Winter Solstice, the True Start of Winter: How is Production & Storage Expected to Fare?

3 min readDuring Constellation’s December Energy Market Intel Webinar, market analysts and meteorologists covered weather and market fundamentals and looked at specific regional issues with a forward look into 2020.

Winter Weather Update

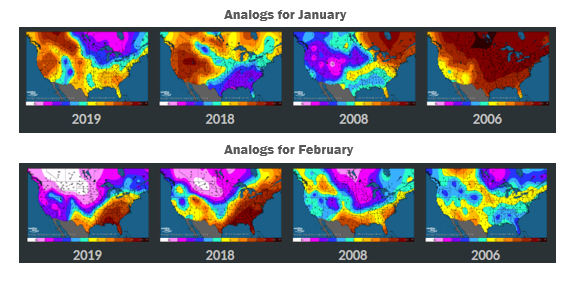

The weather outlook is marked by a higher degree of confidence for the February outlook than for January. The forecast for a colder-than-normal February is in place while the January forecast is highly uncertain due to higher-than-normal Pacific water temperatures and the role they are playing in potentially keeping colder air locked further north in the near term. As weather forecasts go, this is unusual as certainty in weather outlook is highly correlated to time; the closer in time the forecast, the higher the certainty. It was also reminded that winter has not yet started (i.e., Dec. 21 is the actual start to winter) and that there is some potential for upside pricing as the market has seemingly written off the winter before it has started.

Source: MAXAR Technologies

Gas Storage and Production Update

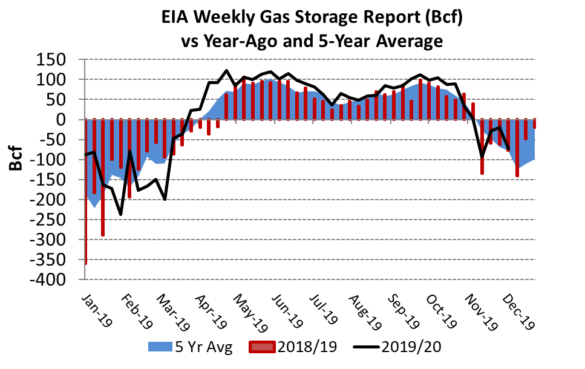

The team looked at the key natural gas fundamentals and noted that storage inventories have been, and continue to be, a bearish factor in the market. The Energy Information Administration (EIA) is forecasting an end-of-winter inventory of 1.9 trillion cubic feet, a number that is considered bearish of natural gas in the near term. However, it was also noted that a colder-than-normal winter could materially change the outlook for end-of-season storage inventory.

Source: EIA

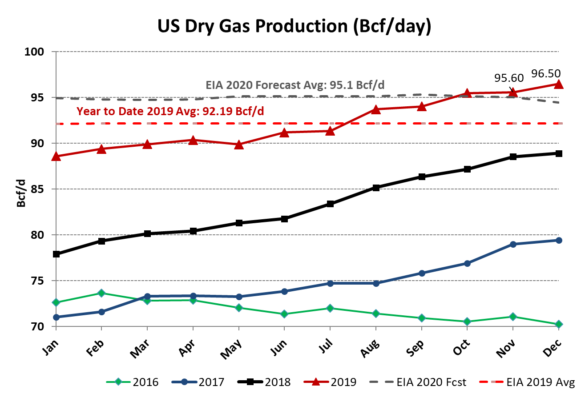

Natural gas production is holding steady at near 94 billion cubic feet (Bcf), however, that is a small amount less than the prior month. Production remains the key for 2020 in terms of pricing direction. Most forecasters are calling for a flattening of natural gas production in 2020 as producers have come under enormous financial pressure because of low prices for oil and gas. If production flattens or even falls modestly in 2020, there is sufficient demand in 2020 to rebalance the natural gas market in the second quarter and potentially lend upside to natural gas and power pricing.

Source: EIA

Regional Updates

The team also reviewed power markets regionally in New York, PJM, and ERCOT, taking note of various non-energy factors (e..g, capacity, transmission and renewable portfolio standards) in 2020 that are having a major impact on total cost of electricity in those regions. California’s natural gas delivery infrastructure problems were also covered during the webinar. The problems are improving and working to relieve some of the cost impacts associated with curtailed gas deliveries to the region.

To stay updated on these topics and more, join us in January for our next Energy Market Intel Webinar on January 15, 2020, at 2:00 p.m. ET. In next month’s webinar, we will review weather-driven gas markets for impact on index power markets and update listeners on recent progress on liquefied natural gas projects in the Gulf Coast.