An Update from our Economist: Are Happy Days Here Again? A Look at the Changing Market

3 min readOver the last six weeks, there have been substantial changes to the interest rate markets and as a result a different view on the future of the economy overall.

The Federal Reserve System or the Fed has lowered interest rates in the front part of the market, a dramatic move changing predictions of a recession. Ninety-day treasuries, which peaked at 2.4% earlier this year, are currently 1.5%. The 10-year treasury note, which bottomed at 1.5% yield, is now 1.9%. The resulting action has reversed the yield curve from inverted to normal.

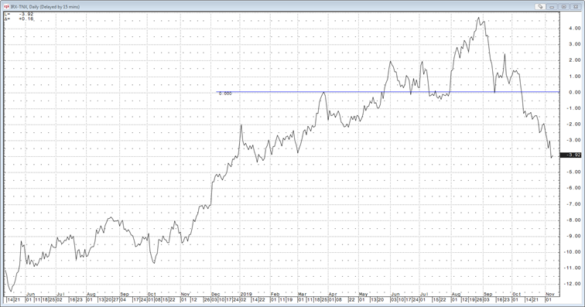

A normal yield curve allows banks to finance lending at a profitable rate, which encourages lending and stimulates the economy. The chart below illustrates how the interest rates on 90-day Treasury bonds were at a premium (positive spread) to 10-year Treasury bonds for much of May to October before recently reverting back to a historically negative spread.

Source: Federal Reserve

In addition to lowering interest rates, the Fed has moved from “quantitative tightening” to “easing” once again and is injecting about $10 billion a week back into long-dated treasuries. It had been in tightening mode until the end of August. Finally, the Fed is injecting hundreds of billions of dollars into the short-term market to promote liquidity and keep rates in the front low, once again to promote cheap lending. The result is the Fed is full speed ahead on stimulus, and the expectation of a recession has eased quite a bit. This easing has pushed the equity markets to new highs led by banking stocks, which are up 10% this month. Banks do well with normal yield curves that grow wide.

Overall, this should encourage lending from banks, investment in projects, stronger economic growth and continued positive economic activity.

Why does this matter to energy managers?

Prices for energy commodities have been stagnant in a low-volatility environment. This is reflective of the economy overall, which has seen slow growth overall. WTI Crude prices this year have had the lowest price volatility since 1999 when prices were in the $20 area. This has followed through to the gas market, which has seen weak prices and low volatility. The second derivative–power–exhibited similar characteristics. In addition, the copper market, a great indicator of industrial activity, has rallied 15% since September, indicating that demand for the metal is increasing.

As the economy picks up, so should the prices of oil, gas and power. In 2020, volatility should be more pronounced, and prices should be a bit stronger. We do not expect there to be remarkable price action especially in the first half of 2020 since there is still plenty of oil and gas around. Six weeks ago, we were fairly confident that a recession was coming but the Fed’s action over the last few weeks has dramatically reduced that probability. Markets are reflecting this action and once again the old saying, “Don’t fight the Fed” is fully in force.

For more updates on factors affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions, be sure to sign up for our monthly Energy Market Intel webinars and other valuable communications at www.constellation.com/subscribe.

Guest Author: Ed Fortunato, Chief Economist

Ed Fortunato, chief economist at Exelon Company, is responsible for providing fundamental views of the economy, oil and natural gas. Ed has spent more than 15 years with Exelon having begun his career managing the proprietary trading book, the short-term analytics group and has led the implementation of trading strategies in both the prop and hedging books since his arrival. Ed has an MBA with high honors in finance from Boston University and a BBA from Baruch College.