Interstate Pipeline Rate Changes: What Do These Changes Mean for Your Business?

4 min readThe natural gas industry has significantly shifted over the last decade.

Technological developments allowed producers to expand hydraulic fracturing and horizontal drilling, significantly increasing supply in the United States. This event sparked the Shale Revolution, which brought prices plummeting to the lowest the market has ever seen. We’ve also watched the balance of supply and demand shift. The United States is now the largest natural gas producer in the world and a natural gas net exporter. In addition, liquefied natural gas (LNG) exports are now a staple of the market fundamentals conversation.

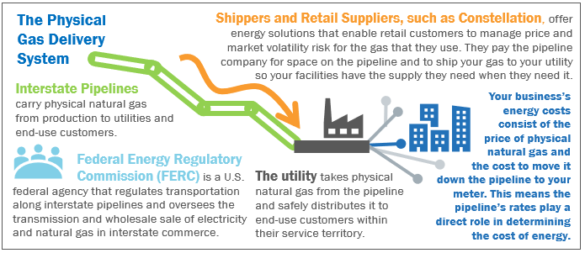

Currently, there is a lot of activity regarding the gas transportation rates being charged by the interstate pipelines. Some rate cases have been prompted by a review by the Federal Energy Regulatory Commission (FERC) in response to the Federal corporate tax rate reduction in January 2018. Additionally, other interstate pipelines filed rate proceedings because of a prior rate case settlement that required the pipelines to make a new rate filing by a certain date.

An interstate pipeline tariff or rate change is completed through a formalized rate case with the FERC, and while we’ve seen similar regulatory changes recently in some markets, in other markets, some interstate pipelines haven’t changed their rates in more than twenty years.

What is the role of the interstate pipeline in my physical natural gas supply?

Why are the interstate pipelines changing their rates?

In response to the Federal corporate tax rate reduction in January 2018, the Federal Energy Regulatory Commission (FERC) wanted to ensure a timely flow to ratepayers of the benefits of those tax cuts with respect to interstate natural gas pipelines. As a result, FERC required all pipeline companies, that did not fall under an exemption, to make an informational filing to allow FERC to evaluate the impact of the tax reduction – essentially a rough estimate of return on equity information – before and after the tax cut.

As a result of this review, several interstate pipeline companies are in the process of proposing or implementing increases, or decreases, to the rates they charge today. In some cases, discussions also involve updates to tariff structures or address modernization efforts, which typically include projects that help ensure the safety and reliability of the physical pipeline infrastructure. Some pipelines have not filed such rate cases for a decade or more, so this may feel like a new event or the first you have heard of this type of filing. Additionally, FERC has initiated some rate proceedings regarding some pipelines based on FERC’s review of the informational filings. Still other rate proceedings that have been initiated in 2018 and during this year are the result of prior rate case settlement filing requirements.

Generally speaking, it is common to see one or two interstate pipeline rate cases in a year. This event has sparked more than ten and counting. Therefore, it is likely that many suppliers and stakeholders are going to be talking about how the market will respond to these rate cases.

If rate changes are made by a pipeline as a result of this review process, the change will impact physical natural gas suppliers that are shippers on the particular pipeline, and associated tariff changes will be made. A tariff outlines the rules, rates and procedures by which the pipeline operates and how it conducts business with other counterparties in the market (i.e., shippers and suppliers, such as Constellation, in this case.)

How does an interstate pipeline rate change impact my business?

As your physical natural gas supplier, it is our responsibility to move gas from where it is received on the interstate pipeline system to your utility so that you will have the gas that you need when you need it. We pay the interstate pipeline company a rate that is comprised of primarily two components: (1) a rate to reserve space on the pipeline (i.e., the reservation rate); and (2) a rate for the volumes of gas that we move (i.e., the commodity rate) to utilities where our customers are located. Therefore, any change in an interstate pipeline’s rates means a change in the costs incurred to serve our customers, if transportation on that pipeline is needed to reach your utility.

Have the interstate pipelines begun charging their new rates?

In these specific rate proceedings, pursuant to an order issued by FERC, the pipelines are allowed to begin charging shippers (including retail suppliers like Constellation and utilities) the proposed new rates following a five-month suspension period of time from the date of the order. The new rates are what the interstate pipelines propose to apply to their tariffs, and they will continue to charge these rates until the conclusion of either settlement negotiations, or administrative litigation proceedings, which involve FERC and other stakeholders. In some cases, the rate case may be settled four to six months from the filed date. At this time, if the new rates that are ultimately approved by FERC are lower than the initially filed rates, then the pipelines will refund the difference to their shippers.

This could mean a higher level of uncertainty in pricing and supply discussions throughout these suspension periods until a final rate is settled upon.

We would like to emphasize that some pipelines are increasing their rates and others are decreasing their rates, and each region might see changes on different timelines. We will keep you informed based on updates in your unique region. Constellation, an Exelon Company, serves a large number of customers across the country. As your physical natural gas supplier, we want to help you effectively manage your price risk and navigate the energy market. If you have questions or would like to learn more, please reach out to your Constellation sales representative and subscribe to our communications at www.constellation.com/subscribe.