Market Over(Reaction)?

4 min readMonday was a tough day in the financial world whether one looks at the bond, equity or energy markets, either internationally or domestically. The selling was heavy across markets and continents, sending investors to seek shelter in the bond markets and sending Treasury yields to new lows. U.S. stocks fell hard enough at the open to trigger a circuit breaker that briefly froze trading for the first time in 23 years. At day’s end, the Dow was down over 2,000 points, suffering its worst decline since 2008 and notching its first loss of more than 2,000 points in a session. The Dow, S&P and Nasdaq were all down ~19% from record highs set earlier this year. A drop of 20% from those highs would halt a bull-market run that began after the financial crisis. In an odd coincidence of sorts, U.S. stocks bottomed out in the aftermath of the financial crisis 11 years ago, on March 9, 2009.

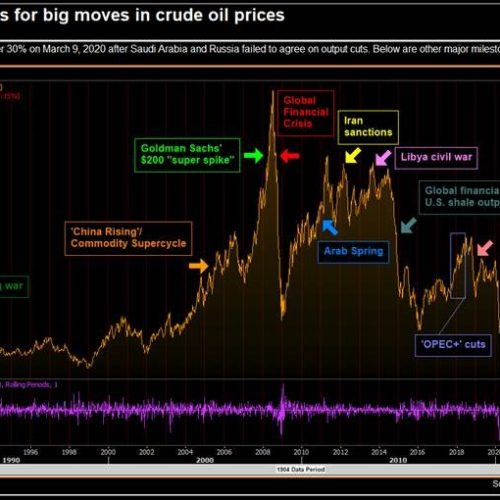

Recent Slump in Oil Prices

In energy markets, all eyes were on oil. In overnight Sunday trading, the Asian markets were hammering crude prices – the WTI April contract – the prompt month U.S. oil futures contract was subject to near panic selling and at one point was trading near $27/barrel. It had been trading over $41 on Friday. By the close of trade Monday, crude prices were barely hanging on to $30 a barrel and had suffered their biggest daily rout since prices fell by one-third at the onset of the Gulf War in January 1991.

What set this off? Saudi Arabia’s strategy of cutting production to protect oil prices hasn’t worked, and it has left the kingdom with reduced market share and lower prices. Over the past decade, Saudi Arabia has orchestrated repeated output cuts by members of Organization of the Petroleum Exporting Countries (OPEC) and more recently by an expanded group including Russia (OPEC+). In a meeting Friday among OPEC+ in Vienna, Russia said “nyet” to Saudi Arabia’s demand that the top global oil producers slash production to prevent overwhelming global oil markets with supply and attempt to prop up prices. Saudi Arabia countered by cutting its official selling prices for oil on Saturday. By the end of the weekend the three-year pact among the OPEC+ producers was in the dust and a race was on between Saudi Arabia and Russia to rapidly boost production in an effort to reclaim market share. The huge 25% slump in oil prices overnight triggered panic selling and heavy losses on Wall Street as the rapid spread of the novel coronavirus amplified fears of a global recession.

When markets opened for trading in the U.S. on Monday, everything was off sharply, but by the end of the day natural gas prices on the NYMEX were higher. Why? Much of the growth seen in recent years in gas output was coming from gas associated with the production of oil in shale basins like the Permian in West Texas. Since natural gas in this situation was just a byproduct of drillers seeking oil, a pullback in oil production spurred by a sharp price cut is going to reduce gas production. Normally, low prices encourage energy firms to cut spending on new drilling and reduce production, but that is not the case when gas is a freebie in the oil production stream. Recall also an ongoing concern we have noted over the past year of the high debt loads being carried by both oil and gas producers and the challenges they will face in the even more cash-constrained marketplace. So the concerns are three-fold; low oil and gas prices will likely slam an industry already struggling to pay down debt, as capital spending falls and oil producers reduce drilling there will be less of that free-gas available, all the while there’s still a high demand both domestically and internationally for our relatively inexpensive molecules. So, while demand will certainly suffer under the effects of the virus, the market is clearly thinking large cutbacks to the supply side of the equation will outweigh lost demand.

The Coronavirus

What about this coronavirus? No one knows with any real certainty how much, or for how long, the coronavirus will impact the U.S. economy. But we do know that it will have an impact. Epidemics normally have a severe but relatively short-lived impact on economic activity, with the impact on manufacturing and consumption measured in weeks or at worst a few months. As an example, health scares of the modern era barely register in collective memory anymore. While some recall the SARS outbreak of 2003 or Zika in 2015, does H1N1 (2009) still register? MERS (2012), anyone? Keep in mind the run-of-the mill flu (influenza) has sickened 15 million and claimed almost 4,000 victims in the U.S. since the beginning of flu season in October yet more than half the U.S. population can’t be bothered to get a flu shot. Pandemics like Spanish influenza (1918/1919), Asian influenza (1957/1958) and Hong Kong influenza (1968/1969) that caused large numbers of deaths had brief impacts on the economy. China’s coronavirus outbreak should mold to this pattern of a severe downturn followed by swift recovery (caveat: so long as it doesn’t set off a broader cyclical slowdown in an already-fragile global economy). The economic impacts of this round of contagion are difficult to quantify, but then so were all the others. This too shall pass.

So, What Should the Energy Manager Do Now?

Take a deep breath. The energy strategy you put in place is still there and recall that it has the flexibility to adjust to near-term changes in usage as well as look for longer term opportunity in the markets. The flu, whether of the corona variety or otherwise, hates warm humid weather. So summer temperatures will likely squash the bug but raise the typical concerns around reserve margins in Texas or what effect a poor water year in the West will have on hydro generation and prices in California. Looking a little further out, the coronavirus isn’t building any new pipelines, so gas deliverability issues into New York City or New England will still be there next winter. Review where prices are today with where they were a couple weeks ago and pick a few spots to layer in at freshly discounted prices.

Want to learn more? Constellation’s Commodities Management team along with energy meteorologist Dave Ryan, will be back on the air next Wednesday, March 18th, to bring all the latest energy news and insight your way.