Key Drivers Impacting Energy Prices the Second Half of 2020

3 min readDuring the Constellation Energy Market Intel Webinar on June 17, the Commodities Management Group (CMG) gave an overview of the key drivers that will guide the market in the second half of the year and into 2021, including summer weather, storage, production and demand.

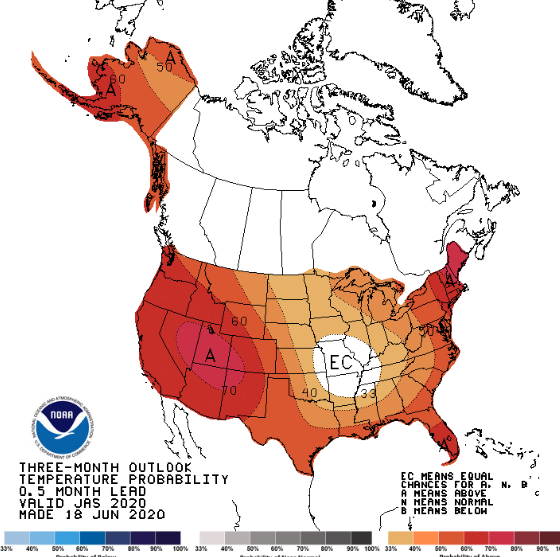

Our summer weather forecast reveals the development of a weak La Niña pattern. If the La Niña conditions continue, a hotter-than-normal summer would be very likely with higher temperatures in the Midwest that would matriculate east. This hurricane season is likely going to be quite active and that could play a role in providing rain and moisture in the Gulf Coast and Southeastern U.S. to keep a lid on high temperature anomalies.

Source: National Oceanic and Atmospheric Administration (NOAA)

Storage and Production Update

The CMG team reviewed the key natural gas and power market fundamental drivers such as storage, production, demand and exports. Current natural gas storage inventories are 36% higher than the same time last year, and the Energy Information Agency (EIA) has forecast the end-of-injection season inventories at greater than 4 trillion cubic feet, a record amount. Ample gas-storage inventories are a strong factor in keeping gas prices in check through the summer air-conditioning season and have played a role in keeping prompt-month natural gas prices below $2 per MMbtu in the second quarter.

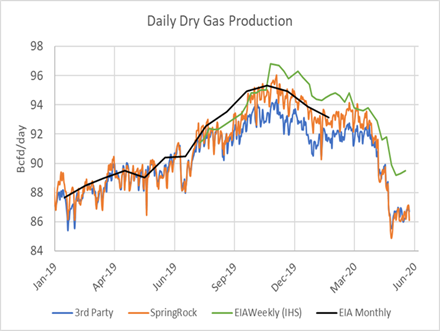

The CMG team looked at the rapid fall in natural gas production that has taken place in this quarter that has been driven by the near-death collapse in the crude oil market in the month of April. Natural gas production has fallen 8 billion cubic feet (Bcf) per day from the beginning of the year with the lion’s share of that decline having occurred during the past two months.

Much of the decline in gas production has come from cutbacks in crude oil production, which subsequently cut natural gas production. Additional cuts to production have occurred from a lack of well completions and from the decline rate to existing production that is occurring as drilling rig activity has ground to its all-time low level. The team also took a quick snapshot of pending oil and gas bankruptcies and discussed the role of these restructurings and higher hurdles for capital as barriers to ramping up production.

Source: Energy Information Administration

Natural Gas Demand Update

While the supply/production of natural gas has dropped at its fastest rate in history in the second quarter, demand for natural gas has actually increased year-over-year led by the power-generation sector. This is remarkable when considering that this past winter was the third warmest since 1950, the compound effect of COVID-19 on the economy and subsequent declines in overall consumption of electricity in various regions. The team noted that even though power generation demand had declined pursuant to COVID-19 shutdowns, natural gas’ share of the power-generation pie grew substantially over coal-fired generation as the price of gas was low enough to edge out coal in numerous markets.

If demand for natural gas is robust, exports of liquefied natural gas (LNG) are certainly not and provide an offset to the effects of declining production on the direction of pricing. U.S. LNG exports have declined sharply in the second quarter from over 9 Bcf per day to about 3.5 Bcf per day. Most of this decline is related to the global recession imposed by the virus coupled with swelling inventories in Europe. LNG exports are forecast to lag at near-current levels through September when they are expecting to pick up with the advent of cooler temperatures and recovering economies in Europe and Asia.

The CMG team also hosted Constellation Chief Economist Ed Fortunato in an overview of the macro economy and the effects on energy markets. Ed discussed recent Federal Reserve interventions relative to market liquidity, debt-service, unemployment benefits and the current and potential direction of the U.S. economy in the second half of the year. He will discuss this in more detail in a new monthly webcast, Fortunato & Friends on Tuesday, June 30 at 2 p.m. ET. Keep a lookout in your email for more details.

Join us for our July Market Intel Webinar on Wednesday, July 15th, at 2 p.m. ET, where we provide updates on factors affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions. Don’t miss out on this chance to ask or hear energy questions from businesses like yours.