Ask the Experts: Natural Gas Fundamentals, International and Domestic Impacts and 2023 Outlooks

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy pricing and purchasing decisions.

Most recently, customers requested information on domestic and international factors affecting natural gas, supply chain issues and declines in the energy sector.

Constellation’s team of market experts address them here:

I read an article in the Wall Street Journal that many European manufacturers who use natural gas as feedstock are moving production to North America. What effect will that have on our prices?

For industries that use natural gas as a critical component, there may be a strong incentive to shift manufacturing to the U.S. or Canada. This could help offset demand lost to an economic downturn; it is unlikely to be a full offset but could be a partial offset. The pressing issue is what happens with production growth of 98 Bcf/day; when do we get to 100 Bcf or 105 Bcf? After that, we need more production to help keep up with LNG demand growth.

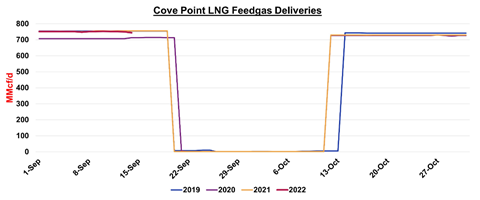

What are the impacts of the Cove Point maintenance?

As detailed in the below chart, the impact has historically been 750 MMct/d for about three weeks, so if they hold to that schedule, the market is factoring it in. If an outage were to be extended, then it is more newsworthy. Cove Point outages help to fill East storage for the three weeks.

What has driven the Dutch TTF lower? Is Europe importing LNG from China?

A seasonal cool-off to the hot summer weather is helping, and European storage is approximately 86% complete, so there is a short-term glut of cargoes in the Atlantic basin. Any news of Freeport not coming back on November 1st could reverse direction.

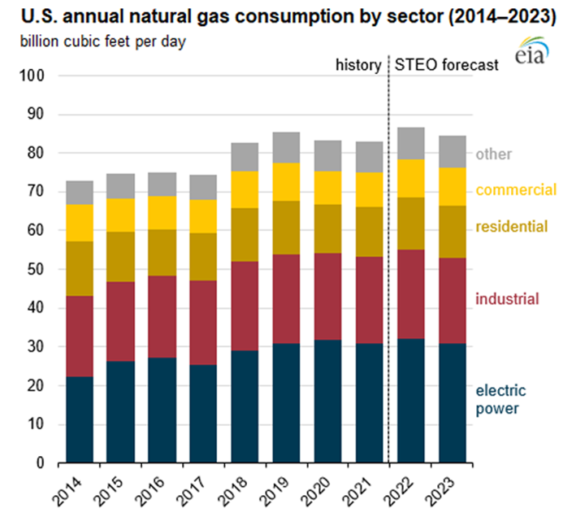

Is forecasted natural gas use in 2023 lower because the expectation of the U.S. entering a recession has grown dramatically as Fed continues to raise interest rates?

The chart referenced was from EIA; see the story link below. They are predicting a decline in 2023 for the industrial and electric power sectors, but that remains to be seen since we are the cheapest BTU. A recession would likely dampen demand, but both weather and economic demand drive power gen demand.

https://www.eia.gov/outlooks/steo/report/natgas.php

U.S. consumption of natural gas in our forecast averages 86.6 Bcf/d in 2022, up 3.6 Bcf/d from 2021, driven by increases across all consuming sectors. We expect consumption to fall by 1.9 Bcf/d in 2023 because of declines in consumption in the industrial and electric power sectors.

https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2022/09_15/

Source: EIA

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.

2022 Constellation Energy Resources, LLC. The offerings described herein are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. Errors and omissions excepted. The views, thoughts and opinions expressed in the ‘Ask the Experts’ blog by each participant belong solely to the author and not necessarily to the author’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual.