Ask the Experts: Oil & Gas Prices, Winter Weather and Crude Oil

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy pricing and purchasing decisions.

Most recently, customers requested information on domestic and international factors affecting oil and gas prices, winter weather scenarios and crude oil drilling.

Constellation’s team of market experts addresses them here:

Given 2022 is an election year (mid-terms) does that cause you to favor one of your scenarios you presented? In other words, will mid-terms politicize Fed policy and actions?

Chairman Powell was just reconfirmed so he has more leeway now to act decisively on inflation. The Fed must figure out how to slow the rate of inflation without throwing the economy into recession. As referenced in the article below, today the Fed announced the first rate increase would be in March, saying in its post meeting statement, “It will soon be appropriate to raise the target range for the federal-funds rate.” They plan to end stimulus packages by March, pass the first of three rate hikes and then figure out how to start reducing the $9 trillion securities portfolio they now hold. They could issue another rate hike before August as inflation numbers continue to be reported for 2022.

The article suggests that they will probably not pass a rate hike in the September or October meeting, right before the election but possibly in their November meeting.

Source: https://www.cnbc.com/2022/01/26/fed-decision-january-2022-.html

What impact will the earthquakes in Texas from fracking and moving wastewater have on pricing in 2022?

Starting in February 2020 there were as series of earthquakes in the Midland Basin area that appeared to stem from the use of saltwater disposal wells. The Texas Railroad Commission which regulates and issues gas drilling permits in Texas, issued a moratorium on new drilling permits for saltwater disposal wells beginning in September 2021 in the Permian Basin (Houston Chronicle).

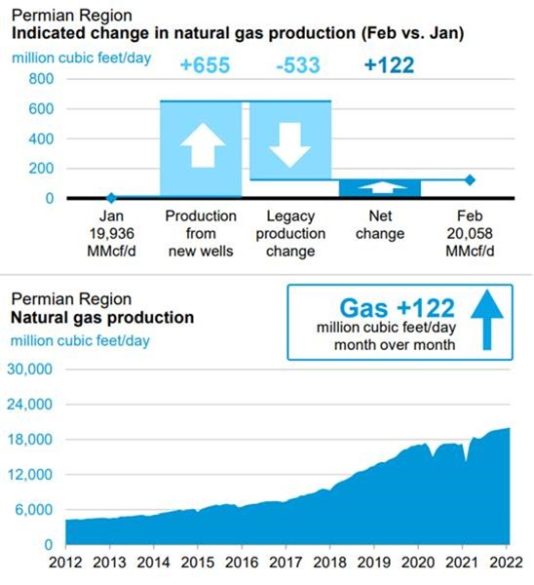

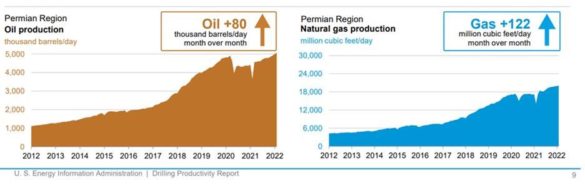

Based on data from EIA’s Drilling Productivity Report, for January 2022, there does not appear to be a noticeable impact of Permian gas production yet.

Source: EIA

Is it too early or too unpredictable to speak on the likelihood of a significant polar vortex impacting the U.S. based on the polar cap situation now?

According to our Constellation Meteorology Team, it is possible to forecast a polar vortex type of event within a two-week window when weather models show cold air over Canada as is the current situation. The variability of the pattern is much more difficult to predict further out because weather models cannot accurately forecast factors such as blocking in the North Atlantic which can have a significant impact on the Jet Stream.

The current weather pattern for February shows that the current cold pattern for January with the recent arctic air will give way to a milder side in the East in February as a La Niña pattern takes hold with above average temperatures more common across the Southeast.

Would additional drilling for crude yield more associated gas like natural gas? To put it another way, would higher crude prices bring lower LNG prices?

Yes, higher oil prices should result in an increase in oil production, and therefore “associated” gas which we saw in previous oil rallies such as in 2015/’16. Yet COVID and the corresponding demand loss has forced financial discipline on the exploration and production (E&P) sector in a way that altered how the drillers operate. They may expand production if oil goes to $100/Bbl but we are not likely to see the steep rate of growth we saw from 2017 to early 2020.

“Shale 3.0” is a much more cost concise and capital constrained environment as companies also need to consider the need for reducing their carbon footprint. As we saw from the Dallas Fed Survey, banks are not a quick to lend to the drilling E&P sector like they did in the past.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.

2022 Constellation Energy Resources, LLC. The offerings described herein are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. Errors and omissions excepted. The views, thoughts and opinions expressed in the ‘Ask the Experts’ blog by each participant belong solely to the author and not necessarily to the author’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual.