Ask the Experts: What to Expect from Energy Prices in 2021 and Beyond

In our monthly webinar series, the Energy Market Intel Webinar, we offer our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy purchasing decisions. Most recently, customers requested further information on calendar year 2021 energy prices and the status of factors that impact them like carbon policies and storage inventories.

Constellation’s team of market experts addresses them here:

For calendar year 2021, do you see energy prices similar to periods from 2015 through 2020, or do you expect prices to resemble the price range of 2010 to 2014?

For 2021, the three primary drivers of energy prices are anticipated to be: winter and summer weather demand, the rate of natural gas production growth or decline from the current levels of 89 Bcf/day, and where oil prices go in 2021 as they have an impact on oil and the “associated” gas production, such as in West Texas and North Dakota.

When will anti-carbon legislation such as the New York CLCPA start to show up in gas futures?

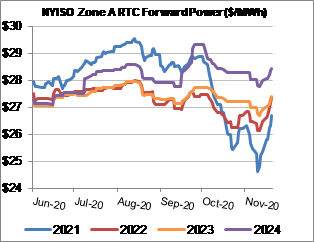

The carbon policy legislation in New York known as Climate Leadership and Community Protection Act or CLCPA is going to show up more in the power forwards and not necessarily the gas futures (existing gas-fired generation will still be operating in 2024). As the chart below shows, the 2024 price continues to trade at a premium to 2021-2023 calendar strips.

Have you run projections for gas storage for winter 2021-2022, and assuming you feel that it will be very low, do you feel the NYMEX has already built in that lower inventory in pricing for 2022 and later?

The Energy Information Administration’s (EIA) monthly Short-Term Outlook (STEO) for December forecasts end of March 2021 storage at 1,564 Bcf and then refilling to 3,563 Bcf by October 2021. That would be much less than this November 2020 level of 3.9 Tcf, and with strong weather demand next winter, that could support pricing into 2022 and 2023.

At what point does a potential transition to clean energy begin to negatively impact demand for natural gas?

The movement towards greater renewables does displace gas-fired generation in some hours of the day when it is abundant, such as hour ending 10:00-16:00 in CAISO when solar output is its highest. Yet, such renewable resources are intermittent in nature, which currently requires utilities and grid operators (ISOs) to have natural gas units (CTs) on hand to balance out the variability of renewable resources.

Would you say with increased supply from the Permian Highway pipeline means cheaper gas prices for California or no impact?

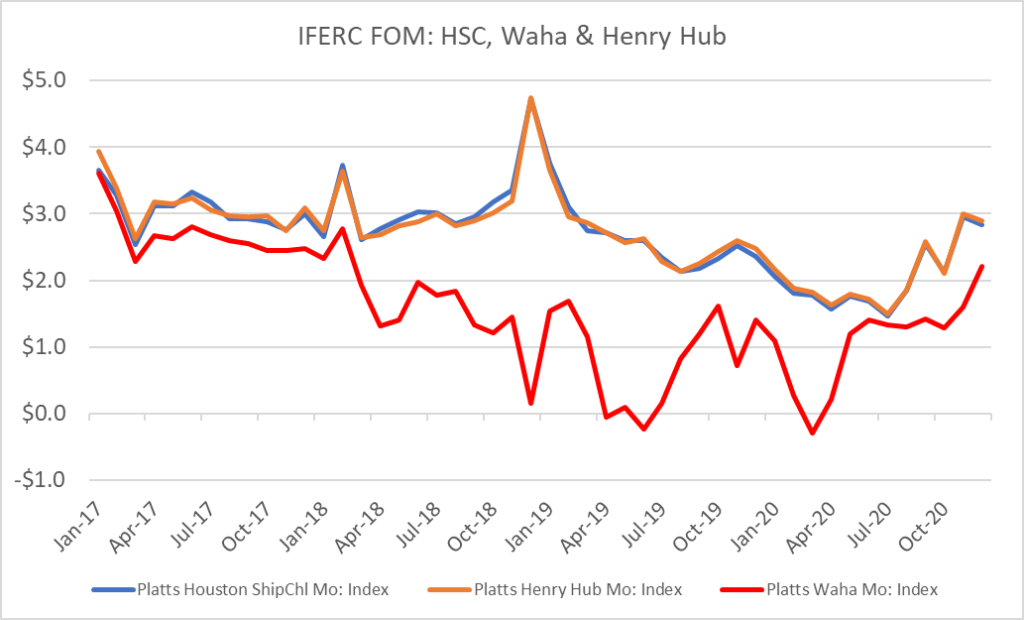

The Permian Highway pipeline will likely imply higher gas prices for SoCal gas customers as the depressed prices at Waha—from 2018 through the first six months of 2020—have been relieved by the drop in Permian supply with the downturn in oil prices and now the ability to move more production east to the Gulf Coast.

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.