Pipeline Transport: How it Can Impact Energy Price

4 min readEnergy supply includes production increases from hydraulic fracturing, horizontal drilling innovations and well expansion, among other sources. Some demand drivers include weather, industrial production, growth and development, and liquefied natural gas exports. These are typically the major energy market drivers that make the front-page headlines, but the critical path between supply and demand—transport—is a third contender driving market volatility as of late.

So, what is transport?

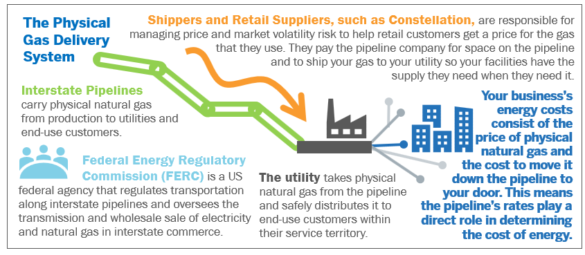

Transport is the method of moving natural gas from producing regions to consumption points via pipelines. There are interstate pipelines and intrastate pipelines that face different regulatory requirements.

Hasn’t transport always driven costs?

Yes, much of the energy pricing you see for your business has these variables factored in. In many cases, interstate pipelines charge a reservation fee for space on the pipeline and then a transport or commodity rate to flow the gas in that reserved space between point A and point B. Shippers, including retail suppliers, are buying and scheduling gas to move down the pipeline so the supply gets to your utility.

… interstate pipelines charge a reservation fee for space on the pipeline and then a transport or commodity rate to flow the gas…

The pipeline has a finite capacity it can reserve or carry in a given timeframe – regardless of how much supply or demand exists at either end. Take a garden hose as an example: you could endlessly run the faucet to create a continuous supply of water, fill up buckets and the sinks to store all the water your family needs. On the other end, in the heat of the summer, all the plants in your garden could need water all at the same time. But the availability of water from your home (“supply”) and the desperation of your wilting flowers (“demand”) won’t change how much water will flow through the hose per minute, which means the supply could sit and some of the flowers will have to wait another day to get watered. This can create constraints on both ends of the system.

Here are two real life examples in which gas prices are impacted by pipelines:

Example 1: High demand due to cold winters.

The ANR Pipeline is a critical artery bringing natural gas from the Southeast and now Ohio, Pennsylvania and West Virginia into major areas of Wisconsin. Wisconsin customers are very familiar with the cold winters that bring on heavy demand. Everyone needs more natural gas to keep warm and keep engines running, but when there’s not enough to go around, who gets it? While hospitals and schools need the gas no question, manufacturers and other commercial facilities can switch to alternative fuel sources (i.e., propane) to opt out of the fight for limited supply and manage costs. But many alternative fuel sources stop functioning under -20 degrees, making gas the only source available for everyone.

The situation: Demand at peak levels greatly outweighs supply.

Pricing: Through the roof. If you needed it, you needed it. Gas prices peaked over $20.00/dekatherm. In 2014, gas prices in New York City (Transco Zone 6) jumped to $100/dekatherm.

The culprit: A pipeline has a defined size. Demand intensified, but the circumference of the pipe didn’t grow to meet demand. An Operational Flow Order, which is a mechanism used by the pipeline to protect the operational integrity, limited delivery of any additional supply into the region.

Example 2: Regulatory shifts

Many interstate pipelines are over 40 years old and require replacement of older pipe and other safety upgrades. Several interstate pipeline are pursuing rate changes this year. To change rates, a pipeline must file a formal rate case at the Federal Energy Regulatory Commission or FERC, which is reviewed and discussed with shippers and other stakeholders, to revise the tariff. Texas Eastern Transmission Pipeline (TETCo), a major pipeline delivering gas to many states from the Gulf of Mexico coast, in particular, has not undergone a rate case like this in 28 years – until late 2018. This impacted the rates that utilities, retail suppliers and others pay to ship gas through the pipeline. If a pipeline changes the structure of its tariff (i.e., how it charges shippers) or its rates (i.e., what it charges shippers), it can have a direct impact on energy prices. Between 2018 and 2020, more than 10 interstate pipelines have either filed a rate case or we anticipate that they will file a rate case.

The situation: Supply stayed the same. Demand stayed the same, but the price to connect the supply to the demand is changing as pipelines need to maintain aging infrastructure.

Pricing: Energy prices may be impacted.

The culprit: In response to 2017 federal corporate tax reduction (35% to 21%), the interstate pipelines had to file a one-time report on the rate effect of the Tax Cuts and Jobs Act. This report influenced some pipelines to file a rate case and prompted FERC to initiate investigations into the rates being charged by certain pipelines (which could lead to transport rate increases or decreases).

So what?

In both cases, our ability to transport and the cost to do so really prove that supply and demand is not simply a two-sided see-saw. The middle bar of the see saw – the transport connecting supply and demand – is worth paying attention to when it comes to understanding price movement.

Customers should be reminded that even though gas prices are currently low, there are many factors that could have an impact on prices, such as transport. Staying apprised of these influencers allows energy managers to remain proactive in modifying their energy strategy to capitalize on price and risk.

Constellation is an active shipper on more than 40-plus pipelines in the United States. Our customers rely on us to help navigate their price risk and manage costs over the long-term. To receive updates on the latest market intel impacting your energy strategy, subscribe to our communications and sign up for our monthly Market Intel Webinars featuring valuable insights from Constellation market analysts.

Stay on top of energy market intel

Guest Author: Jennifer Lowe, Sr. Product Manager – Natural Gas

Jennifer is a member of Constellation’s Portfolio Management team, which oversees all product offerings for commercial and industrial customers. The gas products team focuses on the maintenance, operations and reporting of Constellation’s managed and transactional products, including SmartPortfolio, Manage Portfolio Service and Minimize Volatile Pricing. They also drive the innovation and development of new purchasing strategies to help natural gas customers manage risk amidst a growing and changing market.