Ask the Experts: Economic Volatility, Summer Weather and Global Oil & Gas Prices

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy pricing and purchasing decisions.

Most recently, customers requested information on domestic and international factors affecting oil and gas prices, summer weather scenarios and economic volatility.

Constellation’s team of market experts address them here:

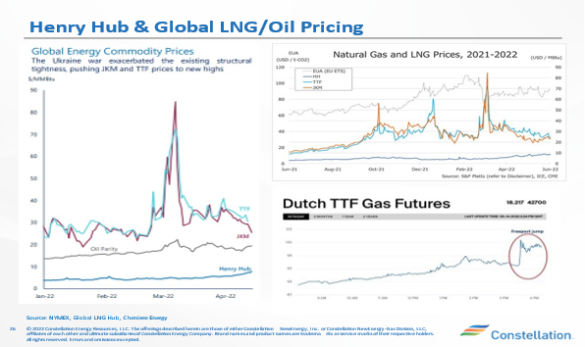

Do you see how Europe’s NBP or TTF % moves will apply to Henry Hub?

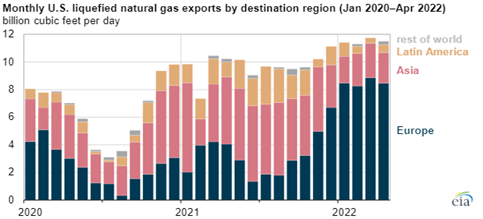

There is a global arbitrage between U.S. prices and overseas prices, and there will be efforts to close it until the price converges regardless of storage. For 2022, the U.S. can get up 14 Bcf/d by the end of year if the rest of the trains 9-18 at Calcasieu Pass come online as scheduled and Freeport LNG returns as scheduled. The chart below shows the growth in the percentage of U.S. LNG exports to Europe, which is now about 70%. LNG exports will likely remain strong to meet European and Asian demand and so it will come down to whether U.S. production can grow at a rate to keep pace with domestic demand as well as export demand.

Source: EIA

Given price levels and expectations of an economic slowdown – when do you believe demand destruction will materialize?

Natural gas went to $9/MMBtu and we did not see any immediate signs of material destruction. People will heat their homes in the winter (might be a bit less). A failure of small businesses in aggregate in a significant economic slowdown could have more of an impact on demand but LNG exports will expand again in 2024 and industrial demand may offset based on global prices.

What are your thoughts on the lack of doing “something” with accusations of Market manipulation?

Industry executives have told Glick the recent run-up in natural gas prices isn’t fully supported by market fundamentals, noting the agency has jurisdiction over abuse in the gas markets. “That’s something we need to consider and take a look at,” Glick said at FERC’s monthly meeting in June.

Much of the concern today relates to gasoline prices that are nationally over the $5/gal level. The U.S. has lost about a million gals/day of refinery capacity since the start of the pandemic, not due to manipulation but due largely to government policy requiring upgrades, tighter EPA permitting processes, and steeper biofuel mandates. Many refiners are unable to justify the costs as Washington is forcing a shift from fossil fuels to EVs.

Energy, like any other commodity, is a competitive, low margin business. There are many producers and many regulators and oversight bodies looking for fraudulent behavior.

With a soft landing by the Fed looking less and less likely, what is the downside price risk to NYMEX in a recession/depression?

It is hard to look at past recessions and compare them with this market volatility, or even COVID because the Shale Revolution occurred post 2008 financial crisis and COVID was a unique economy-wide demand shock. There will be some demand loss, but the economics of U.S. Henry Hub prices and Asian and European LNG prices mean that more industrial demand could be headed to U.S. shores. European industries relied on Russia to supply low-cost natural gas and oil to keep their factories running. With Russia threatening to cut their energy supply to European countries, Europe is looking for alternative energy sources.

The WSJ published an article about the loss of Russian energy and its effect on factory production, here’s the link https://www.wsj.com/articles/some-european-factories-long-dependent-on-cheap-russian-energy-are-shutting-down-11655112927?mod=article_inline

Are LNG export capital projects at risk of not materializing? And is this risk already baked into the price?

At the current time, no, because the spread between Henry Hub and Europe and Asia is wide enough to support long term deal structures. The ESG movement has discouraged investment in fossil fuel projects, but the Russian invasion of Ukraine put the theme of energy security back on the front burner. It is expected several other U.S. projects will go to Final Investment Decision (FID) in 2022.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.

2022 Constellation Energy Resources, LLC. The offerings described herein are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. Errors and omissions excepted. The views, thoughts and opinions expressed in the ‘Ask the Experts’ blog by each participant belong solely to the author and not necessarily to the author’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual.