ERCOT Faces Much Tighter Reserve Margins After Recent Retirements

4 min readTexas has seen robust economic growth since 2000, doubling in size from $741 billion (2000) to $1.61 trillion in 2014 according to data from the Federal Reserve. Corresponding demand for electricity has also risen and was met with a large build out in gas fired generation and renewables, primarily wind. As a result, generation reserve margins were robust enough to meet the growing demand for many years. The shale revolution ushered in record gas production and low gas prices. In addition, improved gas generator efficiencies and scalability of renewables have made older coal units in the Electric Reliability Council of Texas (ERCOT) region less economical the past several years. Several of those coal units were retired this winter and the generation landscape in TX has changed. Much tighter reserve margins for a period of several years could result in volatile real-time pricing, especially in summer months when ERCOT load traditionally sets new demand records or “peaks.”

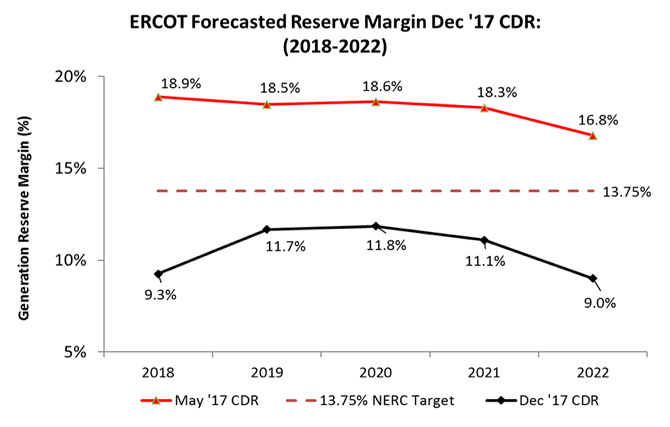

The Capacity, Demand & Reserve (CDR)

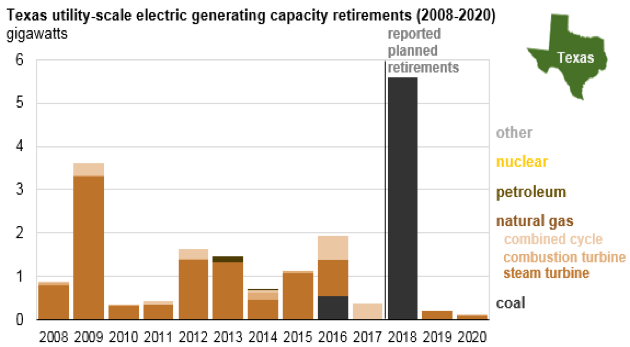

The ERCOT ISO releases a biannual report (in May and December) to monitor future generation reserve margins within the ISO on a rolling ten-year term known as The CDR. While the CDR had been showing tightening margins in ERCOT, they were still above the recommended level by NERC of 13.75%. In October, Vistra Energy announced the retirement of three large coal plants totaling 4,273 MW while older gas fired generation plants that are traditional steam turbine also faced economic pressure. Total retirement and mothballs units reached 5,625 MW by end of 2017 (see below). The December CDR report from ERCOT reflected these announcements and the reserve margin declined significantly for 2018, dropping 9% from 18.9% in the May CDR, to 9.3% for the December CDR.

Source: EIA & ERCOT

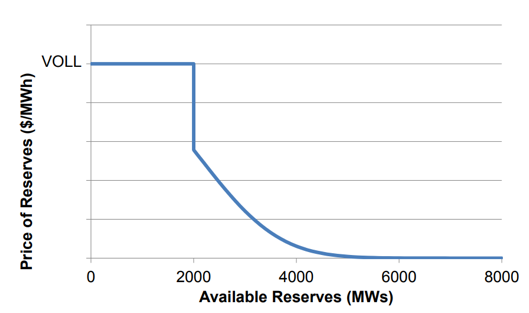

The December CDR shows a reserve margin out through 2022 that is below the NERC recommended level of 13.75%. The NERC recommended level represents the suggested reserve margin reliability standard for a loss of load once every ten years. In other competitive power markets such as PJM a drop-in reserve margins could be addressed through its capacity market, which is an auction where the ISO pays generators to build new capacity. ERCOT is an “energy only” market, meaning the forward price of power would be the price signal for investors to decide to build new generation. As a solution to a lack of a capacity market and to reflect the value of available reserves, ERCOT implemented the Operational Reserve & Demand Curve (ORDC) in June 2014. The ORDC was implemented to address the cost of available reserves when ERCOT reserve margins decline below 4,000 MW and the value of those reserves increase as available reserves decline. The current cap for the ORDC is $9,000/MWh and could be triggered if 30-minute available generation reserves on the ERCOT system decline below 2,000 MW. Since its implementation in summer 2014, ERCOT has had ORDC charges reflected in the Settlement Point Prices (SPP) but has not reached the cap of $9,000/MWh. The retirement of the Vistra coal units and older steam turbine units could tighten reserve margins this coming summer.

