Constellation Meteorologists Forecast Warmer-Than-Normal Winter

3 min readDuring the October Energy Market Intel Webinar, Constellation’s team of market analysts known as the Commodities Management Group (CMG) and internal team of meteorologists presented the 2019/2020 forecast, the status of the economy and its potential impact on energy prices, and honed in on some regional events impacting energy supply and demand.

Our internal meteorologist opened the webinar with a look at past “analog” years – which involve past weather patterns that most resemble the current weather drivers – and forecasting potential outcomes from such.

Weather Update

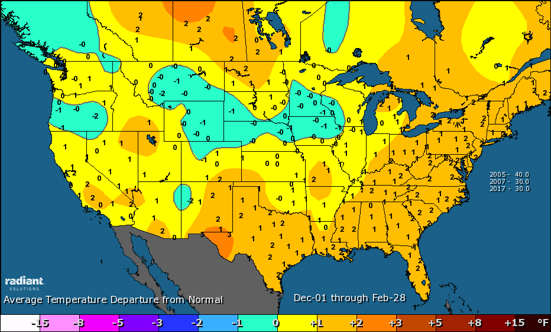

The best winter analog matches to the current weather pattern are 2005, 2007, and 2017. The average population-weighted heating degree-days for those three winters was 2,500 compared to the 30-year average of 2,630. This means that the closest analog winter years (i.e., 2005, 2007, and 2017) were somewhat warmer than normal.

Source: Radiant Solutions

The Constellation weather team is calling for a warmer-than-normal winter in the South and East with a lot of variable cold shots in the Midwest. Arctic sea ice and snow cover continues to run below the 1979-2010 normal and is believed to be a contributing factor in a series of above-normal (i.e., above the 30-year average temperatures weighted for population) winters since 2007. Meteorologist Dave Ryan also pointed out that several third-party private weather services are forecasting a colder-than-normal winter.

Storage and Production Update

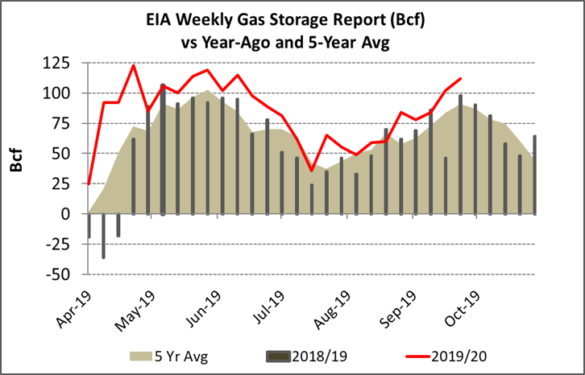

As winter approaches, Constellation’s market analysts reviewed the end-of-year natural gas storage inventories that the Energy Information Administration (EIA) forecasts at 3.8 trillion cubic feet (Tcf). Natural gas inventories are nearly 20 percent higher than last year at this time and are forecast to end the winter season at 1.8 Tcf, significantly higher than last year as well. Throughout the “injection season” (i.e., April through October when natural gas is stored in underground facilities for use in the winter), a series of record gains in inventory provided a bearish (or falling) price factor in the natural gas market.

Source: EIA

The team reviewed natural gas production year-to-date noting that 2019 is a record year, but also noting that production seems to be flattening, growing at a slower rate than past years.

Regional (SoCal) Update

The team also delved into developments in the Southern California Gas (SoCal) system where a host of maintenance problems have held gas off the market, causing price spikes and service disruptions. A major gas pipeline that will return to service in the SoCal system should play a role in reducing gas and power price volatility in that region.

Lastly, the team touched on the potential for a slowing U.S. economy, noting that the Global Purchasing Managers Index is moving into negative territory. A slowing global economy can influence U.S. energy markets, affecting export prices for the market basket of hydrocarbons that the U.S. now exports.

To stay updated on these topics and more, join us in November for our next Energy Market Intel Webinar on November 20, 2019, at 2:00 p.m. ET. In next month’s webinar, we will examine the progression of the neutral El Niño – Southern Oscillation pattern and its impact on winter weather forecasts and monitor regional gas basins for insight into 2020 production, pipeline updates and liquefied natural gas project announcements.