ERCOT’s Generation Reserve Margin Rises for Summer 2020, Could be New Record

4 min readOn May 13th, ERCOT released two important reports that will give customers a picture of what generation ERCOT is expected to have in summer 2020 as well as for a longer term — through 2025: the Seasonal Assessment of Resource Adequacy (SARA) and Capacity, Demand and Reserves (CDR) reports.

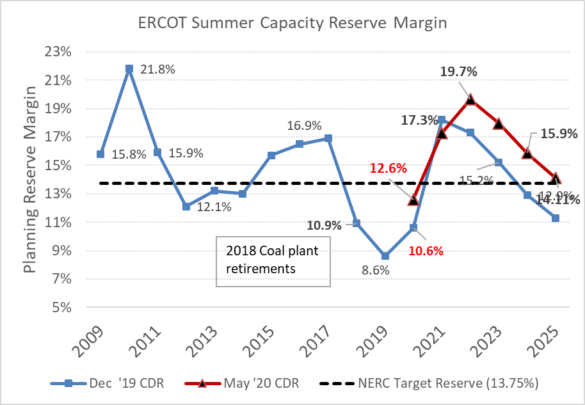

ERCOT’s final summer 2020 SARA report highlighted the potential risk for ERCOT to enter Energy Emergency Alerts (EEA) status this summer. The second report, the CDR report, released by ERCOT is released twice a year in May and December and examines longer-term load growth in ERCOT as well as what new generation is expected in the next five years (i.e., 2021-2025).

Constellation market analysts hosted a webinar on May 13th highlighting the key market drivers and takeaways from these reports. During the webinar, attendees had the opportunity to ask questions about the findings. Below is a recap of the Q&A for energy managers in the ERCOT region to take into account when managing their energy strategy:

Do we know when the 3 gigawatts (GW) of solar is expected to come online for 2020?

ERCOT projected just under 2 gigawatts of additional solar for summer 2020 over summer 2019. Only 380 megawatts (MW) of this capacity is fully commercial; the remainder is still spread across various stages of construction and testing.

In the May CDR, ERCOT highlighted what new resources had become operational since the December CDR, and it is apparent that there was only 88 MW of new gas along with 20 MW of battery capacity, and the rest was renewables (2,165 MW) that was expected to contribute 702 MW of summer capacity. Yet, we know from August 2019 that renewable capacity, especially wind, can vary day to day. Note the number of “Wind-O” plants below – these power plants are projected by ERCOT to provide 16% of their total capacity during peak demand hours, significantly limiting their impact on scarcity pricing.

Is the solar build a response to low wind generation during the day?

This is definitely an aspect. It’s an attractive investment at this time as the operator is able to capture more of the higher “on peak” prices throughout the day. Increased wind power continues to drive overnight pricing lower as their max output aligns with lowered demand overnight, requiring less high-cost fossil fuel generation. It’s also a story of scale and maturity with wind much farther along that curve in Texas than solar currently (~28 gigawatts (GW) of wind vs. ~3.9 GW of solar for summer 20).

The reserve margins for 2021, 2022 and 2023 are much higher now. Should this affect prices for these years?

It could and should if the renewable buildout forecasted by these reserve planning reports come to pass. However, the anticipated near-term build levels are optimistic in their scope (8,000 MW between May 31, 2020 and June 1, 2021) considering the 2019 buildout and 2020 progress to date. Anticipate some of this capacity to delay to latter market years (i.e., 2023-2025). For example, 8000 MW of solar will actually be meeting multiple years of load growth instead of the single year’s worth implied by the reserve margins.

Part of the dynamic here is limited demand for renewables – prices in ERCOT are not viewed as enticing for someone to build a new wind or solar plant and recoup their investment SOLELY from the energy they produce in ERCOT’s market. Instead, these developers are securing an “offtake” agreement for their power, generally at a fixed price through the contract term. As such, there’s only so much demand from a corporate/municipal/power marketer standpoint to be sated by new renewable builds, and securing this offtake agreement is generally a requirement for securing the third capital funding necessary to move forward with these projects.

One additional factor that could affect prices for 2021-2023 is whether we see volatility in real-time prices this summer due to tight reserve margins and or low wind conditions. While new solar and wind capacity will help, both are intermittent in nature and shortfalls this summer would indicate that continued load growth in ERCOT, to 80 GW or higher, could continue to strain reserve margins.

Source: ERCOT

Do we expect to see a material increase in residential demand response this year vs. 2019?

No. Material load-side demand response increases this year versus 2019. ERCOT has put intentional effort into better tracking of distributed generation sources, but there is no indication that these are “new” demand-side resources, simply a better accounting of the existing levels.

Is there a potential material change in industrial demand because of COVID-19 that may not have been considered in the forecast?

The updated lessened peak demand for 2020 comes from updated economic forecasts that are incorporating expected hits to industrial and commercial demand. In Texas, industrial impacts are expected to be felt most heavily in the far West as drilling wells facing an oversupplied market (and corresponding low prices) shut-in. It’s also expected to be felt by the Houston zone as economic and oil/gas market stresses cascade to the downstream refineries, factories, and liquefied natural gas facilities that consume the Permian exports in their supply chains.

The Texas economy is going through an unprecedented demand shock and supply contraction, but we really won’t know how it will affect the second half of 2020 or into 2021 until we can see at what pace normal economic activity can resume. Already, WTI has gotten back above $30/bbl and if it holds these levels that could stem the decline in associated gas output and put a “bottom” in on some of the economic indicators in the chart below.

To access information related to ERCOT summer readiness, visit our resources page. You can also contact your sales representative with any further questions.