Part 2: MOPR and Capacity Markets – The Current Situation in the PJM Capacity Market

4 min readIn part 1 of this series, we discussed minimum offer price rule or MOPR and how it’s impacted the PJM market. In this blog, we discuss more specifically how PJM’s pending capacity market could impact your business.

What Is the Situation?

PJM is the largest independent power system operator (ISO)/regional transmission organization (RTO) in the United States, responsible for coordinating the flow of electric power to more than 65 million electric customers across 13 U.S. states and the District of Columbia. Acting as a neutral independent party, PJM operates a competitive wholesale electricity market, managing the electricity grid to ensure reliability for Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and D.C.

The capacity market was introduced to ensure that electricity supply continues to meet peak demand and will ensure there is enough generation (or load-management capacity) in the system to cope with times of stress on the network, such as a surge in demand. The objective of the capacity market is to achieve long-term supply adequacy. Typically, auctions are held by PJM to set capacity prices and provide grid reliability, and capacity market sellers (power generators) are required to offer their resources for a one-year term, three years in advance.

Capacity prices for June 2022 and beyond are currently unknown because the planned capacity auctions have been delayed. PJM has recently announced that the base auction for the 2022/2023 delivery year will occur in May 2021, and subsequent base auctions will be held approximately every six and a half months. There are generally three approaches an energy supplier may take to price these unknown capacity costs:

- Offer a fully fixed capacity price by forecasting the capacity costs for the periods where the auctions have not yet taken place, thus taking on the risk of the rates being set at a value that deviates significantly from what was forecasted (subject to changes that are the result of a change in law event as defined in the contract).

- Use a baseline capacity cost from which adjustments/pass-through costs will be made once capacity auctions are set.

- Pass-through capacity charges to customers for periods June 2022 forward; thus, the customer will always pay actual capacity costs through the term of the contract.

Many suppliers seem to be taking the second approach for their fixed price offerings—including a baseline capacity cost in their price. With this approach, it’s important to understand what and how baseline costs are included, because it can have a significant impact on what adjustments are made down the road and the cost swings customers may see once the auction clears.

Differences in Baseline Capacity Approaches

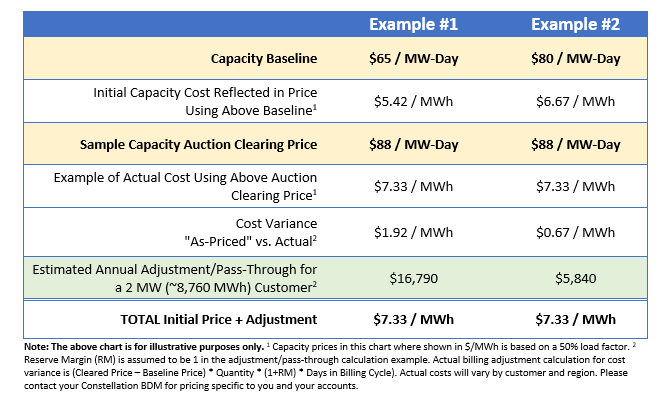

Let’s look at an example of two different baselines from which prices will be adjusted relative to actual costs when known. Using different baseline capacity costs, you’ll see a variance in the initial cost reflected in your price, as well as in the adjustments/pass-through costs you may see after the auction has cleared. The example below illustrates how two different baselines can result in significantly different upfront prices as well as adjustments/pass-through charges down the road.

Because of this, it’s important for customers to look at two things –

First: Understand how each offer you’re comparing addresses forward year capacity rates – that is, are they using a fixed, fixed at a baseline level, or passed-through treatment for capacity? This is key for periods for which capacity auctions have not yet taken place, and as you can see from the chart above, different approaches and baselines can yield significant differences in upfront prices as well as potential adjustments down the road.

Second: Understand how each supplier’s contract language handles pricing adjustments. Some suppliers offer a bilateral adjustment provision, whereby the supplier may adjust a rate—up or down—based on realized costs. However, other suppliers may include a one-sided adjustment to allow only for upward price adjustments (and where potential credits may not be passed through).

Comparison: Car Insurance

One way to think about this issue is using the comparison of car insurance and your policy deductible. As we know, the deductible is the amount you pay before the insurance company does when a claim is made, thus impacting your overall cost as a buyer. When comparing insurance rates, you review the term, deductible and overall cost to you. If you aren’t comparing a $1,000 deductible policy to another $1,000 deductible policy, you really can’t make that comparison accurately because they don’t offer the same level of protection and may result in very different out of pocket expenses. This same logic applies to fixed capacity offers because each offer may be set to include a different baseline cost, you can’t really compare those offers “apples to apples” until you understand those baseline assumptions.

Where Does This Leave Us?

Constellation’s take on this has been consistent for many years. We value transparency in how we do business, and it reflects in our contracts. We offer various product options to meet a range of risk profiles and needs. Whether you’re interested in a fully pass-through or a fully fixed option, or something in between, we are happy to help. Our price adjust offerings include bilateral adjustments to allow customers to benefit from potential cost reductions. As a customer, it’s always important to ask questions and stay informed. With the uncertainty in capacity prices past June of 2022, it’s especially important to understand how capacity costs are being accounted for in your price in order to determine which product and offering will best meet your needs and risk tolerance. Please don’t hesitate to reach out to us for help with these and other energy needs or questions.

Constellation’s energy market insights and energy management tools empower you with the information you need and produce the most successful energy strategies. Get access to energy market intel via Constellation’s email communications, such as the weekly Gas Storage Report, weekly Energy Market Update and our monthly Energy Market Intel Webinars.