Ask the Experts: Electric Commodities, LNG Offshores and Potential Recession Impacts

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy pricing and purchasing decisions.

Most recently, customers requested information on European Union’s natural gas prices in relation to the correlation between electric commodities and natural gas pricing, market effects on LNG, and how the recession can impact pricing.

Constellation’s team of market experts address them here:

We have kept track of natural gas prices for 17 years; we correlate price of electric commodity very close to the price of natural gas. Over the past 10 months, there was very little correlation. It’s almost double now, what has driven it?

If the EU caps natural gas prices, it potentially divert LNG exports to Asia where they would realize higher delivered prices. This could lead to a shortage of LNG into Europe, which might be bearish in short term but might lead to a spike in prices if the price caps are later revoked or suspended. Also, various EU and the UK governments have either already given or are considering giving payment relief from high energy bills. If you cap energy prices and you offer subsidies, don’t be surprised when people use more than you expected.

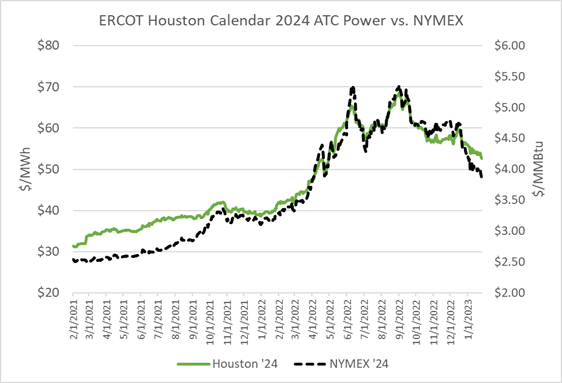

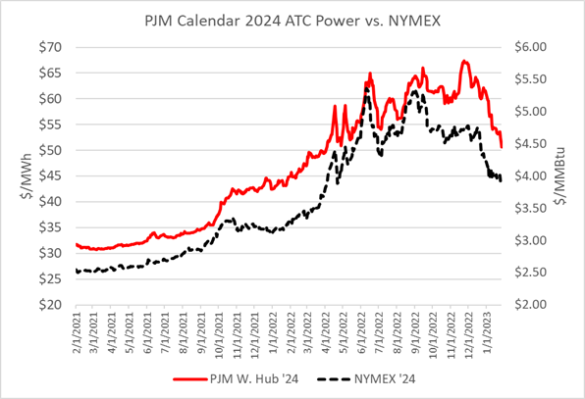

When looking at the gas to power correlation, make sure to be comparing similar terms such as spot, prompt month or forward terms for calendar strips. Looking at the following two power markets (ERCOT & PJM) 7×24 calendar strip for 2024 vs. the NYMEX 2024 calendar strip. There is a 97% correlation for PJM West Hub and 99% correlation to ERCOT Houston Hub.

Source: Constellation & NYMEX

Source: Constellation & NYMEX

How do we position our purchases today to guard against LNG going offshore?

LNG exports won’t necessarily drive-up U.S. natural gas prices as much as a lack of new pipeline infrastructure will limit the growth in supply. The U.S. remains either the first or second largest global producer of LNG and the build out of LNG export trains provided an incentive to invest in pipeline infrastructure upgrades that will move more gas to market out of, say the Appalachian shale, so that they can supply Gulf Coast facilities.

How would a potential recession impact energy prices?

Energy consumption probably would not be affected that much as the U.S. still has the cheapest Btu on the planet. The world is still energy hungry. Apart from the COIVD recession, typical energy demand usually drops by less than 1.5% during recessions. Natural gas and electric power prices are less susceptible to the effects of a general recession than oil/refined-products prices. This has a lot to do with a large portion of consumers of natural gas and electric power not knowing the units of measure nor how these things are priced and cannot see, with any regularity, what the unit price is (as opposed to the price of gasoline and diesel). So, lack of a transparent, knowledgeable, and continuously available ability to discover prices, leads to long lag times for conservation and changes of behavior to kick in. During the recessions of the 1970s and 1980s, we saw little decrease in the demand for electric power and natural gas, but a very large response to demand for oil and refined products. This is not to say that there would not be any downward pressure on demand for natural gas and power in the event of a recession, but rather that it could be much slower to respond to such.

When do you see natural gas basis, especially SoCal, returning to more normal levels?

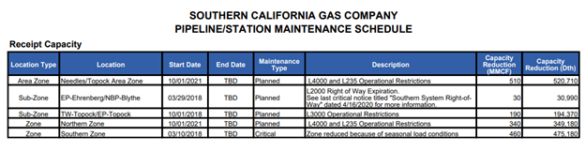

As we discussed during the webinar, the first task will be getting the El Paso Line 2000 back up and running and that is primarily related to the Pipeline Hazardous Safety Admin (PHMSA) approval to restart operations. That process should begin in February. After that, the ongoing work on SoCal gas system (see below) still needs to be completed and so basis is likely to remain elevated in 2023 while this work continues, and gas supplies are limited.

Source: SoCalGas ENVOY

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.

2023 Constellation Energy Resources, LLC. The offerings described herein are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. Errors and omissions excepted. The views, thoughts and opinions expressed in the ‘Ask the Experts’ blog by each participant belong solely to the author and not necessarily to the author’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual.