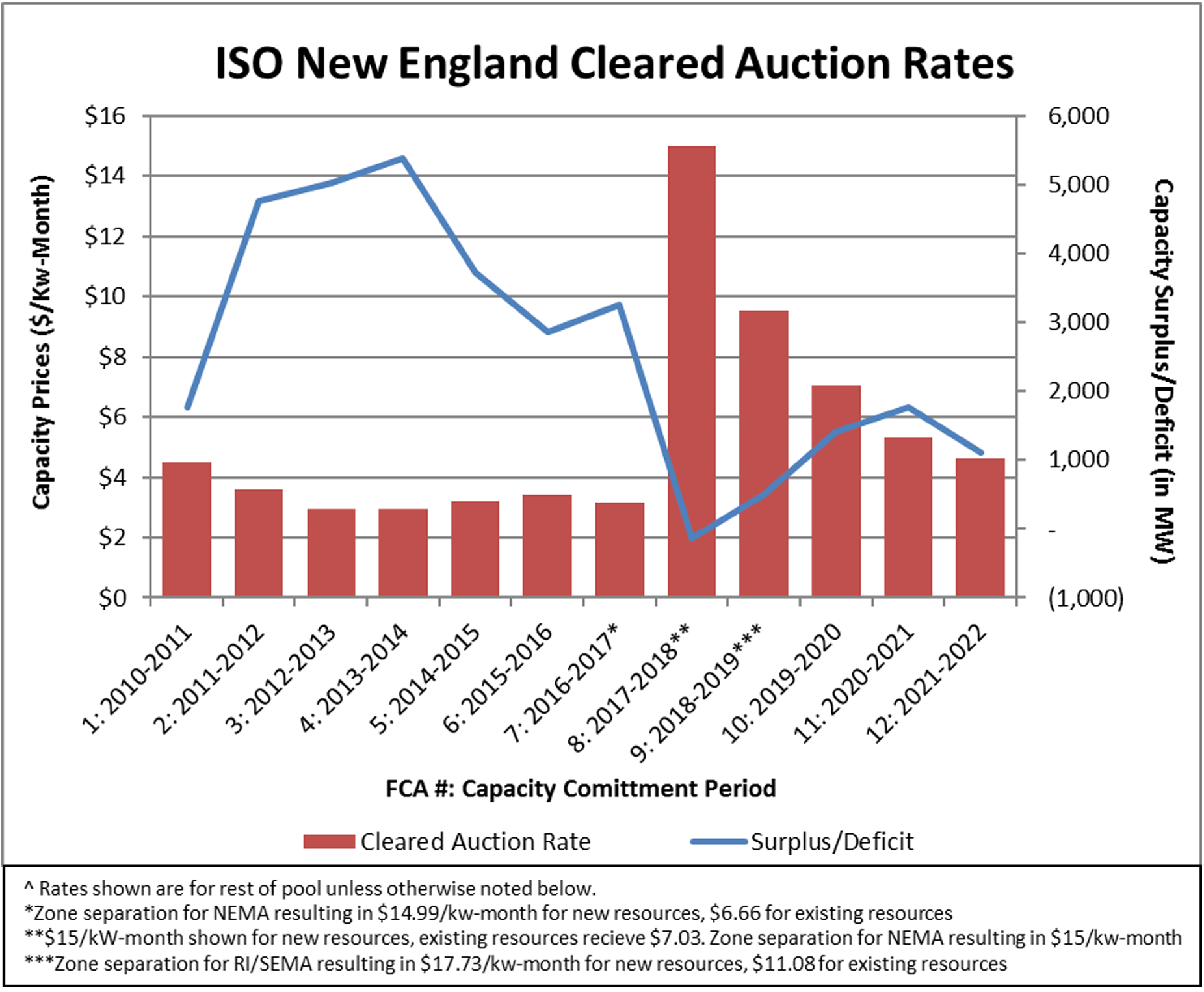

ISO New England’s 12th Capacity Market Auction Yields Its Lowest Rate in 5 Years

3 min readFinal results filed to the Federal Energy Regulatory Commission (FERC) revealed that for the fourth year in a row, the ISO New England’s Forward Capacity Auction clearing price declined from its previous year. The final clearing price for all of New England’s capacity resources was set at $4.631/kW-month, over a 13% drop from the previous auction’s price of $5.297/kW-month. There was no zonal separation leaving all resources to receive that same rate.

The Forward Capacity Auction takes place three years in advance and determines the capacity rates in which resources are paid. Funds paid to the resources must be recouped by ISO New England from the load serving entities, which trickle down to the end-user (commercial, industrial, residential accounts). These capacity rates have been officially published by the ISO New England and all power suppliers/load serving entities will be charged these rates for the next three years on their capacity invoices.

Robust competition for offered capacity along with decreasing generation costs and low-cost resources such as demand response and energy efficiency all contributed to the suppressed rates. The 34,828 MW of capacity procured from the auction surpassed the Net Installed Capacity Requirement that was set by the grid operator at 33,725 MW leaving the region with over a 3% surplus and adequate power system resources for the capacity commitment period (CCP) of June 2021 to May 2022. Of the 34,828 MW of supply resources selected, 174 MW was new generation from existing plant upgrades while 514 MW were new resources classified under energy efficiency and demand response.

The news is welcome to commercial and industrial end-users in New England as capacity costs currently account for over 30% of total supplier price. Declining capacity rates will shrink that share as we move forward, an example of this can be seen in Exhibit 1.

Exhibit 1

Source: ISONE

While end-users are pleased, the low clearing price and abundance of competition was not good for everyone. Three generating units owned by Constellation’s parent company, Exelon, attempted to de-list (remove themselves from an obligation) during the auction. The ISO New England conducted its transmission and reliability analysis on the units and determined two of the units, Mystic #7 & 8, are needed for reliability and were not allowed to exit the market for the corresponding CCP. Mystic 7 is a natural gas combined-cycle unit while Mystic 8 is a dual-fueled unit that runs on either oil or natural gas with nameplate capacity of 575 and 703 MW, respectively. The third unit, the 711 MW Mystic #9 was deemed not necessary for the grid’s reliability and allowed to exit the market for the CCP.

Since these rates are passed to all power suppliers/load serving, capacity costs will be included in a customer’s total fixed rate, indexed rate, or passed-through as a separate line item for most other purchasing strategies. For new or renewal contracts the difference in rates between fixed and passed-through capacity is negligible as the rates are essentially set, but customers can manage their capacity tag to offset these cost hikes.

The account capacity tag is a key component in determining the capacity costs along with the capacity rate. The capacity tag in New England is set during the previous power year on a single hour when the overall demand for the region hits the annual high. Once that hour is determined, each account’s capacity tag is set based on that hour’s consumption. Constellation provides a number of capacity tag management programs, including the popular Peak Load Management, to mitigate these high capacity rates and lower the overall costs of energy. For more information on changing market conditions and how they could affect your business, be sure to subscribe to our communications at constellation.com/subscribe.

Source:

ISO New England www.iso-ne.com