Will a Weak El Niño Drive Summer Cooling Demand Amid a Possible Slowdown in Growth of Gas Production?

3 min readDuring the May Energy Market Intel webinar, Constellation’s Commodities Management Group (CMG) presented on the outlook for summer weather, natural gas supply and demand forecasts for the remainder of the year, and took a look at the electric power capacity market.

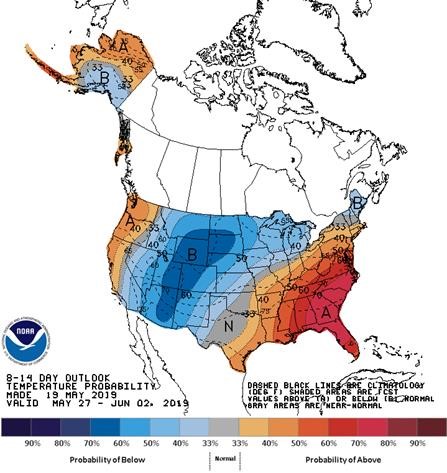

Market analysts kicked off the webinar with a look at the current forecast of a weak El Niño that could portend hotter-than-normal temperatures in certain regions of the country.

Weather Update

The weather report focuses on the persistent weak El Niño that we expect will continue into the heart of the summer. Recent weather patterns and the ongoing weak El Niño suggest that cooler-than-normal weather will continue over the Southwest and California into early June while the Southeast remains very warm to hot, even challenging records in some cases. An East-based above-normal summer is still expected with a cool focus in the Rockies, especially early on.

The forecast for the official first week of summer (NOAA)

Natural Gas Supply and Demand Report Card

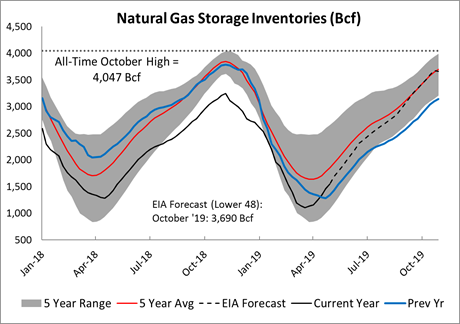

The natural gas supply and demand report card focuses on the Energy Information Administration (EIA) forecast for production in 2019 of 90.3 Bcf per day, an increase of 6.9 Bcf/day year-over-year.

The report card then considers that the year-over-year forecast increases in demand for natural gas in the electric power, industrial, residential/commercial, and exports to Mexico and liquefied natural gas categories. The report card reveals that there is about 1.4 Bcf/day supply advantage for the year, which is not an overly significant supply advantage in an 89 Bcf per day market.

If production of natural gas continues to flatten and a hot summer in the eastern half of the U.S. develops, the supply and demand balance in the natural gas market could tighten and place upward pressure on prices.

Source: EIA

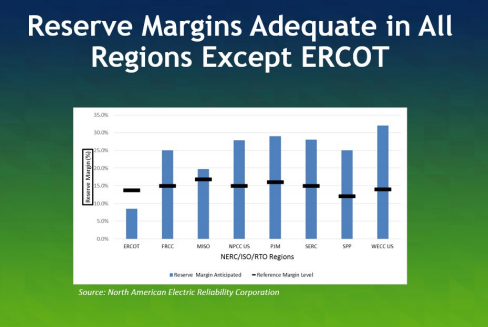

Electricity Reliability Insights in the California and ERCOT Region

2019 will be another year of declining electricity spare capacity in ERCOT with the North American Electric Reliability Corporation (NERC) forecasting below 7.5%, a level half of what is generally prescribed. Tight capacity in ERCOT signals the very real possibility of potentially high spot prices on critical days this summer.

The team also reviewed the situation in Southern California as SoCalGas has delayed the repair of critical pipelines into June and potentially beyond. Currently, the SoCal system is hampered by physical pipeline delivery of natural gas into its system because of ongoing maintenance issues and a lack of available gas storage at Aliso Canyon.

If southern California experiences a hot summer, the need for natural gas will increase as electric power generation requirements would rise to feed the demand for air conditioning load. At this time, cooler temperatures are prevailing, however, end users behind the SoCal system should be keenly aware of the maintenance issues and the storage situation in that market as they have had a profound impact on pricing.

Source: FERC

To stay updated on these topics and more, join us in May for our next Energy Market Intel Webinar on June 19, 2019, at 2:00 p.m. ET as we take a closer look at the summer forecast and revisit the primary market drivers in natural gas and electric power markets affecting industrial, commercial and institutional end-users.