A Summer-Like Fall: What Does That Mean for Natural Gas Prices?

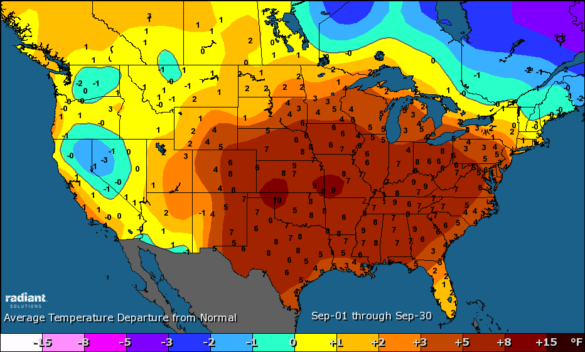

3 min readWith the start of October, the calendar says fall is in full swing, but the thermometer still says summer. A record warm September of 2019 followed by a warmer-than-normal early October is keeping cooling demand strong, and the thought of frost on the pumpkin is far away from most people’s thoughts. Except for a record snow storm out west, temperatures nationally are very warm.

September Temperature Deviations

Source: Radiant Solutions

Most seasonal forecasts have a colder-than-normal winter in store, but our team’s winter forecast is for a warmer-than-normal winter. Warm ocean temperatures and lack of Arctic ice are the team’s pinpointed culprits for the warm winter.

Although our forecast is in the minority, the markets seem to be more concerned about an oversupply of gas rather than an undersupply. The January natural gas contract is trading $2.60 currently. This is higher than the summer low of $2.50 but lower than the $3.00 area it traded in early September. In addition, the January 2020 versus January 2021 spread is trading near contract lows with prompt January trading at a 12-cent discount to January 2021. This tells us there is no fear in the winter coming up. Even the March versus April spread in 2020 has March only a 20-cent discount to April. This spread is winter versus spring where the spring usually trades at a substantial discount to winter as demand for heating fuel drops dramatically in April. So far, this discount is not substantial.

Weather Isn’t the Only Factor Impacting Prices

Is it all the weather forecast? No. Gas production is near a record high of about 91.5 Bcf a day. This strong production level has offset strong demand for cooling needs, higher liquefied natural gas exports and strong Mexican exports. As a result, storage levels, which were in deficit at the start of the injection season, have now caught up and are at the one- and five-year averages. Stronger production has not only led to lower prices in the winter and into the summer of 2020, but forward prices in calendar years 2021 through 2025 have also moved lower. Calendar year 2021, which had been trading $2.60 in July, is now trading $2.45. Calendar year 2023 is $2.58, down 12 cents from its summer price, and calendar year 2025 is down about 15 cents from summer levels at $2.73.

Overall, there is currently more than ample supply of gas around, which is pressuring prices long- and short-term. Can this change?

A cold winter especially in population centers could move prices higher. We are also seeing rig counts for gas drilling moving lower as gas producers find it harder and harder to make money in this low-price environment. On that same topic, we are also seeing an increase in bankruptcies in the drilling sector, and drillers are talking more about profits than production, with newfound capital discipline. This new attitude could lower production or keep production flat tightening supply and support prices down the road. Either way, don’t expect a normal winter for gas.

To hear Constellation’s meteorologists speak more about the winter forecast and its impact on energy prices, sign up for our October 16th Market Intel Webinar. It starts at 2 p.m. ET. In addition to weather, Constellation market analysts will also cover the market factors affecting your business’ energy bill.

Guest Author: Ed Fortunato, Managing Director – Fundamental Analysis

Ed Fortunato is the Managing Director of Fundamental Analysis at Constellation, an Exelon Company and responsible for providing fundamental views of the economy, oil and natural gas. Ed has spent more than 15 years with Exelon having begun his career managing the proprietary trading book, the short-term analytics group and has lead the implementation of trading strategies in both the prop and hedging books since his arrival. Ed has an MBA with high honors in finance from Boston University and a BBA from Baruch College