Ask the Experts Part II: What are the Chances of a Polar Vortex this Winter?

2 min readIn our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions. Most recently, customers requested further information on weather forecasts and gas production during our September webinar.

Constellation’s Commodities Management Group addresses them here:

Hasn’t the El Niño Southern Oscillation (ENSO) turned more cold than warm, indicating if anything we are closer to La Niña than El Niño?

We are indeed closer to La Niña than El Niño with readings in the central Equatorial Pacific at around -0.3 degrees below normal C. Additionally, below-normal readings are found in the East Pacific toward South America, with warmer-than-normal readings found in the far West Pacific. In addition, we are watching subsurface water temperatures cool below-normal throughout the basin, which sometimes can indicate a developing event. Overall, we expect readings this winter to stay below normal, with neutral to weak La Niña conditions prevailing.

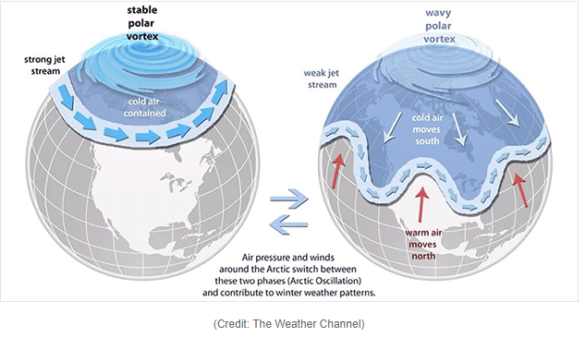

What about a polar vortex this year?

It is not a question about whether the Polar Vortex exists (it exists all the time) but rather where will it set up? Over the Pole, or will it wobble southward away and where? How strong will it be? Typically, a weaker and more displaced vortex will mean colder weather for the mid-latitudes. If combined with blocking in the pattern, the cold can last for extended periods of time. The setup this year favors a stronger, more consolidated vortex closer to the pole, which would keep cold air intrusions into the U.S. more confined to the northern areas and not sustained. If blocking were to develop (i.e., the sunspot theory), then odds would increase dramatically of a cold winter in the U.S., especially in the Midwest and East.

Will the production of motor oil using natural gas have an impact on the natural gas market, like electricity generation had?

The displacement of gasoline and diesel by natural gas in the transportation sector has not been a demand driver for natural gas. Currently, about 0.84 trillion cubic feet (Tcf) of natural gas per year is used in the transport sector, or about 3% of total natural gas produced. Relatively low oil prices coupled with the operational difficulty of needing a large and heavy natural gas container for a personal vehicle, limited fueling station options, and other issues have deterred market development in this area. There will be continued steady growth in the commercial and municipal vehicle space for natural gas fueled vehicles, but it is not on the same scale as gas-fired combined-cycle electric generation.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.