Predicting Future Gas Prices in Asian and European Markets

3 min readAttendees of the Market Intel webinars have an opportunity to ask questions related to energy market trends during webinars. In the October Market Intel webinar, a viewer asked the following:

What is the current forecast (generally speaking) for future gas prices in Asian/European markets? Are they expected to remain around $10 or to rise or fall?

In addition to winter heating load demand, Asian demand for liquefied natural gas (LNG) the past several years has been driven by declining nuclear generation capacity in Japan and overall GDP growth. Historically, Asian LNG prices have historically been linked to global oil prices and the aggregate Japanese oil import price. Prices in Europe have traded at a discount to Asian prices due to shorter transportation costs from the Middle East and North Sea gas supply. In 2014, LNG prices were trading $18-$20/MMBtu based on oil above $100/bbl. They have since recovered from their 2015 lows of $5/MMBtu for Europe and $7/MMBtu for Asia after the collapse in oil prices from $100/bbl to $30/bbl that began in November 2014. With U.S. and global oil prices above $65-$70/bbl, this should continue to support LNG prices at current level.

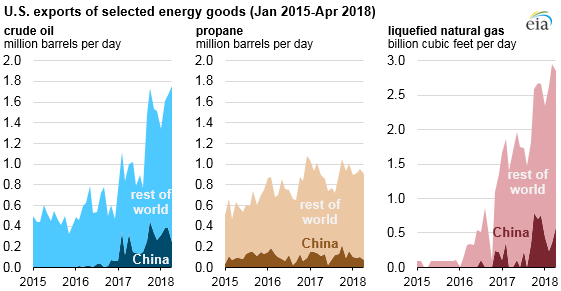

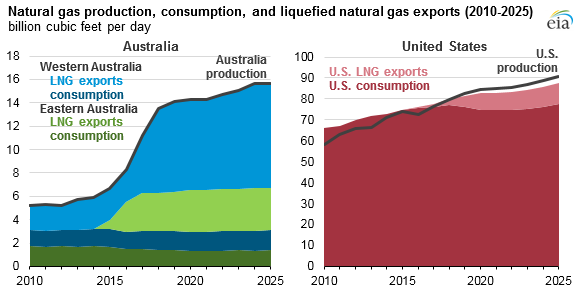

The U.S., Australia and Qatar and, in the coming years, Canada, are all building new LNG export capacity and that will all likely help to meet growing Asian demand, particularly from China. Australia exported more than half its natural gas in 2016, and close to 80% of production will be exported by 2020. Just this week, Inpex Corp, Japan’s top oil and gas producer, sent its first cargo of LNG from its new Australian facility, originally slated to start in 2016. This new facility will produce 8.9 million tonnes of LNG per year, equivalent to 10% of Japan’s current annual LNG import capability per The Wall Street Journal. This LNG export capacity will be competing with U.S. exports to serve China, Korea and Japan. China was a destination for 15% of U.S. LNG in 2017 but last month levied a 10% tariff on U.S. LNG imports.

Source: EIA

Global LNG prices in the short term will be impacted by U.S. and global economic growth, winter weather demand, global oil prices and the growth rate of Asian demand. Over the longer term, there are two factors driving global LNG prices. A key driver on the supply side is the additional LNG export facilities that are constructed post-2020 in the U.S., Canada, Australia and Middle East. On the demand side, a key driver is the rate at which the global demand for LNG and oil grows and whether it outpaces growth in supply.

Register today for our November Market Intel Webinar, scheduled for November 14, 2018 at 2 p.m. ET, where we will update viewers with any changes to our winter 2018/2019 forecast and offer a fundamentals review of production and demand statistics.