Ask the Experts ERCOT Edition: Energy Resiliency During High-Demand Months

In our monthly webinar series, the Energy Market Intel Webinar and our recent regional ERCOT Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy purchasing decisions.

Most recently, customers requested information on ERCOT’s steps to ensure sufficient generation is available during high-demand months.

Constellation’s team of market experts addresses them here:

Will Texas be able to continue to rely on wind in the generation stack in any kind of realistic way?

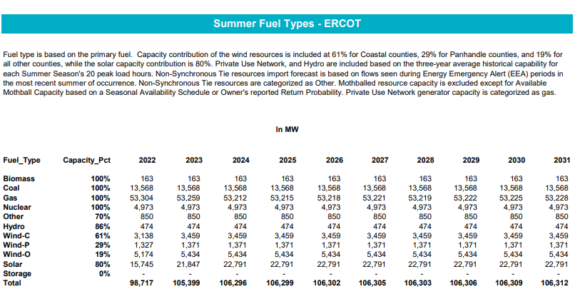

As load in ERCOT continues to increase as a result of the growth in the Texas economy, it is forecasted this summer to reach an all-time high of 77,144 MW, which is greater than the installed dispatchable capacity, and therefore the difference is being made up by growing renewable and some battery storage capacity. If we look at the summer fuel type capacity page of the May 2021 ERCOT Capacity, Demand and Reserves below, you can see from biomass through hydropower for 2022 that there are 73,332 MW of [dispatchable] capacity needed. In any summer, there is some percentage of thermal generation that experiences unexpected mechanical issues for example, and this puts them into forced outages. ERCOT has to rely on wind and solar output, known as intermittent resources, when load is that high.

Source: ERCOT May 2021 Capacity, Demand and Reserves Report

Could you briefly review once again the effect on end user pricing of the $2k/MWh price cap on Texas in the summer?

The System-Wide Offer Cap (SWCAP) of $9,000/MWh reflects scarcity pricing when generation reserves that can be deployed within 30 minutes decline to 2,000 MW. The peaker net margin (PNM) is representative of what net revenue a new peaker resource (e.g., combustion turbine) could have earned in a given year in the real-time market. The net revenue is supposed to represent the total revenue vs. variable production costs (i.e., fuel and labor.) Over the course of a calendar year, when the PNM accumulates to its threshold cap for the year (currently $315,000/MW as set by the Public Utility Commission of Texas and ERCOT), the SWCAP is reduced to $2,000/MWh or 50 times the Katy Hub Gas Daily published Index.

The peaker net margin as of April 22, 2021, stands at $727,932/MW, although that revenue assumption may not reflect the experience of many generators that were offline or not at full capacity during Winter Storm Uri and therefore had to buy back power at $9,000/MWh, as well as generators that had to pay fuel costs that greatly exceeded the norm while operating during Winter Storm Uri. The fact that the peaker net margin is above the threshold means that there will be a System-Wide Offer Cap of $2,000/MWh or 50 times the Katy Hub Gas Daily Index price for the remainder the year. However, the PUCT has proposed modifying the Offer Cap to remove the tie to the Katy Hub. Public comments on the proposed rule change are due on June 3rd, with a public hearing tentatively set for June 10th. For more information on legislation out of the PUCT and Texas Congress, read our blog.

Is ERCOT considering establishing an interconnector with other regions?

At this time, there are no proposals to add additional interconnectors (also known as direct current or DC) ties to ERCOT and its neighbors, either CFE (Mexico), Entergy (MISO) and Southwest Power Pool independent system operators (ISOs). Any new ties would likely require the approval of the Texas legislature and governor, because power is governed in Texas as intrastate commerce by the Texas Railroad Commission and the Public Utility Commission of Texas (PUCT) and not by the Federal Energy Regulatory Commission (FERC). New DC ties would arguably put ERCOT under FERC jurisdiction.

Is there a mechanism in place that would stagger the maintenance (in ERCOT) at different times so that it minimizes the impact on the grid?

ERCOT requires generators to give 45 days’ notice before an unforced or scheduled outage (typically for maintenance). If the generator does not file within the 45-day window and the outage was not scheduled, then ERCOT can require the generator to return to service with some prenotice.

The PUCT and ERCOT are placing a priority on having units available for summer and winter months, so most long-term maintenance takes place in the spring and fall.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.