Ask the Experts: Policy Changes Under the Biden Administration & the Impact on Energy Prices

In our monthly webinar series, the Energy Market Intel Webinar, we offer our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy purchasing decisions.

Most recently, customers requested further information on major events impacting prices, such as the new Biden administration, the shutdown of the Keystone XL pipeline and if that could impact the country’s status of being energy independent.

Constellation’s team of market experts addresses them here:

With the new executive branch leadership, is it possible for “Green Energy” to take second place behind natural gas as the main source of power for the lower 48 States?

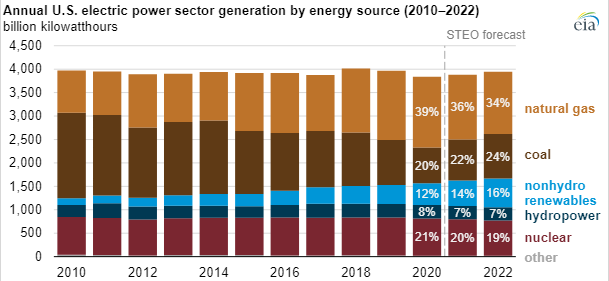

Right now, wind and solar make up only 12 percent of U.S. supply and is expected to grow up to 16% by 2022. These renewable resources may continue to displace coal-fired generation as low natural gas prices and efficient combined-cycle generation, along with likely higher regulation costs, force older coal units to retire. Gas-fired generation will continue to be needed to balance the intermittency of renewable generation until a better energy storage solution is commercially feasible. Current battery storage is not to the scale that it needs to be, which more likely going to need to be tens of thousands of megawatts and not just a few hundred.

Source: Energy Information Administration (EIA)

With the shutdown of the Keystone XL pipeline, and the Biden administration’s view of fracking, do you expect the U.S. will again be dependent on oil from the Middle East? Are we expected to be a net importer once more? Are petroleum prices going to spike? Estimate of the per barrel price in the next 12 months?

The Keystone XL pipeline cancellation limits a new delivery option for the U.S. to obtain more Canadian crude oil. That oil may now go by a pipeline to the Pacific Coast where it would be loaded onto ships likely headed to Asia. We are likely to still import most of our oil from Canada, Mexico, and Nigeria as well as some from Venezuela and the Middle East. Most Middle East production goes to Europe and Asia. The U.S. is currently producing ~10.4 million bbls/day of oil production and ~90 Bcf/day of natural gas. The restriction on federal land would likely reduce U.S. production for some period, but it must be remembered that one of the most prolific shale plays exists in the Permian Basin in Texas and New Mexico, which has been producing oil for 100 years and has a lot of existing infrastructure.

Any sustained run-up in oil prices above $60/bbl for WTI as well as Brent (London UK contract) would likely bring on new production that could offset declines from federal lands. How long the ban on federal lands is in place, and to what degree regulations raise costs, are two factors to consider.

The current forward crude oil price is currently $52 -$50/bbl for the next 12 months. The pace of the global economic recovery, the Organization of the Petroleum Exporting Countries (OPEC) output (and taking into consideration Saudi production cuts) and COVID-19 vaccinations will drive demand for oil. The airline and cruise ship industries may take several years to fully recover.

Can current drilling leases on federal land be rescinded? Are there any current leases that are short term?

Current leases cannot likely be rescinded without some sort of legislation or legal action. Going forward, the Biden administration signed an executive order to suspend new oil and gas leases while the Interior Department reviews existing practices. Work on existing permits will continue.

Currently about 9% of onshore U.S. production comes from federal land, the majority of which is on western land. Per the Wall Street Journal and Energy Information Administration, U.S. oil production on federal lands grew to 954.3 million barrels in fiscal 2019, up 28% from fiscal 2016, Interior Department data showed. Drilling on federal land and water generated almost $6 billion in government revenue last year.

Will midstream MLPs be impacted by the Keystone closure?

Midstream master limited partnerships (MLPs) involved in the transportation, processing, and storage of oil, natural gas, and natural gas liquids but not associated with Keystone XL, will likely not be impacted by the pipeline’s cancellation because MLPs are structured for existing pipelines that already have existing cash flow agreement. Now going forward, new pipeline projects could be much more challenging to get built in the future, and this would impact MLPs.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.