Ask the Experts: Weather’s Impact on Summer Power Demand, LNG Exports & Gas Generation Replacing Coal Influence Prices

4 min readIn our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions, such as weather, gas storage and production, and domestic and global economic conditions. Most recently, customers asked questions during our April webinar that Constellation’s Meteorology team and Constellation’s Commodities Management Group addressed:

Does a weak El Niño translate to lower prices for electricity?

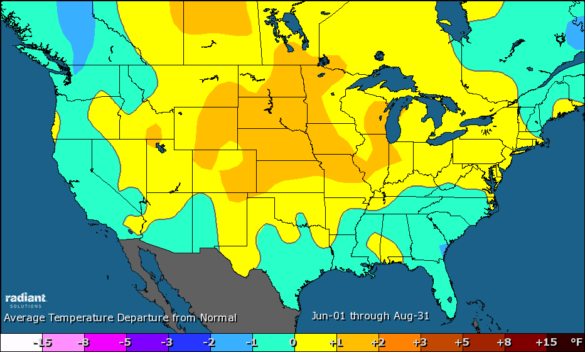

It depends on where you are in the nation. A weak El Niño usually results in near-normal temperatures across the South and above-normal temperatures across the Midwest and Northeast.

High temperatures directly translate to higher cooling demand during the summer. Normal temperatures across the South could mean more normal electricity demand in that region, whereas above-normal temperatures in the Midwest and Northeast (i.e., under weak El Niño conditions) would imply higher electricity demand. Those regions could potentially experience higher electricity prices as a result of higher-than-normal demand.

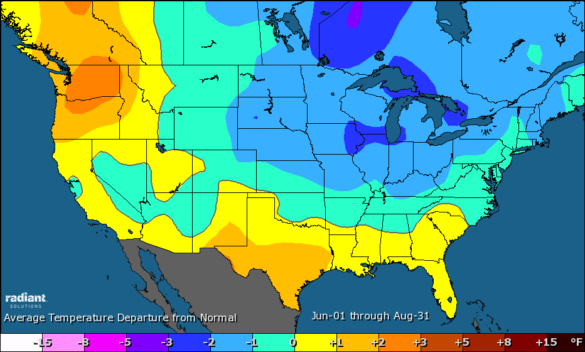

In contrast, a moderate El Niño means that water temperatures are coming in even warmer across the central tropical Pacific, greater than 1 degree Celsius. In moderate El Niño summers, the heat tends to be limited to the Deep South, while the northern two-thirds of the country tends to be cool and wet. This would mean lower electricity demand for the northern two-thirds of the country, with higher electricity demand for the Deep South (Texas and the Southeast).

Weak El Niño:

Source: Radiant Solutions

Moderate El Niño:

Source: Radiant Solutions

Will liquefied natural gas (LNG) exports have any impact on availability or price?

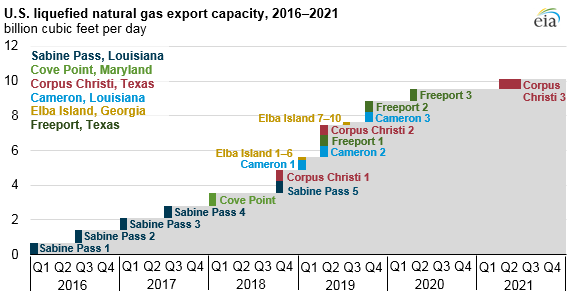

LNG exports represent a pocket of demand that will continue to grow over the next few years until the current pipeline of six LNG projects will be fully realized by the end of 2020. The U.S. is currently exporting roughly 5.5 Bcf/day of natural gas via LNG facilities and that number is likely to double to 10 Bcf/day once all the projects that are under construction are completed. The Lower-48 states have the needed supply and the planned pipeline infrastructure to bring that gas to market and keep the supply/demand equilibrium, but there will be gaps in that equilibrium causing price volatility.

In a market that is currently producing ~87 Bcf/day — an additional 5 Bcf/day of LNG export demand — on top of the existing 5 Bcf/day could be significant but should be taken in the context of how much production will grow over the next 18 months to absorb some of this new demand.

Source: EIA

As natural gas replaces coal generation units, what is the expected change in cost? Will electric costs increase 1%?

The retirement of older coal plants and their replacement by newer natural gas combined-cycle plants has been as much an economic phenomenon as an environmental one as U.S. CO2 emissions have declined over the last several years.1 The shale revolution, associated with the “fracking” of shale rock formations to unearth areas of methane gas pockets that were once non-recoverable, has provided the U.S. with an energy resource that is very economic relative to other parts of the world.

On an MMBtu basis, natural gas is competitive with coal when below approximately $2.50/MMBtu in many markets and can be lower-cost than coal relative to the all-in operating costs of a generating unit. This is because a newer combined-cycle gas generation turbine is more efficient than a simpler steam turbine. This mechanical efficiency of converting more of the fuel into energy is referred to as the “heat rate” of the unit. The lower the heat rate, the more efficient the generation turbine can be. On average, combined-cycle gas units have an efficiency of 7.5 heat rate while coal units have a heat rate closer to 10.2

Going forward, it is hard to specify what percentage effect this shift is expected to have, but from a cost standpoint, natural-gas-fired generation is relatively low in cost. However, natural gas prices are typically much more volatile than coal prices. In 2018, natural gas prices fluctuated more than 70 percent from the first quarter to the fourth quarter of the year. As natural gas-fired power is now the largest single generation component in the U.S. grid, the price of electricity is subject to the volatility in the gas market.

To ask our Commodities Management Group a question regarding energy market trends that may have impact on your business, email us at webinar@constellation.com.

References