Ask the Experts: Winter Weather, Natural Gas Production and Regional Outlooks

In our monthly webinar series, the Energy Market Intel Webinar, we offered our customers the opportunity to submit questions to learn more about economic factors and marketplace trends that may affect their future energy pricing and purchasing decisions. In our most recent webinar, attendees asked questions regarding natural gas production and storage, the anticipated El Nino winter and key regional updates.

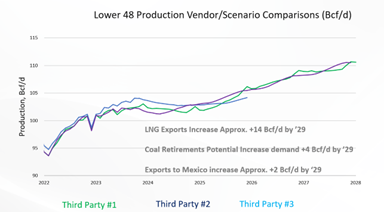

What is the downside risk (range of outcomes) to production given the reduced rig counts? 99 Bcf/day? 100 Bcf/day?

That is probably not a bad (99 to 100 Bcf/day) thought relative to the outcome per falling rig counts. The question beyond that is for how long: How long would production hang at, or very near, 100 Bcf/day , and what other things develop in the meantime, such as a shift in the weather to say a “normal 30-year average winter” as opposed to a warmer-than-normal winter that is currently in the forecast.

As we illustrated on the webinar, production is expected to dip by ~1-3 Bcf/day in first half of 2024.

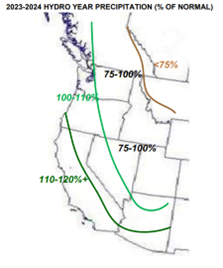

Pacific Northwest – bucking the pricing trend with high pricing Nov and Dec 2023. If cold weather does not hit California, will we see these early winter prices fall?

One key fundamental driver propping up Pacific Northwest power prices is the hydro situation. Water levels in the Columbia basin that are at 22-year lows. See link below.

An El Niño winter will likely see lower than average precipitation in the Pacific Northwest, although our weather team believes that storm patterns will be more variable up and down the West Coast vs. last year, when storms were more focused on California and the Southwest. There is likely going to be significant variability in precipitation this winter in the Pacific Northwest.

You can follow hydro conditions at the Northwest River Forecast Center: https://www.nwrfc.noaa.gov/ws/

Hurricane Season question: What happened to the prediction that the warm Gulf waters were going to create ‘monster storms’?

Gulf waters were very warm this year and are certainly part of the equation in the tropical season. However, atmospheric conditions were not conducive to storm creation. There was a lot of shear present in the Gulf, along with a very strong high pressure aloft over Texas, which kept tropical waves out of the Gulf for the most part. The bottom line is, even though the waters were very warm, the atmospheric conditions were unfavorable and didn’t allow much to get going there.

What impact do you expect on wind output across the Great Plains? I’ve read the strong El Niños can depress wind generation there.

That is correct. Typically, El Niños tend to suppress wind generation in the Plains, especially in the MISO region. We are expecting below normal wind generation across the Plains this winter.

https://education.nationalgeographic.org/resource/el-nino/

During an El Niño event, westward-blowing trade winds weaken along the equator. These changes in air pressure and wind speed cause warm surface water to move eastward along the equator, from the western Pacific to the coast of northern South America.

I have heard suggestions that climate change may result in different impacts from this potentially strong El Niño compared to past ones – that prior relationships could now be broken down. Any thoughts on this?

We don’t have any reason to believe that this El Niño will behave differently than past ones because of climate change. We are certainly in a warming climate now, combined with Pacific and Atlantic water temperatures that are well above normal, giving us the higher confidence on a warmer than normal winter for both the U.S. and Europe. Atmospheric blocking and a weaker than expected El Nino are risks for colder weather.

Do you see significant risks or constraints to being able to supply the additional 10-15 Bcf/day over the next 3-4 years, such as production restrictions, lack of pipeline capacity, or political obstacles to new developments and supply?

As noted in the webinar, one of the major constraints to meeting future demand is the need for additional pipeline capacity in the Permian Basin and the Appalachian Basin. The Haynesville Basin is the only major production region with spare pipeline capacity. However, it is the most natural-gas-price-sensitive producing region as it is very “dry gas” that comes from there. By “dry gas” we mean that the gas produced there does not come with a complement of crude oil and natural gas liquids (propane, butane, ethane), that provide a lot of additional revenue to the gas producer. Additionally, much of the spare pipeline capacity in the Haynesville Shale is misdirected and cannot get to the Gulf Coast to serve LNG exports unless reconfigured. This means that a material amount of new infrastructure will need to be put in place to make this happen.

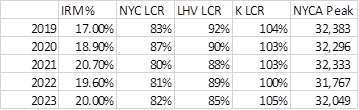

Could you comment on NYISO capacity prices? The spot auctions were elevated all summer, and the 6-month strip auction for this coming winter is the highest on record.

