2020: New Decade, New Price Action

4 min readAs the calendar changes years, markets generally change views. A bull market one year usually goes the opposite direction the next and vice versa.

On Jan. 2, we were lulled into a sense of serenity but events in the Middle East quickly changed price action just a day later. Equities have pulled back slightly from recent all-time highs due to geopolitical concerns. Gold, which had been consolidating for most of 2019, is now at its highest level since 2013, up about $75 since late December. Likewise, West Texas Intermediate (WTI) ̶ an oil benchmark that is central to commodities trading ̶ is approaching 2019 highs after being rangebound (i.e., not straying outside of a particular range) most of last year. The page has turned quickly in 2020: new decade, new price action.

The Fed’s Role in Stimulating the Economy

The Federal Reserve System, also known as the Fed, is the central bank of the United States and has remained steady, keeping rates low enough to keep the yield curve normal by lowering interest rates in the front part of the market, while rates in the long-term remain stable. Ninety-day treasuries, which peaked at 2.4% earlier this year, are currently 1.49%. The 10-year treasury note, which bottomed at 1.5% yield, is now 1.8%.

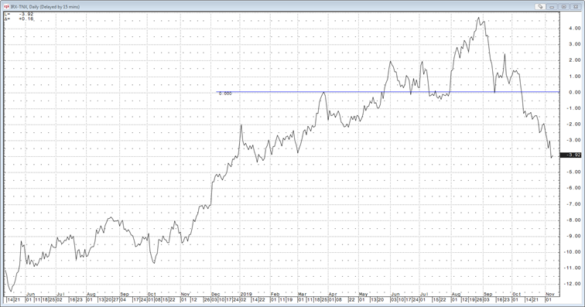

A normal yield curve allows banks to finance lending at a profitable rate, which encourages lending and stimulates the economy. The chart below illustrates how the interest rates on 90-day Treasury bonds were at a premium (positive spread) to 10-year Treasury bonds for much of May to October before recently reverting to a historically negative spread.

Source: CGQ.com

In addition to lowering interest rates, the Fed, which had been in tightening mode until the end of August, moved from “quantitative tightening” to “easing” once again by injecting about $10 billion a week back into long-dated treasuries. Finally, the Fed is injecting hundreds of billions of dollars into the short-term market to promote liquidity and keep rates in the front low, once again to promote cheap lending.

The Fed is full speed ahead on stimulus, and the expectation of a recession have eased although higher oil prices may slow things down a bit. This easing pushed the equity markets to new all-time highs at the end of 2019.

The price action over the first five days of January and the month of January usually set the tone for the year, so keeping an eye on equities over the next couple of weeks is important. Overall, this should encourage lending from banks, investment in projects, stronger economic growth and continued positive economic activity.

The price action over the first five days of January and the month of January usually set the tone for the year, so keeping an eye on equities over the next couple of weeks is important.

Why Does This Matter to Energy Managers?

Prices for energy commodities were fairly stable in 2019, but that has changed at the start of 2020 given the rising tensions in the Middle East. In 2019, WTI Crude prices had the lowest price volatility since 1999 when prices were in the $20 area. This has impacted the gas market, which has seen weak prices and low volatility, excluding recent weather-driven events. The second derivative–power–exhibited similar characteristics.

In 2020, we could see more energy volatility than we saw in 2019. The effect of shale drilling in the U.S. was on display as events in the Middle East played out. Prices are higher but have not exceeded April 2019’s highs, and WTI crude oil is $7.00/bbl less than Brent or North Sea crude oil prices. In the fourth quarter of 2019, the U.S. became a net exporter of crude oil and refined products as U.S. crude oil production exceeded 12.5 million barrels/day.

As the world’s largest oil and gas producer, the U.S. economy is generally viewed as less susceptible to oil-driven supply shocks than in the past, which can cause a spike in gasoline prices and a higher inflation. Any significant disruption to supply, such as another attack on Saudi oil refining capacity, could still lead to higher prices but the U.S. could increase production, which could have a positive domestic economic impact and potentially mitigate dramatic price moves. Given this buffer, as long as the Fed is stimulating, the saying “Don’t fight the Fed” may be the path to follow.

To stay apprised of market updates impacting your business’ energy strategy, subscribe to our regular Energy Market Update emails or attend our monthly Energy Market Intel Webinars featuring insights from market analysts and meteorologists by visiting www.constellation.com/subscribe.

Guest Author: Ed Fortunato, Chief Economist

Ed Fortunato, chief economist at Exelon Corporation, is responsible for providing fundamental views of the economy, oil and natural gas. Ed has spent more than 15 years with Exelon having begun his career managing the proprietary trading book, the short-term analytics group and has led the implementation of trading strategies in both the prop and hedging books since his arrival. Ed has an MBA with high honors in finance from Boston University and a BBA from Baruch College.