ERCOT Summer 2020 Power Prices: What is to be Expected?

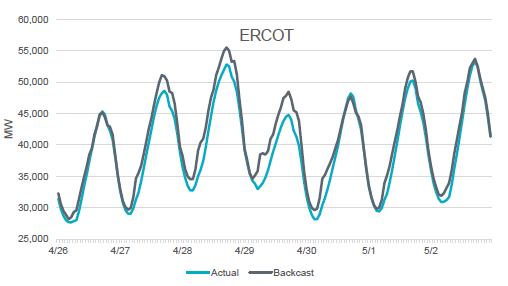

4 min readDomestic and global events continue to impact energy supply and demand across the United States. The oil industry in Texas, in particular, is reeling from a historic collapse in oil demand that has sent prices to all-time lows of below $10/barrel, impacting natural gas and power prices. Quarantine measures, such as stay at home mandates, have resulted in weekly energy use decreasing by 4-5% and daily peaks being lower by the same amount. The biggest decline to load has been in the morning hours of 6-10 a.m. when schools and business were usually opening up.

These trends will likely continue until quarantine measures are lifted, but customers should be aware that peak summer weather (~100 degrees Fahrenheit in Houston and Dallas) as well as low wind conditions increase the chance of generation reserve margins being tight once again in the Electric Reliability Council of Texas (ERCOT) region as they were in August 2019. During periods of high demand, and if requested by ERCOT, customers should be prepared to conserve power usage in any way possible.

Source: ERCOT

How Plummeting Oil Prices Influence Gas and Power Prices

Customers should be aware that the recent drop in oil prices has already begun to impact gas production and has lifted natural gas prices, and as a consequence, has led to higher power prices over the past month; but why is that? An oil well contains both oil and gas, known as “associated” or byproduct gas, which made up approximately one third of U.S. gas production in 2019. Global oil demand has plummeted, leading to a record filling of oil storage and U.S. oil production declining to under 12 million bbls/day per the Energy Information Administration (EIA). Reflecting this relationship, forward 12-month prices for natural gas (May 2020 – April 2021) rose from $2.10 to $2.65/MMbtu while the Houston zone prices have risen from $32/MWh to $37/MWh. Natural gas was 47% of ERCOT’s fuel mix in 2019 and, for the majority of daytime hours, set the price of power.

Weather Will Still Be a Key Factor

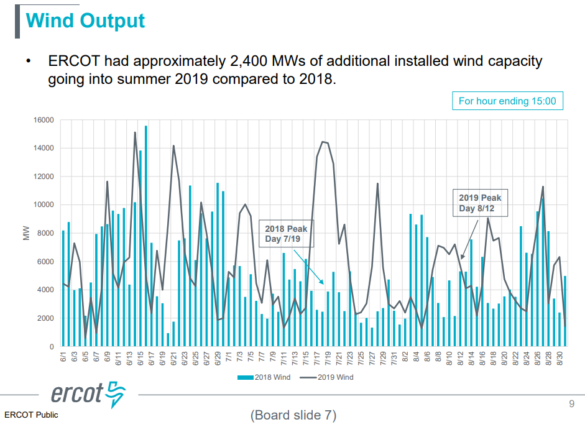

Considering current events, please don’t lose sight of the fact that weather, which includes both temperatures and wind speeds, will still play a critical role in both supply and demand for ERCOT this summer. Specifically, the-day to-day variance in wind generation in the late afternoon hours is key because ERCOT had ~23,000 MW of installed wind capacity at the end of 2019.

In recapping summer 2019 events, ERCOT highlighted the growth in wind capacity from summer 2018 to summer 2019 but also its variability in late afternoon hours (3 p.m.). While the peak day of August 12th did not see real-time prices due to strong wind production, it was the variance of lower wind output on August 15th along with a higher level of generation outages that resulted in ERCOT prices reaching the price cap of $9,000/MWh via the Operational Reserve Demand Curve (ORDC) adder.

During periods of high demand, and if requested by ERCOT, customers should be prepared to conserve power usage in any way possible.

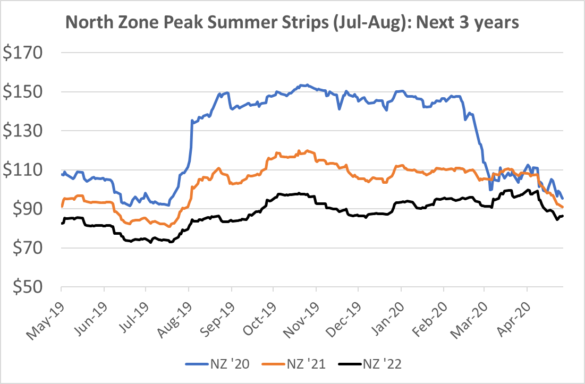

As we saw in August 2019, ERCOT’s pricing mechanisms currently work in a way where if modeled scenarios realize available reserves of generation are declining below 2,000 MW, the ORDC adder will lift real-time prices to $9,000/MWh for some 15-minute intervals. During periods of high demand, and if requested by ERCOT, customers should be prepared to conserve power usage in any way possible. The good news is that the recent downturn in summer 2020 forward pricing from $150/MWh to $110/MWh has created opportunities for customers, but prices could rise if weather forecasts turn warmer than normal.

Source: ERCOT

SARA & CDR Report Will Give ERCOT Customers More Guidance

We expect ERCOT’s forecast for summer generation reserve margin to increase from the current estimate of 10.6% in its biannual Capacity, Demand & Reserve (CDR) update to be released on May 13th. ERCOT will also be releasing the final Seasonal Assessment of Resource Adequacy (SARA) report for June through September 2020. This report looks at grid resource adequacy under four scenarios that consider peak electric load together with weather, wind generation output and forced outages when generation units go offline.

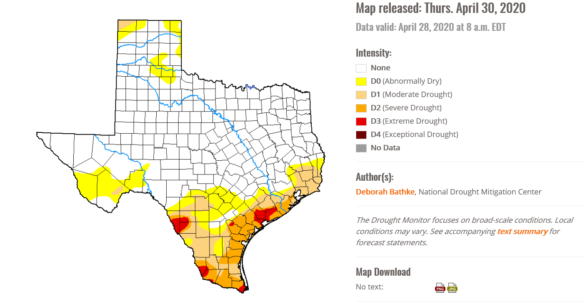

One final factor meteorologists will be looking at are drought conditions. Dry conditions have begun to develop in south Texas, and this could increase to more D3 stage drought before the peak of summer in July/August, which would make the ground harder to cool off and increase cooling (air conditioning) load demand.

Source: NOAA

Source: Constellation

We covered the SARA and CDR reports in depth in an ERCOT Summer Outlook Webinar. Listen to learn about the key findings from the reports to better understand how to address energy market risks when managing your energy purchasing strategy.

We are here to help your business or organization succeed in this challenging time, take advantage of long-term opportunities and are prepared accordingly to discover and communicate impacts to your energy costs. If you have any additional questions, please contact your Constellation sales representative.