Gas Prices Explode to the Upside Ahead of Thanksgiving: November Market Intel Webinar Recap

3 min readDuring the November Energy Market Intel Webinar, Constellation’s Commodities Management Group (CMG) took a granular look at recent pricing action and reviewed the predominant forces driving the near, mid and longer-term natural gas and power markets. They talked about the rise in prompt-month NYMEX natural gas – about $1 since early October 2018, reaching $4 per MMBtu for the first time since 2014.

Our senior meteorologist also offered the latest update on the all-important winter forecast, noting any material changes from last month and pointing to the trends that will shape the weather in the coming weeks. The CMG team also looked at natural gas and power prices adjusted for inflation to offer a perspective on the current low-energy-price environment.

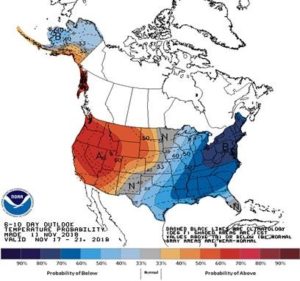

Weather Update

Temperatures in the Eastern half of the U.S. turned decisively below normal in mid-November with snow in Chicago and as far south as Louisville with nighttime lows in key urban centers lowering to the twenties. The first bolt of cold air, early in the heating (i.e., the use of heating) season, worked to drive the short-sellers out of the market and prompt-month NYMEX natural gas gapped up. The current (as of November 14, 2018) weather forecast calls for the well-below normal temperatures to give way to a more “normal” solution in the Eastern half of the U.S. toward the end of November. A weak El Niño has developed, and this is associated with a warmer-than-average December in the upper Midwest and Northeast. However, it remains to be seen whether this weak-to-moderate El Niño holds and though certainly an indicator of upcoming weather patterns, the weak El Niño is no guarantee of a particular outcome. The uncertainty of the future weather pattern is on display in natural gas pricing action in recent days where prices have spiked over 25%.

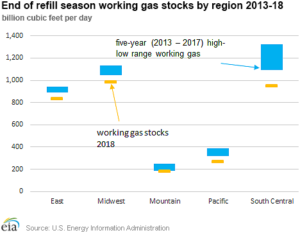

Market Fundamentals Round 1: Gas Production vs. Storage Deficit ̶ And the Winner is…Storage Deficit

Natural gas storage inventories begin the heating season at 3.2 trillion cubic feet (Tcf), a thirteen-year low and 16% below the same period last year. Low natural gas storage inventories have provided the floor for prices during the past three quarters. The most recent price spike has largely been a function of cold air in key markets arriving very early, coupled with low inventories. Low storage inventories are also a function of robust rising demand for natural gas in the power generation sector and rising exports having a material impact on the natural gas market. The current storage deficit of ~580 billion cubic feet (Bcf) represents approximately three weeks of normal winter demand for the December to February time frame. In this light, early cold weather in November is going to add to concerns about where storage could be later in winter if we see a cold November and December. All five regional storage areas are below their five-year minimum levels for the start of winter, so it is not like one area can offer surplus gas to another.

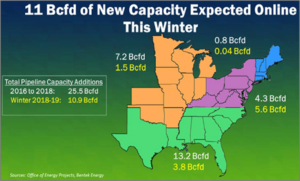

Gas Production Update

Preliminary Energy Information Administration (EIA) data indicate October natural gas production near 86 Bcf per day, a new record and an increase of nearly 14% from the same period last year. Additionally, the Federal Energy Regulatory Commission’s (FERC) Winter Assessment reports nearly 11 Bcf of new pipeline capacity coming online in the calendar year inclusive of the first quarter of 2019. Half of this new wave of pipeline capacity is in the Appalachian producing region. Lots of new pipe combined with what were, until very recently, rising crude oil prices (crude oil has undergone a spectacular fall during the last six weeks), have been the two primary forces in driving gas production higher over the past year.

Inflation-Adjusted Energy Prices are Very Low

Energy prices (i.e., natural gas, electric power and gasoline/refined products) in the U.S., adjusted for inflation, are at multi-decadal lows. The CMG team took a quick look at some key energy market pricing action and discussed the current forward power and gas markets relative to historic inflation-adjusted pricing.

Register today for our December Market Intel Webinar, scheduled for December 19, 2018, at 2 p.m. ET, where we will update with any changes to our winter 2018/2019 forecast along with a review of key production and demand fundamentals, as well as a year in review.