Ask the Experts: Will Renewable Portfolio Standard Legislation Impact Gas Pipelines? Is Solar Capacity Declining in CAISO?

3 min readIn our monthly Energy Market Intel Webinar series, we offer our customers the opportunity to submit questions to learn more about the energy market trends that may affect their future contracting decisions, such as weather, gas storage and production, and domestic and global economic conditions. Most recently, customers requested further information on events that could impact their businesses in certain regions of the country during our June webinar. Constellation’s Commodities Management Group addresses them here:

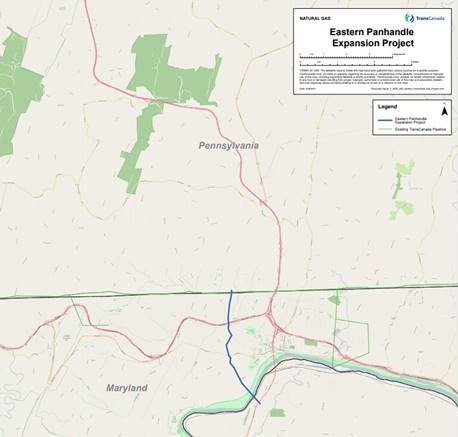

Will Maryland-state Renewable Portfolio Standard (RPS) legislation stop the TransCanada pipeline from crossing Western Maryland into West Virginia?

Although the State of Maryland aims to target 100% clean energy by 2040 via the Clean and Renewable Energy Standard (CARES) strategy, natural gas generation will still likely be needed to balance the output of intermittent renewables on the grid. The Eastern Panhandle Expansion Project will run from Pennsylvania through Maryland and into West Virginia, a total distance of 3.5 miles from PA to WV through Hancock, Maryland. This pipeline will transport gas through Maryland where it will connect to existing pipelines in West Virginia, so it is not likely to be impacted by the new RPS rules as the pipeline has already been approved by the Federal Energy Regulatory Commission (FERC). In addition, TransCanada is continuing to litigate with the State of Maryland over a permit to drill under the Potomac River.

Source: TransCanada

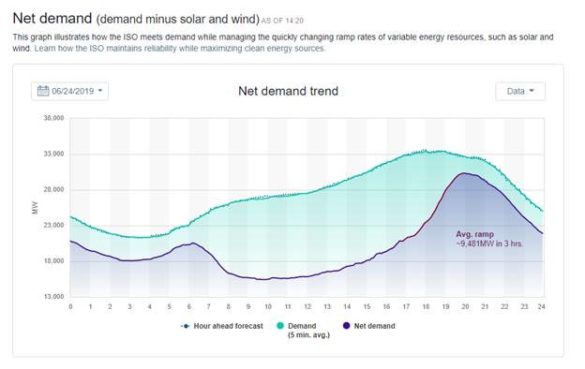

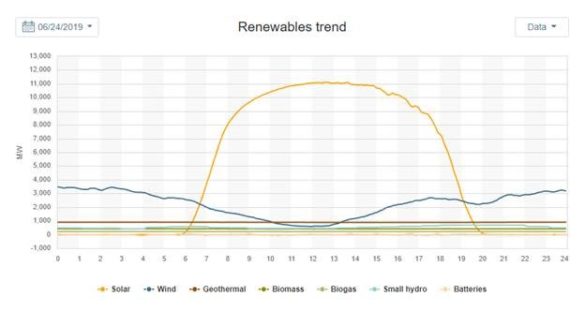

Why is solar capacity declining in CAISO? The North American Electricity Reliability Corporation (NERC) identified the need for CAISO in the evening hours to either rely on power imports from outside CAISO or pull gas from storage to meet evening ramp needs from 5 p.m. to 8 p.m. as solar capacity declines.

The key risk is that CAISO will need 9,000 MW or more of power imports or thermal generation to come online for an approximate 3-5-hour period in the late afternoon hours as solar fades. This will require gas-fired generation but with limited gas supplies via pipeline in SoCal, there is the concern they will have to pull gas from storage.

For more specifics, NERC predicts that CAISO will need either power imports from neighboring states or in-state gas generation in the late afternoon and early evening hours, 4 p.m. to 8 p.m. as solar output declines, but the load on the CAISO grid actually peaks. As the chart below shows, the CAISO saw load peak at 33 GW in HE 17-19 on June 24th but the independent system operator (ISO) needed to bring on 9,481 MW of thermal generation from HE 18-20 to meet evening load demand as solar declined and wind increased but not by enough to meet needs. This has been labeled the “duck curve” because the steep evening ramp resembles the back of a duck’s head.

NERC noted in its summer reliability report for 2019 that the level of gas-fired generation needed could be impacted if there were limited power imports from outside of the state or not enough gas available on pipelines, and storage would need to be pulled from Aliso Canyon storage field outside Los Angeles.

Source: CAISO

Source: CAISO

To ask our Commodities Management Group a question regarding energy market trends that may have impact on your business, email us at webinar@constellation.com.