Ask the Experts: COVID-19’s Impact on U.S. Producers’ Balance Sheets

3 min readIn our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions. Most recently, customers requested more information about the coronavirus and its impact on the economy and energy industry, as well as solicited thoughts on the direction of ERCOT heat rates during our March webinar:

Constellation’s Commodities Management Group and Exelon’s chief economist Ed Fortunato address them here:

Most major exploration and production (E&P) companies and super independents have hedges in place at $50-$55 out until 2021-2022, and so if those same companies have clean balance sheets, will we really see the amount of defaults that the market is predicting in that sector?

Estimates for defaults vary, but the expectation is that low prices will hurt cash flow and the lack of capital applied to the industry will financially strain all participants with badly hurt levered balance sheets. Clean balance sheets are unicorns in this market now.

Major companies like XOM are selling at the same price as 22 years ago. Can things possibly be this bad in the industry?

Yes. No one is making money right now; this goes for even the biggest companies. This has been illustrated by capital spending cuts, stock buyback eliminations and dividend cuts.

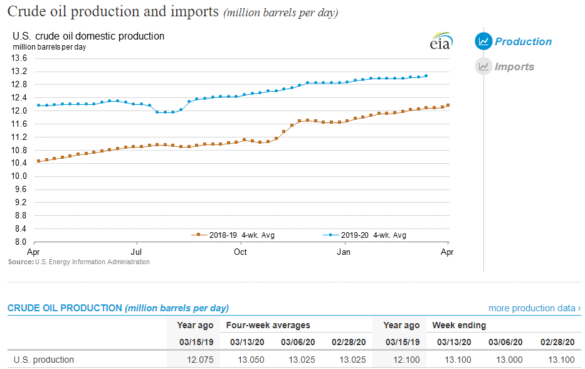

The U.S. is currently producing close to 13 million barrels per day per EIA’s This Week in Petroleum.

Source: EIA

This is a record amount for U.S. production and as a reference, Saudi Arabia recently pledged to increase production from 10 million bbl/day to 13 million, and Russia has pledged to increase to 12 million bbl/day. As companies cut budgets for 2020, (e.g., Continental Resources, a shale pioneer that stated last week it would cut 2020 spending by 50%) we should begin to see a decline in U.S. production.

What are Constellation’s thoughts on consolidation in the U.S. shale industry – and how might that impact natural gas prices?

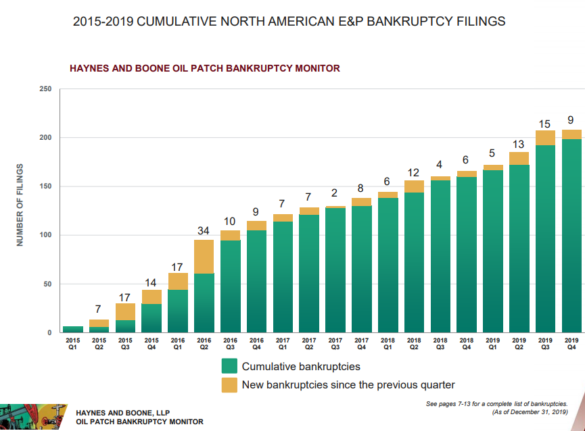

Given where prices for gas and oil are today and staggering amounts of debt in the industry, consolidation will occur and hopefully stabilize prices.

Consolidation within the industry is likely to occur, especially for companies with higher levels of debt. The first actions will be cost-cutting and then from there it depends on how long low prices below ~$35-$40/bbl persist. Already, Occidental Petroleum, which acquired Anadarko Energy for $38 billion, has announced significant capital cutbacks for 2020 and cut salaries for its headquarters employees by 30% and its CEO has taken a 88% pay cut per the Wall Street Journal.

Source: Haynes & Boone

The biggest impact from low oil prices would be to imply higher natural gas prices as associated gas output will decline and dry gas players cut budgets in a sub $2/MMBtu NYMEX market. These cuts will likely show up in production numbers in material size in the second half of 2020.

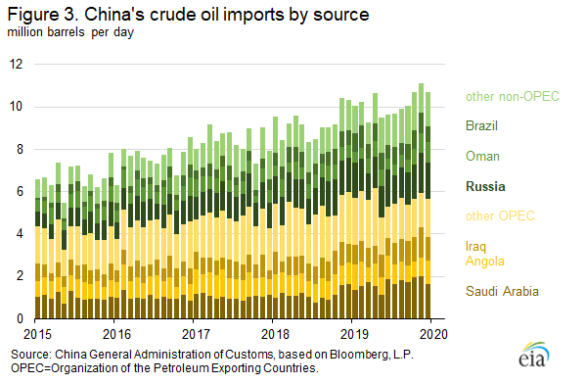

China’s crude oil imports surpassed 10 million bbls in 2019. With the climate of the world economy, any predictions of China’s 2020 imports?

Given recent events, it is hard to predict China imports but imports into their strategic petroleum reserve (SPR) should be strong given current low prices.

Source: EIA

For further reference, see stories from EIA: https://www.eia.gov/todayinenergy/detail.php?id=43216 and https://www.eia.gov/petroleum/weekly/.

Do you have any thoughts on the direction of heat rates near-term in ERCOT?

West Texas gas is basically free now leading to infinity type heat rates that will be reduced as gas prices stabilize.

Heat rates have overall been in decline in ERCOT for Summer (July/August) and balance of 2020 pricing because due to the expected pullback in oil and gas sector activity as well as a general economic slowdown, we are seeing summer pricing retreat significantly from close to $150/MWh for 5×16 July/August strip to $110/MWh for that same strip now.

Register for our webinar on April 22nd at 2 p.m. ET, where you will hear attendees discuss current economic conditions in light of the impact of COVID-19 and get access to a summer 2020 weather preview.