Winter is Coming: October Market Intel Webinar Recap

3 min readDuring Constellation’s October Energy Market Intel webinar, our Meteorology team forecasted the upcoming winter weather and principals from the Commodities Management Group explored the surging gas production and the storage deficit. They also explained why it’s important to become familiar with the economics of U.S. natural gas exports as it relates to liquified natural gas.

The following are some key takeaways from this month’s webinar:

Fall and Winter Weather Update

As natural gas storage levels are well below five-year averages, the outcome of this winter will be extremely important to the market. While the autumn season has come with some cold temperatures, it is likely no more than a “head fake.” The early winter (December-early January) should be warm in the East and cool and stormy in West.

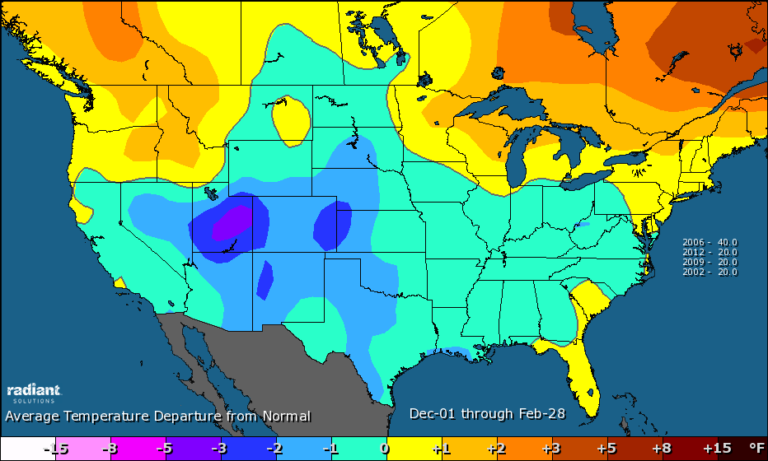

The coldest period this winter may occur in late January and February, very similar to our analog forecast from 2006-2007. This weather pattern relates to a weak El Niño, which is expected throughout the winter and results in colder than normal winters across the Midwest, South and East. Most of the West will be warmer than normal during these episodes.

Factors such as the North Atlantic Oscillation (NAO), blocking and the strength of the El Niño will determine the transition and staying power of any change to colder temperature patterns in January and especially February.

Winter 2018/2019 Forecast & Corresponding Analog Years (Source: The National Oceanic and Atmospheric Administration (NOAA)/Radiant Solutions)

Market Fundamentals: (Surging Production vs. a Stubborn Storage Deficit)

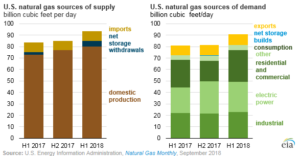

Surging natural gas production has kept pricing in check during the past six months, but inventories of natural gas in underground storage are near a 15-year low (i.e., 2005), providing the potential for upward pricing action. The Energy Information Administration (EIA) forecasts inventories will total 3.3 Tcf at the end of October and based on EIA Short-Term Energy Outlook, underground storage is projected to finish March 2019 at 1.37 Tcf, very close to the 1.35 Tcf seen last year.

Winter weather will be a key factor along with production growth in driving 2019 pricing between now and year end.

U.S. Liquefied Natural Gas Exports: Changing the Global Landscape

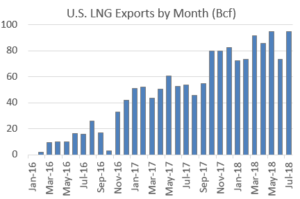

The U.S. natural gas market is undergoing a fundamental shift. With exports of natural gas increasing and the U.S. emerging as the rising star in the global liquefied natural gas (LNG) market, it is important to consider the macroeconomics of U.S. LNG exports, such as the cost to produce, liquify, ship and regasify, minus the key Asian and EU price indices.

LNG exports are expected to account for ~12% (10 Bcf/day) of total U.S. natural gas demand by 2023. Procurement professionals and facilities managers will need to become familiar with the economics of U.S. natural gas exports as an emergent force in future domestic pricing action.

Source: The Energy Information Administration (EIA)

Register today for our November Market Intel Webinar, scheduled for November 14, 2018 at 2 p.m. ET, where we will update with any changes to our winter 2018/2019 forecast and offer a fundamentals review of production and demand statistics.