Here are a few factors that are supporting capacity prices overall, both statewide and in NYC:

- A decrease in net imports from neighboring regions has driven NYCA spot market prices higher periodically this year. It’s expected that this trend may continue, especially with the pending closure of Homer City coal unit in PA. The forward market is likely taking this into account.

- Installed Reserve Margin (IRM) and locational capacity requirements (LCRs) moved up for NYCA and NYC localities from the last power year and are expected to move up again for the 24/25 power year. Final numbers will be available in late December/early January – y/o/y increase is estimated to be between 1-3% higher (20.8%-23% vs 20% this year).

- The generation portfolio in NYC is in the process of turning over and volatility is expected.

- New York State’s Department of Environmental Conservation (DEC) “Peaker Rule” may result in several unit retirements in NYC in the coming years. It was anticipated to shrink available reserves this summer and support prices in NYC and neighboring capacity zones for the foreseeable future.

- 500 MWs were retired effective 5/1/2023.

- The NYISO Q2 STAR report found transmission security deficiencies beginning in summer 2025 for NYC. This is partly due to the expected deactivation of peaker units caused by the DEC’s Peaker Rule.

- NYISO is in the process of soliciting and evaluating solutions to address this reliability need. If no permanent solution is in place by 2025, an interim solution, including a potential retirement delay for certain DEC Peaker Rule-affected resources, could be necessary.

- This has put upward pressure on capacity prices, especially in NYC and to a lesser extent, LHV and ROS capacity zones.

- New York State’s Department of Environmental Conservation (DEC) “Peaker Rule” may result in several unit retirements in NYC in the coming years. It was anticipated to shrink available reserves this summer and support prices in NYC and neighboring capacity zones for the foreseeable future.

Why doesn’t the U.S. government place a large tax on LNG Exports?

This is most likely due to the same reason that the U.S. government does not place a large tax on U.S. exports in general: the U.S. government is in favor of exporting goods and services. Additionally, exporting goods and services does not mean that such goods and services would be cheaper if not exported. For instance, the U.S. is the largest producer and exporter of food in the world. One may argue that we should not export food but keep it here so prices would fall dramatically. However, if we did not export food, we would have a massive oversupply in the U.S. and indeed prices would likely collapse in the very near term. But with a major price collapse in food, resulting from a cessation of exports, there would be a similar massive collapse in the amount of food produced by farmers. Therefore, supply would collapse in the teeth of low prices – subsequently driving prices up.

Having said that, LNG has been subject since 1995 to the Special Motor Fuels Tax since is it is classified as a liquid fuel, as is diesel for example. Some related material on LNG taxes.

https://afdc.energy.gov/files/pdfs/truk4-3.pdf

https://www.enerdata.net/publications/executive-briefing/global-lng-tax-and-trade.html

What price does natural gas need to be to attract more production?

As is often said in such situations – “it depends.” So, what does it depend upon? Production in the Haynesville Shale depends much on the actual price of natural gas itself far more than say, production from the Permian and the Appalachian basins (which combined, account for 55% of all gas produced). This is because gas in the Haynesville is largely “dry” (meaning it does not come with crude oil or natural gas liquids), as opposed to “wet” gas from the Permian and Appalachian basin that contains crude oil and natural gas liquids that significantly improve the economics of a well. Gas primarily from the Permian is also “Associated Gas” produced along with crude oil.

So, dry gas in the Haynesville needs prices around $4/MMBtu to attract investment, while wet gas in the Permian or Appalachian basins can be profitable at lower prices like $2-3/MMBtu. Additionally, the prices of crude oil and natural gas liquids (propane, butane, ethane) are a major consideration on top of the gas price when evaluating the economics of drilling in those basins. It is somewhat safe to say that $2 gas is uneconomic long-term, $3 gas is borderline, and $4 gas provides sufficient returns, all else being equal.

Please see EIA Today in Energy article on Haynesville shale: https://www.eia.gov/todayinenergy/detail.php?id=52018

Get access to more insights on the latest weather and market factors impacting your energy bill by attending our next Energy Market Intel Webinar.

©2023 Constellation. The offerings described herein, if applicable, are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. The views, thoughts and opinions expressed in the ‘Ask the Experts’ blog by each participant belong solely to the author and not necessarily to the author’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual. Constellation does not make and expressly disclaims, any express or implied guaranty, representation or warranty regarding any opinions or statements set forth herein. Constellation shall not be responsible for any reliance upon any information, opinions, or statements contained herein or for any omission or error of fact.