How to Evaluate an Electricity Price in New England and Understand the Impact a Capacity Price Adjustment Can Have on Your Bill

5 min readIn a previous blog, we highlighted some tips for navigating a New England energy contract and identifying some of the risks that could result in incremental cost differences on an invoice within the term of a fixed price agreement. In this article we take a deeper dive into New England (NE) capacity charges, which make up a significant portion of the total supply charges. We also provide examples showing how to assess the financial difference between a fully fixed capacity product versus a price adjustable “fixed” capacity product.

Capacity Cost Basics

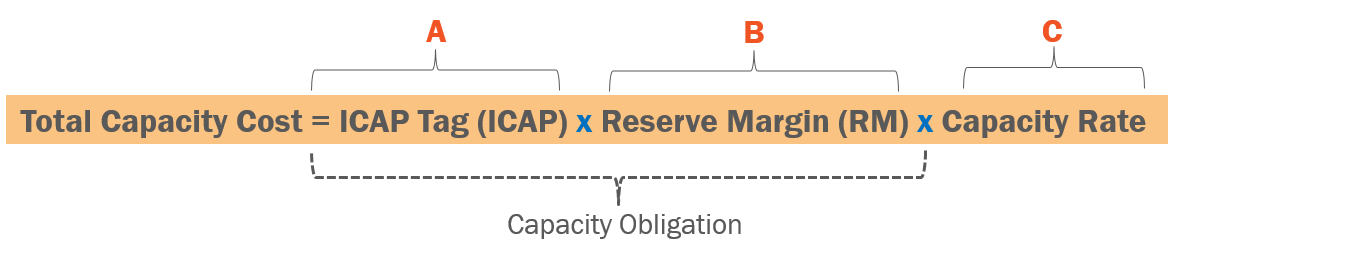

To accurately complete this valuation, we need a high-level understanding of how the total capacity costs are determined in New England. Below is the basic formula highlighting the three primary inputs for deriving these costs: ICAP Tag, Reserve Margin and the Capacity Auction Rate:

- C: Focusing first on the capacity auction rate, the Forward Capacity Market (FCM) is designed to ensure that the New England system has enough generating resources to meet demand three years in advance of the New England Capacity Power Year (CPY), which runs from June 1 through May 31 each year. This is accomplished through the Forward Capacity Auction (FCA) where generators bid their load until the ISO-NE forecasted capacity requirement is met. As the FCAs take place, capacity auction rates become known and the market develops a level of price certainty in the prompt three years.

- A & B: Understanding the capacity auction rate leaves us with two inputs to understand as a part of this formula. They are the ICAP tag (ICAP) and other ISO/Utility factors (such as Reserve Margin (RM)), which are sometimes referred to collectively as the Capacity Obligation. Both the ICAP and applicable ISO methodology factors (including but not limited to RM) reset at the beginning of the New England CPY on June 1st.

- A: An ICAP tag is a value derived by the utility that corresponds to a customer account’s usage during the ISO-NE peak for a given capacity power year.

- B: The other ISO/Utility factors such as RM is an adjustment which scales the actual system peak load (sum of ICAP) to the amount of capacity procured in a given FCA (forecasted over 3 years prior to flow).

Despite capacity auction rates being known multiple years out, the year-over-year fluctuations in Capacity Obligation can still introduce significant volatility and pricing risk. For more details on capacity, what it is and how it works, please refer to “Electricity Capacity Cost: What is it and How do I Manage it?”

How Could Two “Fixed” Capacity Products Differ?

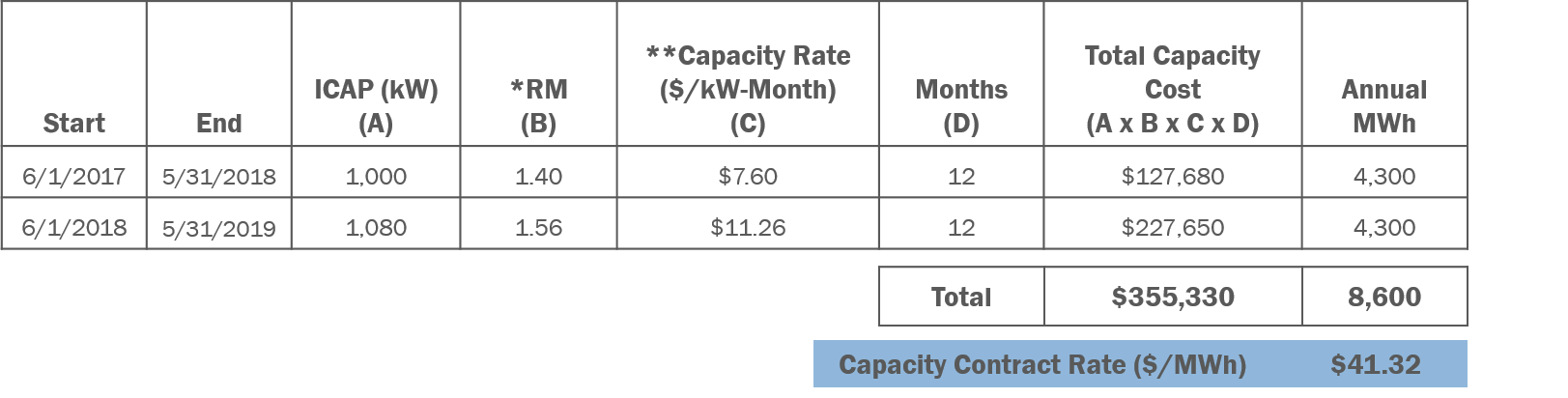

A FULLY FIXED capacity product has fixed capacity costs that do not allow for adjustments or pass through charges based on changes to any of the 3 inputs above (A, B, or C). We can see an example of the total capacity cost a supplier is taking on by walking through the below example. For this example, we assume the account is located in the Southeastern Massachusetts (SEMA) capacity zone, capacity costs are fixed for 24-months, the account uses 4,300 MWh annually, and the ICAP tag is 1,000 kW in CPY 17/18, which then increases to 1,080 kW for CPY 18/19. The capacity cost associated with this example is as follows:

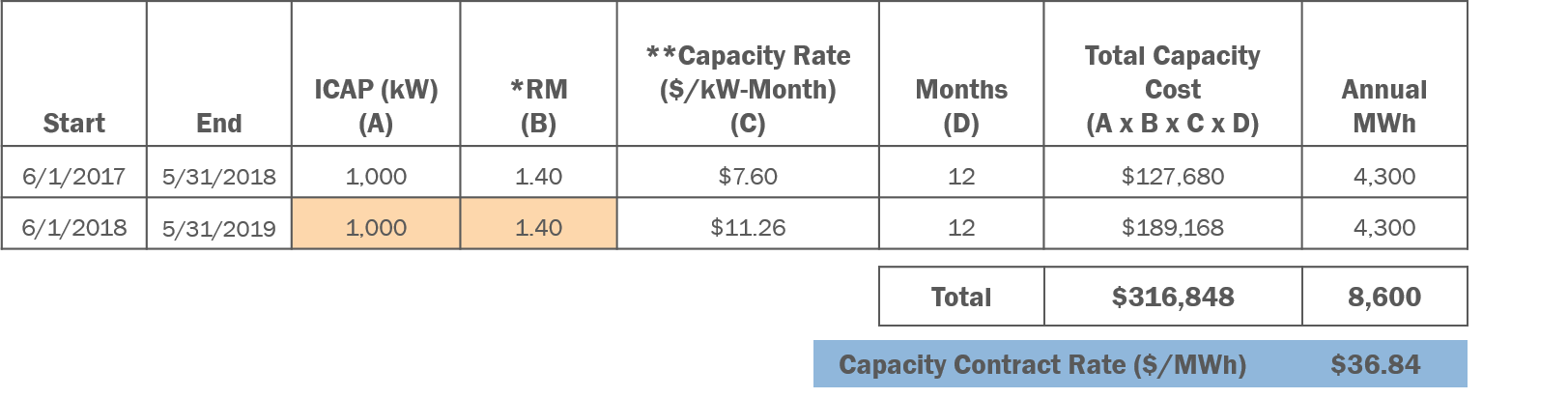

So, how does a PRICE ADJUSTABLE “fixed” capacity product differ? One way a price adjustable capacity product can be treated is to pass along the volatility or cost increases associated with the Capacity Obligation (A x B). The price adjustable capacity cost is determined using the ICAP and other ISO/Utility factors such as RM effective at the time of pricing, which in the above example assumes June 1, 2017. Working through the same calculations, the total capacity costs associated with the price adjustable product would be as follows:

As you can see, all values used to derive the capacity rate are identical except for the CPY 18/19 ICAP and other ISO/Utility factors such as RM which are highlighted in the table in yellow. By holding those two values constant across the entire term, the capacity price adjust product assumes a total capacity cost $38,482 lower than the fully fixed capacity option, which when unitized over the term the volume of 8,600 MWh results in a rate of $36.84/MWh, $4.47/MWh lower than the fully fixed capacity product.

When presented with the two contract rates, the initial reaction may be to take the lower rate. However, it is important to keep in mind that the lower rate isn’t necessarily reducing the total capacity costs, it is merely shifting those costs to another year. In this example, the fully fixed product is unitizing the total capacity costs of $355,330 over the total volume of 8,600 MWh resulting in a unit cost of $41.32/MWh over the entire 24-month term. The price adjust product produces a unit cost that initially appears cheaper at $36.84/MWh, but after 12 months, when the new ICAP and other ISO/Utility factors such as RM obligations become effective on June 1st 2018, will increase by $8.95/MWh to a unit cost of $45.79/MWh.

Understanding your company’s risk tolerance and budgetary needs are an important part of determining which energy strategy is right for your unique business needs. If you are looking for budget certainty and want to avoid the year-over-year volatility associated with a price adjustable product, Constellation’s standard fixed price contract offers a fully fixed capacity product that provides you that certainty.

Customers who choose from Constellation’s wide variety of solutions can expect a transparent contract whether they choose a fully fixed capacity solution or a capacity adjust solution. We also believe in investing in our customers by educating them and providing them access to resources so their bills come without surprises. To get Constellation communications, resources and more directly to your inbox, subscribe at constellation.com/subscribe.

Guest Author: Kurt Spaeth, Manager – Retail Pricing

Kurt joined Constellation in 2014 as part of the acquisition of Integrys Energy Services, Inc., and is currently working as the Northeast Retail Pricing Manager. His 17 years of experience in the energy industry are currently being applied to performing analytics and optimization of retail power offerings in the New England and New York markets.