ERCOT ORDC Curve

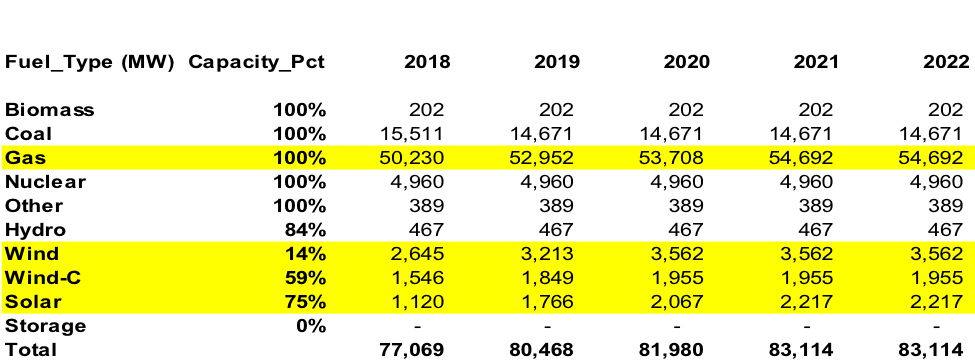

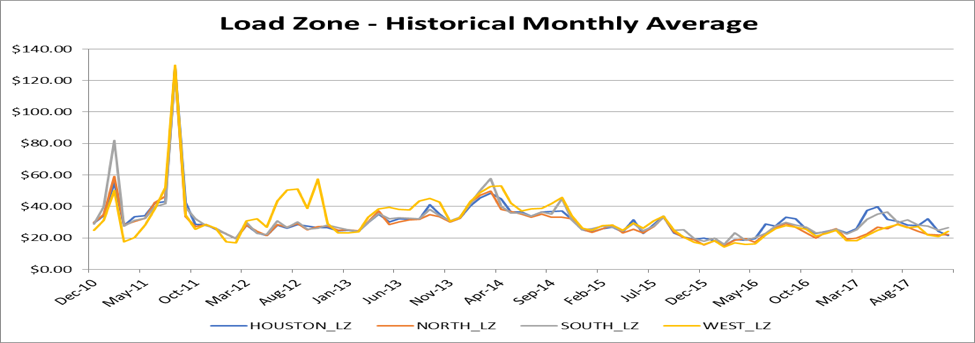

As an energy only market, the declining cost of natural gas and other factors (link to WSJ blog) have resulted in power prices at historic lows in ERCOT earlier in 2017 and a very thin pipeline for new thermal generation. New wind and solar renewable resources will come online in the next several years but they are intermittent in nature.

ERCOT Net Generating Capacity by Fuel Type

The release of the CDR in late December provided some lift to forward prices but it would likely take an event in the real-time markets. This is similar to August 2011 when reserve margins were significantly tight (see below), that increases forward prices enough to add new generation. The December CDR shows reserve margins climbing to 11.7% in 2019 & 2020 but that could depend on ~3,000 MW of new gas fired capacity that may not get built under current forward prices due to a low rate of return at current forward prices. This poses an additional risk to ERCOT customers because any new build could take 18-24 months to complete at the earliest.

The Impact of Tighter Reserve Margins

Customers should be aware that with the retirement of close to 40% of ERCOT’s coal generating capacity, reserve margins have significantly tightened for 2018 and beyond. A robust economy that is helping to drive load growth in ERCOT, ~1.5% annually (above national average), along with a warmer than normal summer could lead to an even tighter reserve margin and higher ERCOT real-time settlement point prices.

Market volatility and budget risks associated with these reserve margins are factors that could impact your business’ energy management strategy. Customers can work with their Business Development Manager and our dedicated team of market professionals to make sure they fully understand the changing landscape of the ERCOT market and how to address energy budget risk. For more information on the products available to mitigate market and budget risks for you and your business, visit constellation.com.