ERCOT’s Final Summer 2019 Assessment & Report Findings: Declining Reserve Margins and Limited New Gas Generation

5 min readOn May 8th, ERCOT released two important reports that will give customers a picture of what generation ERCOT will have for summer 2019 as well as for a longer term — through 2024. ERCOT’s final summer 2019 Seasonal Assessment of Resource Adequacy (SARA) highlighted the potential risk for ERCOT to enter Energy Emergency Alerts (EEA) status this summer.

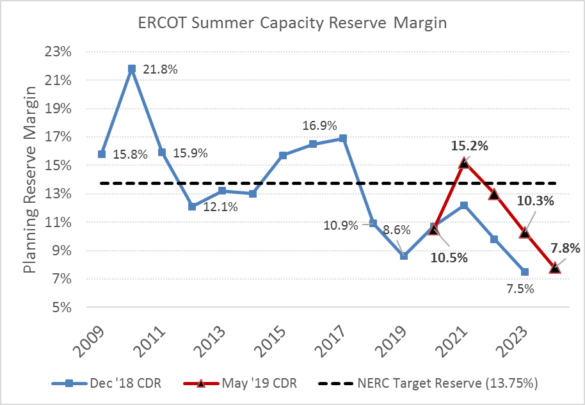

The second report, the Capacity Reserve & Demand (CDR) report, released by ERCOT on May 8th is released twice a year in May and December and examines longer-term load growth in ERCOT as well as what new generation is expected in the next five years (i.e., 2020-2024). The May CDR highlighted ERCOT’s reserve margin will rise to 15% by 2021 but then fall back below the North American Energy Reliability Corporation (NERC) recommended levels of 13.75% through 2024.

The May CDR report highlights the growing dependence in ERCOT on renewables as the primary source of new generation to increase the reserve margin from 8.6% in 2019 to 15.2% by 2021, but wind and solar are intermittent in nature and ERCOT could therefore be short generation at critical summer peak load periods.

Breaking Down the SARA: Potential Energy Alerts Under All Four Scenarios

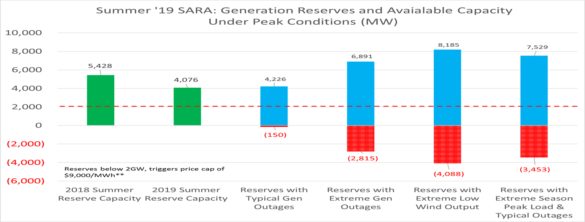

ERCOT’s final summer 2019 SARA forecasts ERCOT’s generation reserve capacity will remain tight under several scenarios this summer. ERCOT lists total resources at 78,929 MW, an ~800 MW increase from the preliminary SARA. ERCOT is forecasting summer peak demand will remain at 74,853 MW, an ~1,300 MW increase from last year’s peak record load. This would leave only 4,076 MW of Reserve Capacity vs. 6,000 MW last summer as depicted in the graph below.

In its Summer SARA, ERCOT examines the range of potential risks under four specific peak-condition scenarios. Under all four scenarios, available capacity reserves are reduced to negative levels. This would imply repeated index prices at $9,000/MWh as the price cap would be triggered when reserve margins drop below 2,000 MW.

- In the first scenario, ERCOT examined what the available capacity would be under peak conditions for both previously planned maintenance or “unforced” and unplanned or “forced” generation outages for the historical averages of 2016-2018 summer seasons. Unforced generation outages were 381 MW, and forced outages were 3,845 MW for total outages of 4,226 MW. When applied against the above listed Reserve Capacity of 4,076 MW, reserves decline to 150 MW.

- The second scenario considers extreme outages, which looks at historical forced outages and then assumes a 90% confidence interval. In looking at a historical distribution of outages, the 90th percentile would assume the far end (i.e., top 10%) scenario of a bell-shaped distribution curve. ERCOT estimated extreme outages would add an additional 2,665 MW of outages to the 4,226 MW identified above for a total of 6,891 MW of outages. This would result in a negative capacity of -2,815 MW after all outages.

- The third scenario examines extreme low wind output under peak load conditions. ERCOT looked at wind output during the 100 highest net load hours (load less wind output) over the 2015-2018 summer seasons. Total wind output was equal to or less than 960 MW s. In a low wind scenario, ERCOT effectively removes 3,959 MW of historical wind production during peak periods and reduces total capacity by 8,185 MW. This reduces reserve capacity to a negative level of -4,088 MW.

- Finally, the fourth scenario considered was extreme peak load under typical generation outages. This scenario considers 2011 weather, particularly when ERCOT was under extreme drought conditions. The fourth scenario forecasts summer load to reach 78,156 MW, which would add an additional 3,303 MW to load. Total available reserves would decline by 7,529 MW to -3,453 MW.

Source: ERCOT

The CDR Indicates Limited Gas Builds

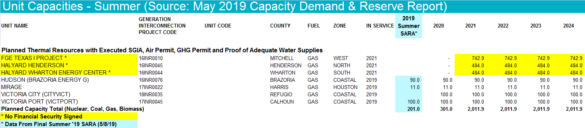

The May 2019 CDR highlighted the continued tight reserve margins in ERCOT and that most new generation will come from wind and solar additions, which are intermittent in nature. There are a limited number of new gas units entering service, and of those, several projects face hurdles with securing financing, which could push their construction start date further into the future.

The below table indicates only 2,002 MW of new gas-fired generation will come online between now and 2021. That might not be enough to keep up with ERCOT’s load growth of between 2% or higher on an annual basis. In addition, several of the larger-sized units (highlighted in yellow) are listed by ERCOT as having “No Financial Security Signed,” which indicates they have not secured project financing at this time. These projects may secure financing, but they have been in the ERCOT CDR queue for several years. This leaves only approximately 300 MW of new gas capacity to come online that has financing at this time. Further delays may reduce ERCOT’s reserve margin for 2021-2024 as these projects are either cancelled or pushed further into the future.

New Planned Thermal Generation (May 2019 CDR)

Source: ERCOT

Source: ERCOT

What Does this Mean for Customers?

Customers should be aware that as we approach summer 2019 there is a likelihood of higher real-time index prices as reserve margins of generation tighten and load continues to grow.

Tighter reserve margins that reduce available generation below 4,000 MW will lead to higher real-time Settlement Point prices via the higher Operational Reserve Demand Curve (ORDC) charges at the same level of reserves versus in 2018. The ORDC curve was instituted by the Texas Public Utility Commission (PUC) in 2014 to address scarcity pricing as the reserve margin of available generation declines towards operating levels that would trigger an Energy Emergency Alert (EEA) at 2,000 MW.

Higher real-time prices this summer would likely increase forward prices through 2022 or even longer, until enough new generation is in ERCOT’s planning queue and under construction. This could raise the forward price of power for customers on retail contracts expiring past summer 2019.

Visit our website to learn more about our solutions to help you protect your business from these risks.

Guest Author: Keith Poli, Principal, Commodities Management Group

Keith has been providing energy market intelligence and strategic analysis to Constellation’s commercial and industrial customers for nearly seven years. As a member of the Commodities Management Group, Keith specializes in various regions for both the gas and power markets including Texas and California. Prior to Constellation, Keith has had over a decade of experience purchasing and trading commodities. As a member of the Commodities Management Group, Keith seeks to deliver market insight, innovative deal structures, and execution strategies for our customers to enable them to make better energy decisions.