Electricity Capacity Cost: What is it and How do I Manage it?

4 min readEnergy supply costs are a significant portion of an electricity bill and, therefore, are often the primary focus for most energy managers. However, other components like capacity and transmission may also result in steep costs reaching upwards of 50% or greater depending upon location. Understanding what they are and how the costs are set can help you manage your overall energy budget. In the past, we discussed how transmission rates are set, today we will focus on capacity costs.

Why Do We Need Capacity?

Balancing energy demand with energy supply is one of the most important objectives of an energy system. If there is not enough energy being generated the energy grid can experience brownouts or blackouts. So, how do system operators ensure that there is enough electricity supply available on the grid at all times to meet potential demand? Many markets across the country use a construct called a ‘Capacity Market’, which will be the focus of this article. Capacity markets are designed to ensure that there are enough electricity capacity resources to serve homes, businesses, hospitals and municipal buildings on the hottest and coldest days of the year – at the lowest possible cost.

An electricity capacity resource can be a power plant (from nuclear, gas or coal to wind, solar or hydro) or the customer’s ability to reduce electricity demand through programs such as demand response. With demand response, end-users reduce consumption during periods of peak demand and thus provide relief to the system to ensure there is adequate supply to meet demand.

The Role of Regional Electricity Grids

Regional distinctions impact energy price and capacity. Some regions, such as the Northeast rely heavily on natural gas to generate their electricity. Infrastructure limitations for gas pipelines and electricity transmission lines can severely impact regional reliability during high peak times when suppliers are trying to flow power and gas into the region to meet demand. Power prices in the Northeast, therefore, are typically more susceptible to natural gas availability and price volatility than other regions as a result. In the Midwest, by contrast, markets are exposed to less price volatility due to less demand and more supply availability, thus congested paths and the overall accessibility of different fuels needed to generate electricity.

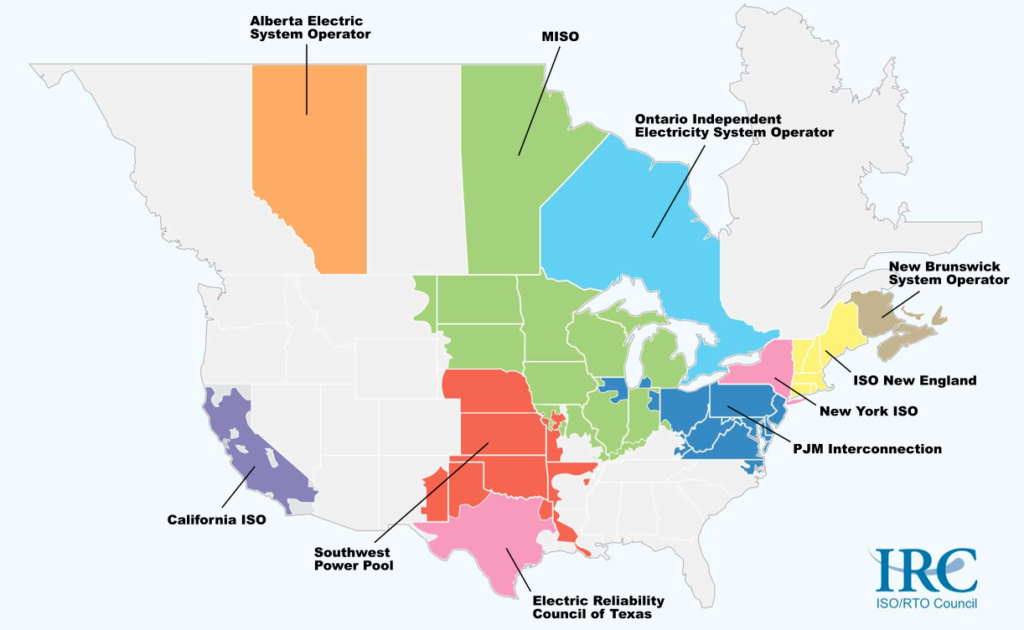

There are 7 regional ‘grids’ whose main function it is to ensure that electricity gets to its final destination in a safe and reliable manner. Some of these ‘grids’, known as Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs), pay power generators and demand response customers for their ‘capacity’, which is essentially a guarantee that there will be enough supply resources available to meet their forecasted peak energy demand into the future. (PJM, for example sets capacity rates for a 3-year horizon, whereas MISO, sets their capacity rate for only one year.)

Source: IRC

What is a Capacity Auction?

To facilitate the payments to generators, some ISOs and RTOs set capacity rates using competitive auctions. Before each auction, the ISO, or RTO provides the bidders estimates for peak electric usage for their region. Bidders then bid in existing power plants, new power plants, imports, demand response and energy efficiency. The auction is designed to ensure that there is enough capacity to meet the estimated peak usage plus a reserve margin, which is a cushion for unforeseen events. An accepted bid is a commitment. If capacity resource is not available when needed, that resource owner is assessed a financial penalty.

Who Pays for Capacity Costs?

So, who actually pays for the insurance of having the necessary electricity generating capacity available? Ultimately, it’s the consumers who pay the capacity costs based on the auction clearing price for their zone. Energy suppliers (also known as Load Serving Entities) charge their customers based on the approved capacity rate. This charge may be in a separate line item on the bill or incorporated into a line item with other charges. The supplier then pays the ISO/RTO for the capacity required to cover the MWs they are contracted to serve and the ISO/RTO in turn pays the participating generators and demand response suppliers.

Determining Capacity Obligations

Capacity obligations in many markets are generally determined by an end-user’s peak load contribution (PLC), Installed Capacity (ICAP) or peak monthly demand during a specific timeframe. When the end-user takes supply from an LSE, the local utility provides the PLC to suppliers. Here are some examples of how end-users’ PLCs and ICAPs are determined.

In New York and New England (NYISO & ISO-NE) markets, an end-user’s ICAP is determined by their usage during the “peak hour from the previous year.” The peak hour is the hour during which the usage was the highest across the ISO, as published by the ISO. Once a customer’s ICAP is established, it is set for the planning year. The planning year is May 1-April 30 in NYISO and June 1-May 31 in ISO-NE.

Across the 13 states (Mid Atlantic, Ohio & Northern Illinois) and Washington, D.C. that comprise the PJM territory, an end user’s PLC is determined by their usage during the “five coincident peak hours” (totaled and averaged) from the previous year. The five coincident peak hours are the weekday hours during which the usage was the highest across the RTO, as published by the RTO. Once a customer’s PLC is established, it is set for the planning year, which is June 1-May 31.

Managing PLCs to Lower Your Electricity Cost

Since annual capacity and transmission rates are based on consumption during these peak hours, many businesses are actively curtailing their demand during this timeframe and seeing significant cost reductions. By participating in solutions like Constellation’s Peak Load Management, end users are notified on a day-ahead and day-of basis of expected peak setting hours. Consumers who choose to reduce their consumption can reduce capacity and transmission costs during the following year.

Permanent energy offsets, like energy efficiency upgrades can also help lower PLCs and ICAP. And now, energy efficiency upgrades are available without upfront capital requirements with Constellation’s Efficiency Made Easy. Through in-electric bill funding, businesses and institutions can get much needed lighting, HVAC or motor upgrades that reduce energy demand with short-term payback.