented a very small portion of the total electricity supply bill, the recent increase in costs in some zones has likely had an impact on a typical customer’s energy spend. In some cases, the increase in capacity costs may even offset the recent historic declines in electric commodity costs.

For a given planning year, a customer’s capacity obligation is determined by the auction clearing rate and the customer’s individual Peak Load Contribution (PLC), which is determined based on particular days when the demand on the system is the highest, typically during the hottest summer days.

Constellation offers solutions to help you better manage your energy use, such as Peak Response, Demand Response, Efficiency Made Easy and Distributed Energy products (solar, back-up generation, combined heat and power, and fuel cells), which can lower your PLC and reduce the costs you would otherwise pay.

For more information on how these products may complement your energy procurement plan, please reach out to your Constellation Business Development Manager. Also stay tuned to our blog and subscribe to our regular market updates for more information on how MISO’s proposed capacity market changes may impact your bottom line.

Published: April 27, 2016

- Tags:

- Market Intelligence

Share this article

Oops! We could not locate your form.