U.S. Becoming a Net Energy Exporter, Why Imports Still Matter

3 min readThere has been recent news and opinion suggesting the U.S. is energy independent, mostly regarding oil. The U.S. is set to be a net oil exporter by 2020,1 but that doesn’t necessarily mean imports are going away, and we will discuss why a little later.

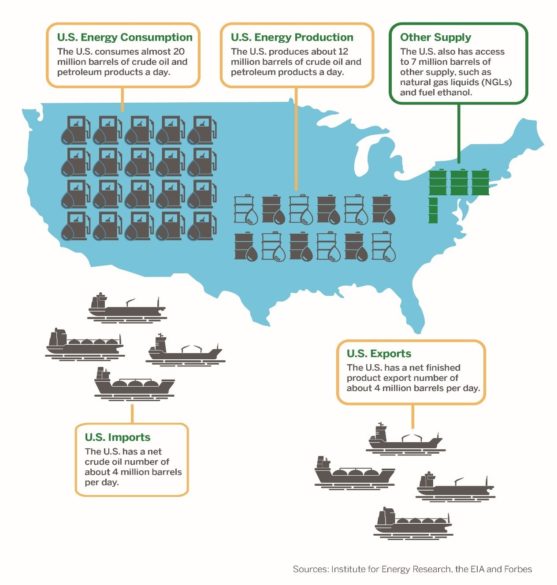

Currently, the U.S. consumes almost 20 million barrels of crude oil and petroleum products a day. The U.S. produces about 12 million barrels of crude and has a supply of other sources like natural gas liquids and ethanol. It imports about 4 million barrels of crude oil and exports about 4 million finished products.2

The graphic above, depicts several statistics of the ins and outs of crude and other products. Even if the U.S. may be identified as energy independent, there are still logistics to consider.

Some other countries can be seen as reliant on the United States’ refined and lighter oil product in order to mix it with their thicker oil so that it effectively travels through pipelines.3 These exports, paired with America’s increasing energy consumption, make trade an important part of supporting energy supply to meet both global and domestic demands.

Let’s put the spotlight on the Venezuela situation.

Venezuelan exports ̶ about 500,000 barrels per day of crude oil to the United States ̶ have halted with tankers floating in the Gulf of Mexico, due to imposed U.S. sanctions. The four main U.S. importers of heavy Venezuelan oil, including Chevron, Citgo, Valero and PBF, are left seeking alternative supplies. Saudi Arabian crude oil might be the answer for an alternative but the logistics of moving crude oil that far get expensive. U.S. refineries depend on heavy crude oil, so that refined or light oil can be produced and exported.

In addition, The Organization of the Petroleum Exporting Countries (OPEC) and Russia cuts have also affected this situation by removing 1.2 million barrels a day from the market.

A targeted release of sour crude oil barrels from the U.S. Strategic Petroleum Reserve (SPR) could help, but the situation hasn’t become dire yet.4

So, although the U.S. may be viewed as balanced energy-wise, especially in terms of its shale oil supply used to produce gasoline, it is arguably still dependent on acquiring its heavy crude oil elsewhere.

All oil burns and can be cracked in a high heat and high-pressure machine to make refined products (e.g., gasoline and heating oil primarily), but crude comes with different characteristics of the area from which it is extracted. Some oils are as thin as maple syrup and can be burned as gasoline without the help of a refinery whereas others are as thick as tar and full of sulfur. Most refineries are designed to take a certain type of crude oil. For example, the Gulf Coast refineries are designed to take heavy sour crudes that produce heavier products (i.e., heating oil and asphalt). That’s where imports of heavy crudes into the U.S. may be viewed as a crucial part of the equation for continuing to meet consumption needs.

To stay apprised of what’s happening in the energy market, tune into our April 17th Energy Market Intel Webinar.

Guest Author: Ed Fortunato, Managing Director – Fundamental Analysis

Ed Fortunato is the Managing Director of Fundamental Analysis at Constellation, an Exelon Company and responsible for providing fundamental views of the economy, oil and natural gas. Ed has spent more than 15 years with Exelon having begun his career managing the proprietary trading book, the short-term analytics group and has lead the implementation of trading strategies in both the prop and hedging books since his arrival. Ed has an MBA with high honors in finance from Boston University and a BBA from Baruch College.