Blockchain Basics: An Introduction for Energy Managers

4 min readAs blockchain technology continues to gain media exposure and investment, applications for the energy industry are starting to look interesting. Various startups, utilities, renewable generators, wholesale traders and suppliers are working together to test concepts, business models and technologies that may lead to entirely new digital energy infrastructures and markets.

The key stakeholders that seems to be missing from many of the conversations, however, are the energy and sustainability managers and energy buyers. As a market factor that may have a significant impact on the future roles of energy and sustainability professionals, Constellation’s Lev Goldberg, Principal, Sales Strategy, and Exelon’s Chris Buzby, Senior Technology and Process Innovation Manager, spoke at Smart Energy Decisions’ recent Innovation Summit in Austin, Texas. Smart Energy Decisions’ John Failla, Lev and Chris had an onstage discussion in front of approximately 75 energy and sustainability managers from some of the largest energy users in the country. The conversation ranged from the fundamentals of blockchain, to what it can enable and specific implications for energy management.

Blockchain Basics

If you’re just learning about blockchain for the first time give yourself some time, be patient and mix a little ‘wonder’ with some healthy skepticism about the topic. Below are some basics to help get you started.

First, there is no single blockchain. There are many different blockchains that use different architectures with distinct pros and cons. At this stage of the game, however, we will put the technical differences aside and focus on some of the key aspects of blockchains that make them so intriguing.

- Blockchain is a Distributed Network. Most networks (digital or otherwise) involve some sort of central authority or hub to distribute, process or verify data to and from the various parties. Blockchains are ‘distributed,’ meaning that the various computers (or nodes) that participate on the network can distribute, process and verify data without the need for a central authority. Without centralized ‘hubs,’ the risk of a single point of failure to a network is removed from the process.

- Blockchain is a Shared Digital Ledger. In a traditional network, each participant has their own ledger showing their own version of the truth. After a transaction, ledgers are reconciled so that they match up. This ‘lag’ allows for the potential problem or ‘double spend.’ Imagine if you have $10 in an account today. If you write two separate checks to two separate people, you will have double spent. Only after your counterparties try to cash those checks will one of them realized that you did not have the funds in your account. In a blockchain network, all nodes host the same ledger and have access to the same data and history. When one transaction is completed and written to the blockchain, all ledgers hosted on all of the nodes are updated at the same time. This creates only one ‘record of truth’, the shared ledger, and helps to solve the ‘double spend’ problem.

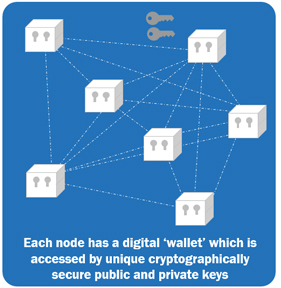

- Blockchains are Cryptographically Secure. On a blockchain, each node has a digital ‘wallet’ which is accessed by unique cryptographically secure public and private keys. Please note that news accounts of hacks resulting in millions of dollars in cryptocurrencies like Bitcoin or Ether being stolen did not refer to hacks of the actual blockchains themselves, but rather failures at the ‘edge’ of the system to protect these keys. The Bitcoin and Etherium blockchains have not been hacked. Blockchains allow public ‘openness’ with ‘anonymity’ for the users.

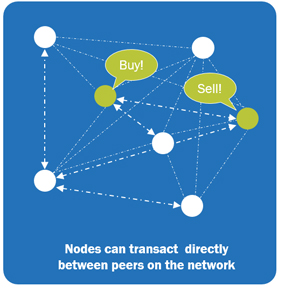

- Blockchains allow Peer to Peer Transactions. One key element of blockchains is the fact that nodes can transact unique digital tokens amongst each other directly. These digital tokens can represent specific physical assets, have distinct identification characteristics and allow for the transfer of value digitally. Traditionally, digital assets cannot carry value because they can be copied. Tokens on a blockchain are, like their physical counterparts, unique and cannot be copied. After a transaction is completed, the other nodes on the network verify the transaction is valid and confirm it.

- Blockchain allows an Immutable History. After a transaction is verified by the network, it is combined with other transactions to create a new ‘block’ of data. This block is then added to the chain using a ‘hash’ that references the previous block. Since, all blocks reference the previous block there is, effectively, no way to change or manipulate the data on the blockchain.

What Does This All Mean?

When you boil down all the points made above, here’s what you get:

- Blockchain technology allows a single ‘record of truth’ that can be accessed by multiple parties in multiple organizations.

- Parties who do not know or trust each other can transact for items of value without a need for a central authority.

- Blockchain allows the creation of digital assets with title and ownership and the transfer of value through code.

All of this enables innovations that could help revolutionize how energy is bought, sold and valued. These features include:

- Historic record of assets

- Digital scarcity

- Direct peer to peer transactions

- Real-time transaction settlement

- Proof of ownership

- Microtransactions

- Ease in shared or fractional ownership

- Self-sovereign digital ID

- Automated transactional processes

For the latest energy market information and discussions from our energy market professionals on new, innovative technologies subscribe to our communications at constellation.com/subscribe.

Guest Author: Lev Goldberg, Principal, Sales Strategy

Lev’s 13-year energy career with Constellation began with the marketing team where he helped the company and businesses throughout Illinois navigate the newly competitive retail energy market. Since then he has overseen Constellation’s marketing efforts for national accounts and public-sector customers, run the company’s digital and social media programs and produced content and events that help energy users understand the market, regulation and technology trends that can affect energy and sustainability budgets and operations. Today, Lev focuses on developing new business models and markets that will be enabled by the convergence of distributed ledger technology, distributed energy resources and environmentally sustainable business practices.