The Impact of El Niño on Summer Weather, Ample Gas Production Keeps Prices in Check Despite Storage Deficit

2 min readDuring the April Market Intel webinar, Constellation’s Commodities Management Group (CMG) presented on the key fundamental drivers in the natural gas and electric power markets as we exit the winter and move toward the summer season.

With winter long in the rearview mirror, the attention now turns toward summer and the potential for air conditioning load to drive demand for natural gas-fired electric power in key markets. Market analysts opened the April webinar with a close look at the near-term forecast and then moved to the longer-term outlook for summer.

Weather Outlook

The general view on the summer 2019 weather outlook features a weak El Niño, which would keep things a bit cooler than normal in the Midwest, slightly cooler than normal in Texas and hotter in general in the Pacific Northwest. We may have peaked on a wet weather pattern across the central and eastern United States. A drier outcome in the spring would lessen the probability of a cool summer.

Gas Storage and Production

Natural gas storage inventories finished the winter heating season at a five-year low coming in near 1.1 trillion cubic feet (Tcf) and more than 500 billion cubic feet (Bcf) below the five-year average. Low storage inventories are generally supportive of natural gas and power prices, all other things being equal.

Natural gas production continues to climb to new highs, however, there is some amount of discrepancy between the production numbers reported by the Energy Information Administration (EIA) and those reported by other third-party vendors. That being noted, natural gas production year-over-year is up more than ten percent and is being pointed as a force in keeping a lid on gas and power prices in the second quarter.

Natural Gas Continues to Displace Coal

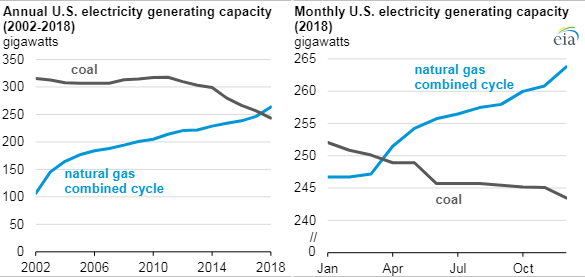

The EIA reported that for 2018, on a national basis, Natural Gas Combined Cycle (NGCC) capacity exceeded coal as the predominant power generating capacity. As of January 2019, NGCC capacity reached 264 GW versus 243 GW of coal-fired capacity.

Source: EIA

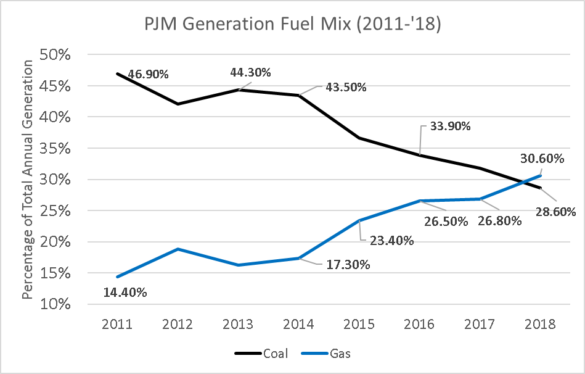

The growing shift to gas-fired capacity has mirrored itself in PJM, previously a coal-heavy region, in terms of annual output. The PJM State of Market 2018 report noted for the first time that gas-fired generation (30.6%) surpassed coal generation (28.6%), a trend that has accelerated since 2014. Nuclear has been consistent at ~34% over the term. Both growing power generation and exports (liquefied natural gas and pipeline) are among the biggest demand drivers for gas.

Join us in May for our next Energy Market Intel Webinar on May 15, 2019, at 2:00 p.m. ET as we take a closer look at the summer forecast and revisit the primary market drivers in natural gas and electric power markets affecting industrial, commercial and institutional end-users.