ERCOT Preliminary Report Highlights Potential Tight Reserve Margin Conditions this Summer

4 min readIn early March, the Electric Reliability Council of Texas (ERCOT) released a preliminary Seasonal Assessment of Resource Adequacy (SARA) for summer 2018, June through September. The purpose of the SARA is to assess resource adequacy for the ERCOT grid under several scenarios that assume a variety of stressed grid conditions from normal to above normal, generation outages or low wind output. Due to recent retirements of coal generation in Texas and a robust state economy, ERCOT could see tight generation reserve margins that would be below the recommended 2,300 MW threshold. These scenarios in the SARA report were a contributing factor in rising forward power prices for July and August that were seen in early March.

For summer 2018 (June-September), ERCOT is forecasting a peak load of 72,746 MW. This is an increase of 2.3% (i.e. – approximately 1,600 MW) from ERCOT’s current peak demand record of 71,110 MW set in August 2016. In addition to this predicted peak load, the retirement of 4.3 GW of coal generation in ERCOT this winter along with ~400 MW of older steam turbine gas units has significantly tightened reserve margins in Texas from 18.9% last summer to around 9.3% for this summer. If load peaks at 72,746 MW as forecasted, ERCOT predicts there could only be 4,902 MW of available generation.

Report Details

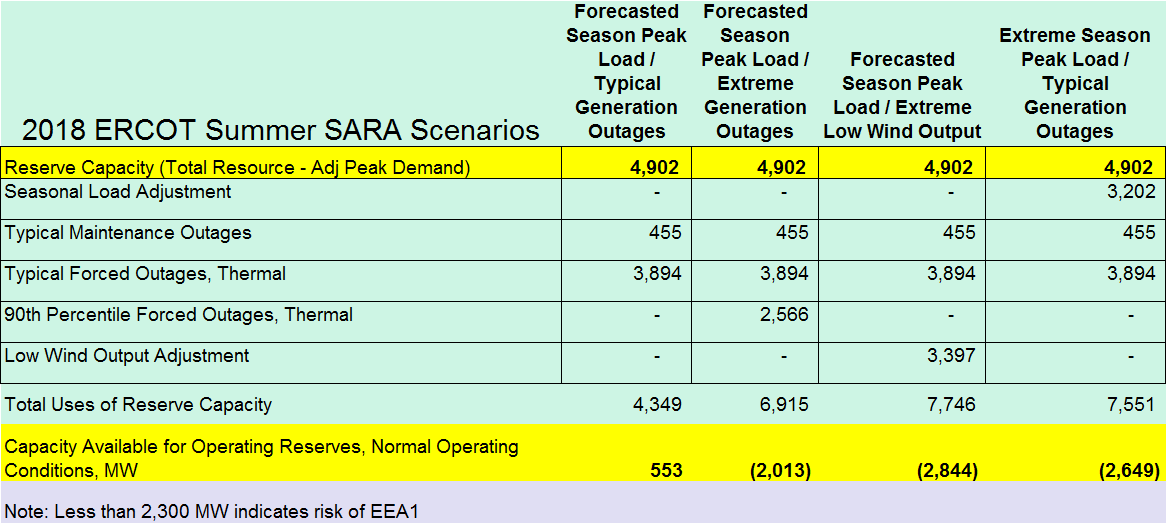

The SARA report examines four different scenarios regarding peak load in conjunction with weather and forced generation outages. The SARA then estimates the corresponding available capacity to the ERCOT system under these scenarios. The four scenarios can be seen in the table below and they are all based on the impact of outages and weather on reserve capacity of 4,902 MW in peak weather conditions.

Source: ERCOT

As mentioned earlier, ERCOT forecasts that peak summer load for 2018 will reach 72,756 MW, an increase of 2.3% from 2016 load records, and is based upon peak weather conditions in Texas from 2002-2016. ERCOT places total available resources at 77,658 MW, which includes total thermal resources and expected output of wind and solar renewables. The difference between peak demand and total resources is the reserve capacity, which is 4,902 MW.

Stepping through the scenarios, the first examines peak conditions where reserve levels would decline to under typical generation outages based on actual ERCOT data for a June-September time frame going back to 2012. Maintenance outages account for planned and prescheduled outages at 455 MW which is usually light in summer months. Forced outages are unplanned outages related to mechanical issues at generation facilities that, in most cases, force the need for short term repairs. The 3,894 MW is the historical average of forced outages in summer months according to ERCOT and represents 5.9% of ERCOT installed generating capacity. Under the first scenario, total reserves would decline by 4,349 MW, leaving only 533 MW of operating reserves. Before moving on, it is important to note that under this base scenario, total reserves would be well below the 2,300 MW that would trigger an Energy Emergency Alert level 1 (EEA 1) and well below the 2,000 MW threshold that would send the real-time prices to $9,000/MWh price cap in ERCOT.

The next three scenarios examine stressed grid conditions such as a higher levels of forced outages in scenario 2, lower than expected wind output in scenario 3, and finally extreme weather based on 2011 data in scenario 4. In all three cases, available reserve capacity is negative by 2,000 MW and would trigger load shedding events in ERCOT.

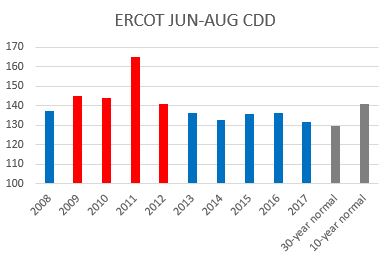

For more detail, the second scenario assumes a higher level of forced outages (90th percentile), based on historical data for ERCOT. The third scenario assumes a low wind output of approximately 10th percentile of a standard deviation. Wind output between coastal wind and wind in west Texas would drop to only ~800 MW of output from an expected 4,000 MW under normal conditions. The fourth scenario assumes weather conditions based on 2011 data. As the graph below illustrates, Cooling Degree Days (CDD) would be significantly higher (165 CDD) versus a 10-year normal of 140. It is worth noting that ERCOT has not exceed the 10-year normal weather on a CDD basis since 2011.

Source: NOAA

The Outcome

The reaction to the preliminary SARA in the forward power market has created continued upward pressure on prices in ERCOT primarily for the balance of 2018, but has also impacted prices through 2020 to a lesser degree. It is important to understand that ERCOT is an “energy only” market where higher prices are supposed to be the mechanism for which new generation is built. A historical look at forward pricing shows that until recently those prices were near all-time lows for 2019 and beyond. As the table below illustrates, prices for 2021 and 2022 are still less than 5% from all-time lows. As a result, there is very little new gas fired generation under construction in ERCOT, but there will be additional wind and solar capacity added in the coming years. The intermittent nature of wind and solar capacity means that they are harder to forecast and rely upon, especially in late afternoon hours when solar capacity declines and wind speeds could be low. Yet in the late afternoon/early evening hours, 4pm to 7pm, air conditioning load can be at its highest demand point and this can further stress reserve margins.

For more information on resource adequacy and available capacity in the ERCOT market, please watch our webinar on the SARA report.